Complete guide to doing business in Spain in 2026, for growing startups and entrepreneurs

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

Are you planning to expand your business to Germany? Understanding the corporate tax landscape is crucial for making informed decisions about entering Europe's largest economy.

Germany offers a stable business environment with well-established tax frameworks, but navigating the complexities of corporate taxation requires careful planning. From understanding tax rates to managing compliance obligations, getting your tax strategy right from the start can significantly impact your business success. Whether you're considering establishing a subsidiary or expanding operations, having a clear grasp of Germany's corporate tax system is essential for strategic planning and financial forecasting.

If you're looking to streamline your international operations and manage cross-border payments efficiently, Wise Business can help simplify your financial management as you expand into the German market.

💡 Learn more about Wise Business

This publication is provided for general information purposes and does not constitute legal, tax, or other professional advice from Wise Payments Limited, its subsidiaries or affiliates, and it is not intended as a substitute for obtaining business advice from a tax advisor or any other professional.

The corporate income tax rate in Germany is 15% at the federal level, but when combined with the solidarity surcharge of 5.5% and municipal trade tax (Gewerbesteuer), the effective corporate tax rate typically ranges between 24% and 36%, depending on the municipality.1

For example, in major business centres like Frankfurt, the total effective corporate tax rate is approximately 32%, while in Munich it's around 33%. Berlin has an effective rate of about 30%, making these major cities relatively competitive compared to smaller municipalities that may have higher trade tax rates.2

Foreign companies with permanent establishments in Germany are subject to the same corporate tax rates as domestic companies. However, companies that are only tax resident in Germany on their worldwide income, while non-resident companies are only taxed on their German-source income.3 4

| Read more about Corporate Tax Planning best practices |

|---|

Corporate tax payments in Germany are made in Euros and must be submitted through the German tax authorities' electronic filing system called ELSTER (Elektronische Steuererklärung). Companies are required to file annual corporate tax returns and make advance quarterly payments throughout the year.5

The German tax year follows the calendar year, running from 1 January to 31 December. Corporate tax returns must be filed by 31 July of the following year, though this deadline can be extended to 28 February of the subsequent year if a tax advisor is engaged.6

Germany operates a system of advance payments (Vorauszahlungen) where companies make quarterly instalments based on the previous year's tax liability. These payments are due on 10 March, 10 June, 10 September, and 10 December each year. The final balance is settled when the annual return is filed and assessed.6

Late payment of corporate taxes incurs interest charges of 0.15% per month on the outstanding amount.6 Additionally, late filing penalties can range from €25 to €25,000 depending on the severity and duration of the delay.7

Let's calculate the tax liability for a company with an annual turnover of €1.5 million. Assuming a profit margin of 10%, the taxable profit would be €150,000. Using Frankfurt's effective corporate tax rate of approximately 32%:

Corporate tax due: €150,000 × 32% = €48,000

If this payment were made 30 days late, the interest charge would be:

€48,000 x 0.15% = €72.00

Total amount owed: €48,000 + €72.00 = €48,072.00

When expanding your business to Germany, the right financial tools will make the process smoother. Using a platform like Wise Business makes it easy to expand internationally with local EUR account details (only with Wise Business Advanced) . A multi-currency account allows businesses to pay for incorporation costs, registration fees, and government taxes in local currency without paying high exchange rate fees.

Get started with Wise Business 🚀

Some helpful steps to ensure your company stays compliant with German tax regulations:

Since 2022, Germany has strengthened enforcement of the Transparency Register. All legal entities must disclose their beneficial owners, regardless of whether this information was previously available in other registers. Non-compliance can result in significant fines.9

If you’re planning to expand your venture abroad, Germany must make it to your list of potential locations. Being the world’s third largest overall, it boasts a GDP of $4.7 trillion and a per capita GDP of $55,910.10 11 The country’s population of 84.8 million, combined with direct access to the EU single market of over 450 million consumers.10 12 This presents companies entering Germany with significant growth opportunities.

The German market is characterized by strong consumer purchasing power, averaging €27,848 per person in 2024, making it an appealing destination for businesses selling goods and services.13 The government also invests heavily in innovation. It spends 3.1% of its GDP on research and development, compared to the EU average of 2.1%.14 This commitment has positioned Germany as a hub for knowledge-driven industries, advanced manufacturing, and technology.

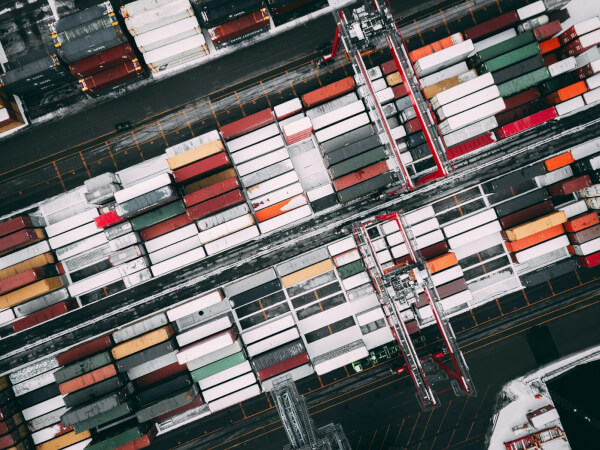

Germany also plays a central role in international trade, accounting for nearly 29% of all EU exports to non-EU countries. An open economy with a foreign trade quota of 84.4% makes it a strategic base for global business operations.15 Connectivity is another strength this region boasts. The country has 830,000 km of roads, nearly 40,000 km of railways, and major ports like Hamburg, which handled 111.8 million tons of cargo in 2024.13 16

The workforce is equally attractive for investors. In 2023, 45.9 million people were employed in Germany.17 This figure reflects a highly skilled and reliable talent pool for expanding businesses.

The steps to set up a business in Germany are as follows:

To explore more insights tailored to UK businesses entering Germany, take a look at Wise’s guide on starting a business in Germany. It offers practical, on-the-ground advice for establishing a business in Germany efficiently.

| Discover the top 5 best Corporate Tax softwares |

|---|

To incorporate a business in Germany, you’ll need to prepare specific information and complete several registrations. The process ensures compliance with national regulations, including requirements related to German corporate tax.

Below are the essentials:18

Note: German law requires that every GmbH or UG appoint at least one managing director (Geschäftsführer) who is a resident of the European Union or European Economic Area (EEA). If no such director is available, companies may face additional scrutiny from banks and trade offices, and it can be significantly harder to open a corporate bank account.

Managing corporate tax obligations across multiple jurisdictions requires a strategic approach that balances compliance with tax efficiency. Here are key practices that can help international businesses navigate complex tax landscapes effectively:

Researching corporate tax is a crucial step when expanding your business into a new country. The next step is setting up the financial infrastructure to handle the complexities of operating across borders, from managing multi-currency cash flow to mitigating FX risk.

The Wise Business account provides the financial tools to make your international expansion to Germany efficient and simple. It's the one account for managing your money globally.

With a Wise Business account, you can:

Pay suppliers and initial fees: Pay suppliers, global payroll, and one-off incorporation costs in the local currency.

Get paid like a local: Use local account details (only with Wise Business Advanced) for 8+ major currencies to easily receive payments from customers or investors.

Manage your money across borders: Hold and exchange 40+ currencies in one account, always with the mid-market exchange rate and low, transparent fees.

Streamline your accounting: Integrate with tools like Xero or QuickBooks to simplify tracking your company's international finances.

Empower your team: Provide multi-user access for your finance team and issue expense cards for international spending.

Wise is designed to support every step of your journey, from paying your first registration fee to receiving international payments and managing your global treasury.

Get started with Wise Business 🚀

All German resident corporations are liable for corporate tax on their worldwide income. This includes stock corporations (Aktiengesellschaft - AG), limited liability companies (Gesellschaft mit beschränkter Haftung - GmbH), and other corporate entities. Non-resident companies are only liable for German corporate tax on income derived from German sources, such as through a permanent establishment or German real estate.

Germany offers several tax incentives, particularly for research and development activities. The R&D tax credit allows companies to claim up to 25% of eligible R&D expenses, capped at €1 million per year. Additionally, there are accelerated depreciation allowances for certain assets, and special provisions for start-ups and small businesses. Some federal states also offer regional investment incentives for businesses establishing operations in economically disadvantaged areas.19 20

Dividends paid by German companies to German corporate shareholders are generally exempt from corporate tax under the participation exemption rule, provided the shareholding is at least 10%. For individual shareholders, dividends are subject to a flat withholding tax of 26.375% (including solidarity surcharge). Foreign shareholders may benefit from reduced withholding tax rates under applicable double taxation treaties. 21 22

Common pitfalls include failing to register with tax authorities promptly, underestimating the complexity of the trade tax system across different municipalities, and not properly documenting transfer pricing for intercompany transactions. Many businesses also struggle with the electronic filing requirements through ELSTER and fail to make adequate quarterly advance payments, leading to cash flow issues when the final assessment is due. Additionally, not leveraging available double taxation treaties can result in unnecessary withholding tax burdens.

Sources used in this article:

Sources last checked 01/09/2025

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

Discover which UAE business visas you can apply for from the UK, what to keep in mind and how the process works for each visa type in our guide.

Last month, the United States (US) Supreme Court ruled that many of the government’s tariffs were unconstitutional. The 6-3 decision found that the...

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

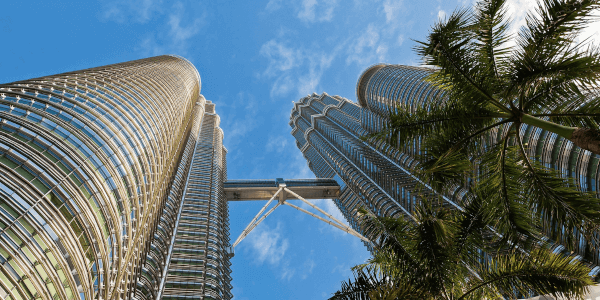

Discover the essential costs involved in starting a business in Malaysia as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

There comes a time in almost every startup’s journey — whether in the UK, Europe or further afield — when its executive team considers expansion to...