Cost of Starting a Business in Malaysia: The Complete Guide for UK Residents

Discover the essential costs involved in starting a business in Malaysia as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

Thinking about launching a business in the largest country of Southern Europe? The Entrepreneur visa for Spain offers UK founders the chance to build innovative ventures in one of Europe's most dynamic economies. This guide walks you through everything you need to know in 2025, from eligibility to application steps, so you can focus on turning your ideas into action.

Handling international financial transactions is an important consideration for brand-new businesses trying to find a path to steady growth. Wise Business account offers a smart payment solution. It grants access to 40+ currencies and the possibility to manage payments in 40+ countries, no hidden fees included. For a UK startup expanding operations in Spain, it's the perfect solution for managing transactions across the border.

The Entrepreneur visa for Spain (also known as the Residency Visa for Entrepreneurs)1 is designed for non-EU nationals who plan to launch an innovative business in Spain. This visa allows UK founders to live and work in Spain while building startups that contribute to the country's economy and technology sector.

It's part of Spain's broader initiative to attract global talent and strengthen its startup ecosystem. If your business meets the criteria set out in Spain's immigration law under the 14/2013 Entrepreneur's Act2, you may be granted residency based on how innovative your business proposal3 is. Approved applicants can also bring family members, making it ideal for business-minded individuals relocating from the UK.

To qualify for the Entrepreneur visa in Spain, UK applicants must show they're ready to build an innovative, high-potential business that benefits the Spanish economy. Below are the key conditions you'll need to meet3 before applying.

- Innovative business idea – Your startup must be original, scalable, and aligned with Spain's economic or technological interests, especially in areas like sustainability, fintech, or digital transformation.

- Business plan approval– You'll need to submit your business plan to ENISA4 or UGE for review. Approval is required before your visa application is considered.

- Proof of financial means – You'll need to provide both the original and a copy of documents showing that you have enough financial resources to support yourself and the family, if they're joining you. This can be personal savings or proof of a steady income. You must show funds equal to 100% of Spain's IPREM (Public Income Index)5, plus an additional 50% of the IPREM for each dependent1.

- Valid UK passport – Your passport must be valid for at least 1 year and include enough blank pages for a visa and entry stamps.

- Health insurance – You'll need to provide the original and a copy of your health insurance certificate. The policy must be with a public or private insurer that's legally authorised to operate in Spain.

- Proof of local residency in the UK– Applicants must show they live in the consular district or are physically attending classes there. You can check which district you fall under on the official website of the Spanish consulate.

- Representative's ID and authority – If someone is applying on your behalf, you must include copies of their passport or ID along with legal proof that they're authorised to represent you (such as a signed power of attorney). Originals must be presented at your appointment. Any foreign documents must be properly legalised or apostilled, and officially translated into Spanish when required.

- Visa fee payment – The visa fee must be paid in local currency when you submit your application. Note that the exact amount may vary slightly depending on current exchange rates.

Securing an Entrepreneur visa in Spain offers UK founders a unique gateway into one of Europe's most promising startup ecosystems. Spain boasts a lower cost of living6 and business operations compared to Western European nations, making it a financially attractive base for early-stage startups. Major cities like Barcelona, Madrid, and Valencia are recognised as thriving startup hubs, with access to accelerators, coworking spaces, and venture capital networks.

Beyond startup infrastructure, visa holders also benefit from a fast-track residence process – often processed in under 20 working days when approved by Spain's Large Companies and Strategic Groups Unit (UGE)7. You can bring family members under the same permit and enjoy access to Spain's public services, including healthcare and education. Additionally, the visa allows you to travel freely within the Schengen Area, enabling easy business mobility across Europe.

| 💡 Explore moving to Spain from the UK |

|---|

With Spain's growing support for innovation and digital entrepreneurship, UK applicants can tap into government-backed funding (such as through ENISA) and internationalisation incentives, all while living in a vibrant, internationally connected business environment.

Applying for the Entrepreneur visa in Spain involves a multi-stage process that can vary slightly depending on whether you apply from the UK or within Spain.8 Most UK applicants will apply through a Spanish consulate, while those already in Spain under a legal visa may apply directly for a residence permit.9 The process takes 20 working days after submission (though timing may vary depending on your business plan approval and personal documentation).

The important thing to remember is that your business proposal must be approved by UGE (Unidad de Grandes Empresas) or ENISA, Spain's entrepreneurship evaluation bodies. The approval can significantly affect how quickly the visa is granted.

Before anything else, you'll need to gather the required documents that prove your eligibility and support your business case. Strong documentation increases your chances of a fast-track approval. Be sure everything is accurate, up to date, and professionally translated into Spanish where needed. Documents include:

- Valid UK passport (at least 1 year of validity)

- Completed application form

- Detailed business plan in Spanish (covering innovation, market, and growth)

- Proof of sufficient funds (approx. €2,400/month for main applicant)

- Private health insurance valid in Spain

- Police clearance (last 5 years, from all countries of residence)

- Proof of clean immigration status in Spain

- Civil documents (if applying with spouse/children)

- Visa application fee receipt

Spain wants to attract innovative, high-impact startups. That's why your business idea needs approval from a qualified body like ENISA or UGE. This step determines whether your idea fits Spain's economic and tech development goals.

Once your business plan is approved, it's time to apply for the actual visa. UK residents must apply in person at their nearest Spanish consulate. You'll present your documents, ENISA or UGE approval letter, and submit biometric data (fingerprints and ID photo). Consulate appointments should be booked in advance. Keep a close eye on email communications in case additional paperwork is requested.

After visa approval, you'll receive a visa sticker in your passport valid for entry into Spain. Once you arrive, the priority is to register your address (empadronamiento) at your local town hall or online.10 This step is essential to continue with residence formalities. Make sure you do this within 30 days of arrival. You'll need proof of housing (rental contract or deed) and ID. Registration is free and usually completed in one appointment.

Your Tarjeta de Identidad de Extranjero (TIE)11 is your official residency ID in Spain. It's mandatory for all non-EU residents staying longer than 6 months. This card also allows you to open a local bank account and access public services.

Book an appointment at your local Oficina de Extranjería (Foreigners' Office) or online.12 Bring your empadronamiento certificate, passport, visa, photographs, and completed TIE form. The card is typically issued within 2–4 weeks.

To legally operate and register a business in Spain, you'll need a local business account. This account will handle your initial capital contributions, staff payroll, and tax payments. It's best to open this account before registering your business officially.

With a Wise Business account, you can manage finances across 140+ countries while holding 40+ currencies, making international trade easier from day one.

With your visa, TIE, and business account ready, you can now formally register your business. This includes choosing a legal structure (e.g. SL or autonomous), getting a CIF (company tax ID), and registering with the Spanish Commercial Registry (Registro Mercantil).13

You'll also need to register for social security and VAT (IVA), and begin filing taxes quarterly. Hiring staff or renting office space may also trigger additional local or regional registrations.

Launching a startup in Spain means navigating some unique business norms and legal systems. To take advantage of Spain's strong startup ecosystems in cities like Barcelona, Madrid, and Valencia, open a business account early. Doing this first is crucial, as it is mandatory for registering your company and handling all official transactions. It's also wise to decide on your legal structure in advance. Most founders opt for a Sociedad Limitada (SL), Spain's equivalent of a private limited company.

As you start building your startup, one of the first steps you'll need to take is to open a business bank account. This will allow you to receive investments, manage taxes and other expenses. When it comes to handling international business payments, setting up a Wise Business account can be a great option to manage cross-currency transactions and get things moving right away, ahead of your move.

| 💡 Read our guide on starting a business in Spain |

|---|

Wise Business can help you get started almost immediately, allowing you to transfer money to suppliers, pay distributed staff and receive payments from abroad from the jump. This may be particularly useful as opening a local Spanish bank account may be time-consuming or restricted for newcomers.

When you're starting a business across borders, Wise Business is built to take the hassle out of managing money internationally.

You'll get:

(only with Wise Business Advanced)

in major currencies

Launching a business in Spain comes with exciting opportunities. With the right tools, it's easier to get going than you might expect.

Sources:

Sources last checked on date: 25-Jul-2025

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the essential costs involved in starting a business in Malaysia as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

There comes a time in almost every startup’s journey — whether in the UK, Europe or further afield — when its executive team considers expansion to...

Learn about all the costs to budget for to start a business in Spain as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

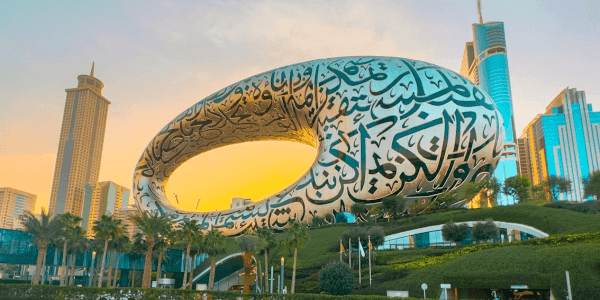

Read our guide to clearly understand all of the business setup costs in Dubai, from licence fees and visa charges to office space and more.

2026 has kicked off with some significant shifts in the currency markets. To help your business navigate these movements, we sat down with Nathan Solomon, FX...

Learn about the various costs you'll need to account for if you want to start a business in Abu Dhabi in 2026 in our comprehensive guide.