Wise Business Pricing Explained

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

In today’s digital economy, simply accepting payments isn’t enough. You need a strategy that keeps pace with global trends.

Did you know that digital wallet transactions, favored by platforms like Apple Pay and PayPal, are rapidly growing? In fact, e-commerce is expected to grow at a 15% annual rate between 2023 and 2027 1. Businesses must offer these preferred options to remain competitive.

This article takes a closer look at Nuvei, the Canada-based payments technology leader, and provides a guide to payment methods with Nuvei. It also mentions Wise Business, which helps you accept card payments online in currencies - a great option if you have customers all over the world.

Nuvei makes global payments simpler by bringing everything into a single, flexible platform. Instead of juggling multiple providers, businesses can manage the entire payment process in one place. The platform is built to scale and is fully vertically integrated. This means Nuvei handles payment processing, merchant acquiring, and risk management under one roof.

When a customer pays by card, digital wallet, or bank transfer, the platform securely captures the payment details and instantly uses smart routing. This technology finds the best path for each transaction, helping payments go through faster, with higher approval rates and lower costs.

It takes care of every step, including:

Nuvei supports payments in over 200 markets, 150 currencies, and hundreds of alternative payment methods 2.

If you’re a business that operates internationally, you should look for a reliable payment platform. Nuvei offers an integration point for a wide range of global and local payment methods, along with strong risk management tools. This makes global expansion easier for e-commerce sellers and other companies. There is no longer a need to manage multiple payment providers.

Listed below are the steps that follow when a business intends to receive payments via Nuvei:

The first essential step is creating a Nuvei account. This usually happens through the merchant portal or an e-commerce platform partner. The business provides detailed company information to help Nuvei complete its approval process, including verification and underwriting. After Nuvei fully approves the account, the merchant can start processing payments and transacting online 3.

Nuvei offers a range of flexible integration options to fit different business needs and technical capabilities.

After choosing the integration method, the business logs into the Nuvei merchant portal to set up payment settings and receive its unique API credentials. This typically includes a Merchant ID, Secret Key, and Site ID. These credentials are securely added to the business’s website or application, creating a safe connection between the online store and Nuvei’s payment gateway 4.

Once the connection is in place, the merchant can customise the payment experience. This includes enabling preferred payment methods, from credit cards and e-wallets like Apple Pay to local payment options and cryptocurrencies.

Merchants can also set up multi-currency authorisation and activate advanced risk management tools, such as Dynamic 3D Secure 5. Nuvei’s platform lets merchants control which payment methods appear, helping optimise the checkout experience for customers around the world.

After integration, the platform starts processing transactions and uses smart routing to improve approval rates. The final step is settlement. Nuvei transfers approved funds from the acquiring bank directly into the merchant’s chosen bank account and often offers fast funding options to support cash flow.

Merchants can track all transactions and financial data in real time through one consolidated reporting dashboard.

Nuvei acts as a central payment hub, connecting merchants to almost every major digital and local payment option worldwide. Below is a quick overview of the primary payment types it supports:

Nuvei offers direct local acquiring in over 50 markets 6. This helps businesses accept major card brands while improving approval rates and reducing interchange costs.

These are among the fastest-growing payment options worldwide. Nuvei allows you to integrate leading digital wallets for mobile and online checkout.

Local payment options are key to improving checkout success. Customers often prefer familiar methods. Nuvei supports hundreds of APMs.

Nuvei also supports modern digital payments. It connects traditional finance with blockchain technology.

Nuvei does not list fixed pricing on its public website. It uses a custom pricing model based on each merchant’s business type, transaction volume, risk level, and the countries in which they operate. This means fees vary from one business to another.

The most accurate details about your pricing are found in your Merchant Agreement (Schedule A) and your monthly processing statements. You can access these through the Nuvei Control Panel.

| Fee Type | What It Covers | International Impact |

|---|---|---|

| Processing Fee | The core fee for handling a transaction. Nuvei mainly uses the Interchange++ model, where you pay the actual interchange fee, card network fees, plus Nuvei’s agreed markup 8. | Cross-border transactions have higher interchange and scheme fees. Nuvei applies an additional international or cross-border fee to cover these costs. |

| Per-Transaction Fee | A small fixed fee (~$0.40) is charged for each transaction attempt, including declined transactions 7. | Usually the same, but it may vary slightly depending on the payment method (card vs. bank transfer). |

| Fixed/Administrative Fees | Ongoing fees such as monthly minimums, annual fees, admin fees, or PCI compliance fees. | These fees don’t depend on the transaction location but vary by merchant, country, and setup. |

| Ancillary Fee | Event-based fees, such as chargebacks, refunds, and retrieval requests. | International chargebacks can be more expensive due to higher processing and admin costs. |

For international transactions, Nuvei passes through unavoidable costs charged by global card networks while using tools to reduce friction and improve approval rates.

At this point, you should know that Nuvei typically operates on an Interchange Plus Plus (IC++) model 8, which is the most transparent structure for international transactions:

Total Fee = Interchange Fee + Card Scheme Fee + Nuvei’s Margin

Interchange and Scheme Fees: These fees for cross-border transactions are set by Visa/Mastercard and are non-negotiable by any processor. For cards issued outside the EEA and used within the EEA, for example, the total Interchange and Scheme Fees can range from 1.50% to 2.80% (plus a fixed cent fee) 9. \

International Surcharge: Nuvei adds its own negotiated margin on top of the fluctuating card network costs. For international transactions, this margin, along with the higher network fees, results in a noticeably higher total processing fee than domestic transactions. Nuvei’s focus on local acquiring across 50+ markets is a strategy aimed at minimising cross-border fees wherever possible.

Managing payments effectively with Nuvei means more than just accepting transactions. Businesses can use advanced tools to boost revenue, control costs, and streamline global operations. The tips below include:

Let Nuvei automatically direct each transaction to the most reliable and cost-effective acquirer. This reduces failed payments and increases approvals. You can also enable popular local payment methods (e.g., iDEAL in the Netherlands, Alipay in China). Nuvei supports 700+ APMs, making checkout smoother and more likely to convert.

Use Nuvei’s local acquirers in key markets to lower fees and reduce cross-border costs. It also helps companies track all transactions, fraud alerts, and financial data from a single dashboard for easier reconciliation and revenue insights.

Dynamic fraud tools, like Dynamic 3D Secure, add verification only when needed, reducing checkout drop-offs. Meanwhile, tokenisation securely stores card details for recurring payments and one-click checkouts while easing PCI compliance requirements. These features protect both your business and your customers, ensuring smooth, secure payments.

Trade internationally? A cost-effective solution for accepting online payments from customers all over the world is Wise Business.

With your account, you can request payments from customers in just a couple of clicks. Send a Quick Pay link or QR code, or create an invoice, and select ‘Card’ as the payment method. The customer can simply enter their card details, and you’ll get a notification - the customer will also receive proof of payment by email. It’s easy, quick and convenient.

Best of all, it lets you accept card payments in currencies, so you can sell worldwide and let customers pay in their own currency.

It’s ideal for online sellers, remote and mobile businesses, subscription services, international B2B service providers, global freelancers and consultants alike.

Fees are low* and transparent at just 1% for domestic (UK) cards, and 2.9% for all international and business cards.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Yes. Nuvei supports UK-based businesses and provides local acquiring across multiple European markets. UK merchants can accept GBP payments, offer popular local and international payment methods, and process cross-border transactions using Nuvei’s global infrastructure.

Settlement times depend on the payment method, the acquiring bank, and the merchant's agreement. Card payments are typically settled within 1-3 business days, while bank transfers and alternative payment methods may vary. Nuvei also offers faster funding options for eligible merchants.

Yes. Nuvei supports payments in over 150 currencies and operates in more than 200 markets. Merchants can enable multi-currency processing, local acquiring, and dynamic currency conversion (DCC) to improve approval rates and reduce friction in international transactions.

Sources used:

Sources last checked on date: 18-Dec-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

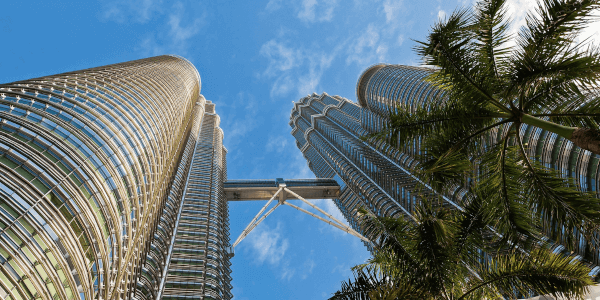

Discover the essential costs involved in starting a business in Malaysia as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

There comes a time in almost every startup’s journey — whether in the UK, Europe or further afield — when its executive team considers expansion to...

Learn about all the costs to budget for to start a business in Spain as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

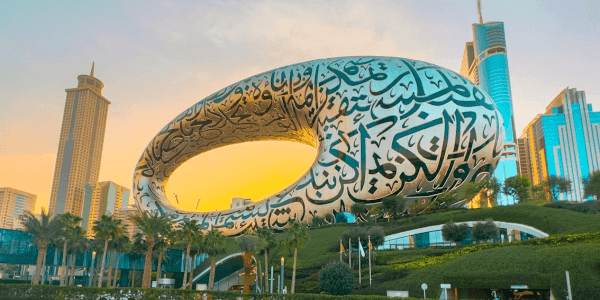

Read our guide to clearly understand all of the business setup costs in Dubai, from licence fees and visa charges to office space and more.

2026 has kicked off with some significant shifts in the currency markets. To help your business navigate these movements, we sat down with Nathan Solomon, FX...