Best joint business bank accounts in the UK

Looking for the best joint business accounts in the UK? We compare features, fees and best usage to help you find the ideal shared account.

Are you a small business owner or a startup in the UK looking to expand to the US? Chances are, you’re here seeking the best business accounts in the US to receive international payments and make payments to suppliers or vendors with ease.

This is why we’ve put together this guide. Here, we provided a detailed roundup of some of the best business bank accounts in the US to consider.

If you plan to move your business to the US, you may need a traditional bank account. However, digital providers like Wise can help get your business running overseas from the jump, without a time-consuming set-up process. To easily send and receive international payments, consider using Wise Business, a versatile international payments platform that lets you receive money in 40+ currencies with local account details (only with Wise Business Advanced) , including US dollars.

Get started with Wise Business 🚀

Here’s a quick overview of the best business bank accounts you should consider in the US:

| Bank/ Provider | Business account options | Key features | Monthly fees | Opening requirements |

|---|---|---|---|---|

| Chase | Checking - Complete Banking, Performance and Platinum Savings - Total, Premier Savings⁴ Chase Business Certificates of Deposit⁴ | 5,000 branches, 15,000+ ATMs¹ Up to 500 free transactions⁴ Free incoming wire transfers⁴ | $10-$95 (depending on tier)⁴ | EIN required⁵ Business ID proof ⁵ Initial deposit varies⁵ |

| Wells Fargo | Checking - Initiate, Navigate and Optimize ⁹ Savings - Business Market Rate, Platinum, Time Account (CD) | 4,000+ branches⁷ Foreign currency wire transfers⁹ Up to 250 free transactions⁹ | $10-$75 (depending on tier)⁹ | Business registration docs¹⁰ Credit history review¹⁰ $25 min. opening¹⁰ |

| Bank of America | Business Advantage (checking) - Fundamentals, Relationship and Savings ¹² Business CDs (Multiple types)¹² | Extensive branch/ATM network Interest rate boosters (5-20%) $500 debit card purchase waiver | $16 - $29.95 (depending on tier)¹² | Federal tax ID/EIN ¹⁴ Personal ID ¹⁴ State formation documents¹⁴ $25 minimum opening¹⁴ |

| Capital One | Checking - Basic, Enhanced and Premier¹⁷ Business Savings¹⁷ | Free Capital One ATM deposits¹⁷ High savings APY (3.70%) ¹⁷ | $15-$99 (depending on tier)¹⁷ | Business federal tax ID¹⁹ Business license ¹⁹ Formation documents ¹⁹ Personal info verification¹⁹ |

| Wise | Wise Business account and cards | Hold 40+ currencies Pay suppliers in 140+ countries Mid-market exchange rates, no fixed fees Built-in integrations | Opening: £50 (Advanced plan) or for free (Essentials plan) | Business registration Identity verification (varies by jurisdiction) |

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Before delving deeper into the providers, it’s worth considering the types of business accounts available to ensure its capabilities match your organisation’s financial goals and priorities.

The common types of accounts are:

It’s also advisable to know the different types of banks on offer depending on business needs and expansion goals. Each one has its advantages, shortcomings, and requirements.

Chase is the U.S consumer and commercial banking of JP Morgan Chase & Co. (NYSE: JPM), a major global financial services firm with $2.6 trillion in assets and operations worldwide¹. Headquartered in New York, Chase has up to 5,000 branches and more than 15,000 ATMs for you to make deposits and get cash¹.

The bank offers a wide range of business bank accounts, ranging from Business Checking Accounts to Business Savings Accounts. Chase also offers a Business Certificate of Deposit account that allows you to save money at a fixed rate of interest for a fixed length of time.

Chase also supports both domestic and international wire transfers². Meaning you can send U.S dollars to a foreign bank or send U.S dollars to individuals or businesses inside the U.S.

Chase has a Trustpilot score of 1.2 out of 5.0 based on 2,000 reviews³.

Best for: Businesses of all sizes, from small companies to mid-sized and large companies.

Here’s a rundown of the checking accounts Chase offers:

| Feature | Chase Business Complete Banking®⁴ | Chase Performance Business Checking®⁴ | Chase Platinum Business Checking℠⁴ |

|---|---|---|---|

| Monthly service fee | $15 (or $0 with waiver)⁴ | $30 (or $0 with waiver)⁴ | $95 (or $0 with waiver)⁴ |

| Fee Waiver Requirements | $2,000 minimum daily balance incl. other options⁴ | $35,000 combined average beginning day balance⁴ | $100,000 combined average beginning day balance⁴ |

| Checks & Deposits with Banker | 0 - 20 transactions for free⁴ $0.40/each transaction after the first 20 ⁴ | 0 - 250 transactions for free⁴ $0.40/each transaction after the first 250⁴ | 0 - 500 transactions for free⁴ $0.40/each transaction after the first 500⁴ |

| Wire Transfer Fees: (Incoming) | Domestic and international - $15 per transfer⁴ | Domestic and international - $0 per transaction ⁴ | Domestic and international - $0 per transaction⁴ |

| Wire Transfer Fees: (Outgoing) | Domestic - $25-$35 per transfer⁴ International U.S. Dollar⁴ - $40-$50 per transfer⁴ International FX -$5 per transfer or $50 in branch. $0 per transfer if the amount is equal to $5,000 USD or more⁴ | $0 for the 2 most expensive outgoing domestic wire transfers per statement period⁴ Domestic - $25-$35 per transfer⁴ International U.S. Dollar⁴ - $40-$50 per transfer⁴ International FX -$5 per transfer or $50 in branch. $0 per transfer if the amount is equal to $5,000 USD or more⁴ | $0 for the 4 most expensive outgoing wires per statement period⁴ Domestic - $25-$35 per transfer⁴ International U.S. Dollar⁴ - $40-$50 per transfer⁴ International FX -$5 per transfer or $50 in branch. $0 per transfer if the amount is equal to $5,000 USD or more⁴ $0 for all wire fees when linked to Chase Private Client Checking, JPMorgan Classic Checking, or Private Client Checking Plus⁴ |

| In-Branch Cash Deposits | $5,000⁴ | $20,000⁴ | $25,000⁴ |

Here’s a walkthrough of Chase savings accounts:

| Feature | Chase Business Total Savings℠⁴ | Chase Business Premier Savings℠⁴ | Chase Business Certificates of Deposit⁴ |

|---|---|---|---|

| Monthly service fee | $10 or (or $0 with waiver)⁴ | $20 (or $0 with waiver)⁴ | No monthly service fee |

| Transaction Fees per month | 0–15 items free⁴ 16+ $0.40/each⁴ | 0–30 items free⁴ 31+ $0.40/each⁴ | N/A |

| Interest | Yes - earn interest on balance⁴ | Yes - earn interest on balance⁴ | Yes - fixed rate of return⁴ |

| Transaction Limits | Standard savings withdrawal limits⁴ | Standard savings withdrawal limits⁴ | Penalty for withdrawing principal before the maturity date⁴ |

| Minimum balance | Not specified | Not specified | $1,000⁴ |

| Wire Transfer Fees (Incoming) | Domestic- $15 per transfer⁴ International - $15 per transfer⁴ | Domestic- $15 per transfer⁴ International - $15 per transfer⁴ | N/A |

| Wire Transfer Fees (Outgoing) | From $5-40 per transfer depending on method. If sending over 5000 USD, you may be exempt from Chase’s FX wire fees.22 | From $5-40 per transfer depending on method. If sending over 5000 USD, you may be exempt from Chase’s FX wire fees. | From $5-40 per transfer depending on method. If sending over 5000 USD, you may be exempt from Chase’s FX wire fees. |

To open a Chase business account, you need to have the following:

Wells Fargo was founded in March 1852 by Henry Wells and William George Fargo to handle banking and express business prompted by the California Gold Rush⁶. Today, the national bank operates over 4,000 branches⁷.

Wells Fargo offers multiple foreign currency payment options, including wire transfers that can be sent in-person at branches, over the phone, or online, with the ability to receive wires in many foreign currencies.

On Trustpilot, Wells Fargo has a score of 1.4 out of 5.0 based on 546 reviews⁸.

Best for: Small and mid-sized companies.

Here’s a comparison of the different types of checking accounts at Wells Fargo:

| Feature | Initiate Business Checking®⁹ | Navigate Business Checking®⁹ | Optimize Business Checking®⁹ |

|---|---|---|---|

| Minimum opening deposit | $25⁹ | $25⁹ | $25⁹ |

| Monthly service fee | $10 (or $0 with waiver)⁹ | $25 (or $0 with waiver)⁹ | $75 for up to 5 Optimize Business Checking accounts⁹ $30 per account in excess of 5 Optimize Business Checking accounts⁹ |

| Fee Waiver Requirements | $500 minimum daily balance⁹ OR $1,000 average ledger balance⁹ | $10,000 minimum daily balance⁹ OR $15,000 average combined business deposit balances⁹ | N/A |

| Transactions fee | $0 for the first 100 transactions⁹ $0.50 for each transaction over 100⁹ | $0 for the first 250 transactions⁹ $0.50 for each transaction over 250⁹ | $0 for the first 250 transactions21 $0.50 for each transaction over 250⁹ |

| Cash deposit processing fee | $0 for the first $5,000 deposited⁹ $0.30 per $100 deposited over $5,000⁹ | $0 for the first $20,000 deposited⁹ $0.30 per $100 deposited over $20,000⁹ | $0.0030 per $1 deposited per statement period21 |

| ATM fees (per transaction) | $0 at Wells Fargo ATMs⁹ $3.00 at a non-Wells Fargo ATM within U.S/ U.S territories⁹ $5.00 outside of the U.S⁹ | $0 at Wells Fargo ATMs⁹ $3.00 at a non-Wells Fargo ATM within U.S/ U.S territories⁹ $5.00 outside of the U.S⁹ | $0 at Wells Fargo ATMs⁹ $3.00 at a non-Wells Fargo ATM within U.S⁹ $5.00 outside of the U.S⁹ |

| Wire transfer (Incoming) | $15 each - Domestic, US currency and FX⁹ | $15 each - Domestic, US currency and FX⁹ | $15 each - Domestic, US currency and FX⁹ |

| Wire transfer (Outgoing) | Digital wire - $25 each - Domestic, USD and FX⁹ Branch - $40 each - Domestic, US currency and FX⁹ Standing transfer order (non-analysed accounts) - $25 each - Domestic, USD and FX⁹ Standing transfer order - (analysed accounts) - $18 for Domestic, $30 in USD and N/A in FX⁹ | Digital wire - $25 each - Domestic, USD and FX⁹ Branch - $40 each - Domestic, USD and FX⁹ Standing transfer order (non-analysed accounts) - $25 each - Domestic, USD and FX⁹ Standing transfer order - (analysed accounts) - $18 for Domestic, $30 in USD and N/A in FX⁹ | Digital wire - $25 each - Domestic, USD and FX⁹ Branch - $40 each - Domestic, USD and FX⁹ Standing transfer order (non-analysed accounts) - $25 each - Domestic, USD and FX⁹ Standing transfer order - (analysed accounts) - $18 for Domestic, $30 in USD and N/A in FX⁹ |

Below is a quick comparison of Wells Fargo savings accounts:

| Features | Business Market Rate Savings | Business Platinum Savings | Business Time Account (CD) |

|---|---|---|---|

| Monthly service fee | $5⁹ (See website for waiver conditions) | $15⁹ (See website for waiver conditions) | N/A |

| Minimum opening deposit | $25⁹ | $25⁹ | $2,500⁹ |

| Interest | No ⁹ | No⁹ | Yes; fixed and based on account opening rate⁹ |

| Cash deposit processing fee | $0 for the first $5,000 deposited⁹ $0.30 per $100 deposited over $5,000⁹ | $0 for the first $5,000 deposited⁹ $0.30 per $100 deposited over $5,000⁹ | N/A |

To open a Wells Fargo business account, you’ll need to provide:

Bank of America is one of the largest U.S. financial institutions, serving millions of consumers and businesses through an extensive network of branches, ATMs, and digital banking platforms. This bank provides a wide range of services, including checking and savings accounts, loans, and extensive foreign exchange services.

Bank of America has a Trustpilot score of 1.3 out of 5.0 based on 3,000 reviews¹¹

Best for: Small, medium-sized, and large companies.

Here is a quick overview of Bank of America checking accounts:

| Features | Business Advantage Fundamentals™ Banking¹² | Business Advantage Relationship™ Banking¹² |

|---|---|---|

| Monthly service fee | $16(or $0 with waiver)¹² | $29.95 (or $0 with waiver)¹² |

| Fee Waiver Requirements | (See website for waiver conditions) | (See website for waiver conditions) |

| Minimum opening deposit | $25¹² | $25¹² |

| Interest | No ¹² | No¹² |

| Cash deposit processing fee |

|

|

Below is a walkthrough of the Bank of America savings account:

| Features | Business Advantage Savings¹² |

|---|---|

| Monthly service fee | $10(or $0 with waiver)¹² |

| Fee Waiver Requirements | (See website for waiver conditions) |

| Minimum opening deposit | N/A |

| Interest rate |

|

| Cash deposit processing fee |

|

| Features | Flexible CDs¹³ | Business Featured CDs¹³ | Fixed Term Business CDs¹³ |

|---|---|---|---|

| Minimum opening deposit | $1,000¹³ | $1,000¹³ | $1,000¹³ |

| Terms | Open a 12-month term¹³ | 7 months to 37 months¹³ | 7 months to 37 months¹³ |

| Annual Percentage Yield (APY) | 3.25-3.25%¹³ | 0.11-4%¹³ | 0.03-3.75%¹³ |

You’ll need the following to open a business account with Bank of America:

Capital One Financial Corporation is a major American bank holding company founded in 1994 and headquartered in Tysons, Virginia¹⁵.

The bank offers a comprehensive range of financial services, including credit cards, personal and business banking accounts, auto loans, savings accounts, commercial lending, and investment products.

Capital One has a TrustPilot rating of 1.3 out of 5.0 based on 3,000 reviews¹⁶.

Best for: Small businesses and large corporations.

| Feature | Basic Checking¹⁷ | Enhanced Checking¹⁷ | Premier Checking¹⁷ |

|---|---|---|---|

| Monthly Fee | $15 (waived with $2,000 min balance)¹⁷ | $35 (waived with $25,000 min balance)¹⁷ | $99 (waived with $100,000 min balance)¹⁷ |

| Domestic Wires (Incoming) | $15¹⁷ | Free¹⁷ | Free¹⁷ |

| Domestic Wires (Outgoing) | $25¹⁷ | Free (first 5/month), then $25¹⁷ | Free (first 10/month), then $10¹⁷ |

| International Wires | $15 incoming, $40 outgoing | $15 incoming, $40 outgoing¹⁷ | Free incoming, Free outgoing (first 4/month)¹⁷ |

| Cash Deposits | Free at Capital One ATMs¹⁷ | Free at Capital One ATMs¹⁷ | Free at Capital One ATMs¹⁷ |

| Features | Capital One Savings Accounts |

|---|---|

| Minimum opening deposit | N/A |

| Monthly Fee | $3 (waived with $300 minimum balance)¹⁸ |

| Withdrawals | Up to 6 free withdrawals per monthly cycle¹⁸ |

| Annual Percentage Yield (APY) | 3.70% APY - 3-Month Guaranteed Promotional Rate¹⁸ |

To open a Capital One business account, you need the following:

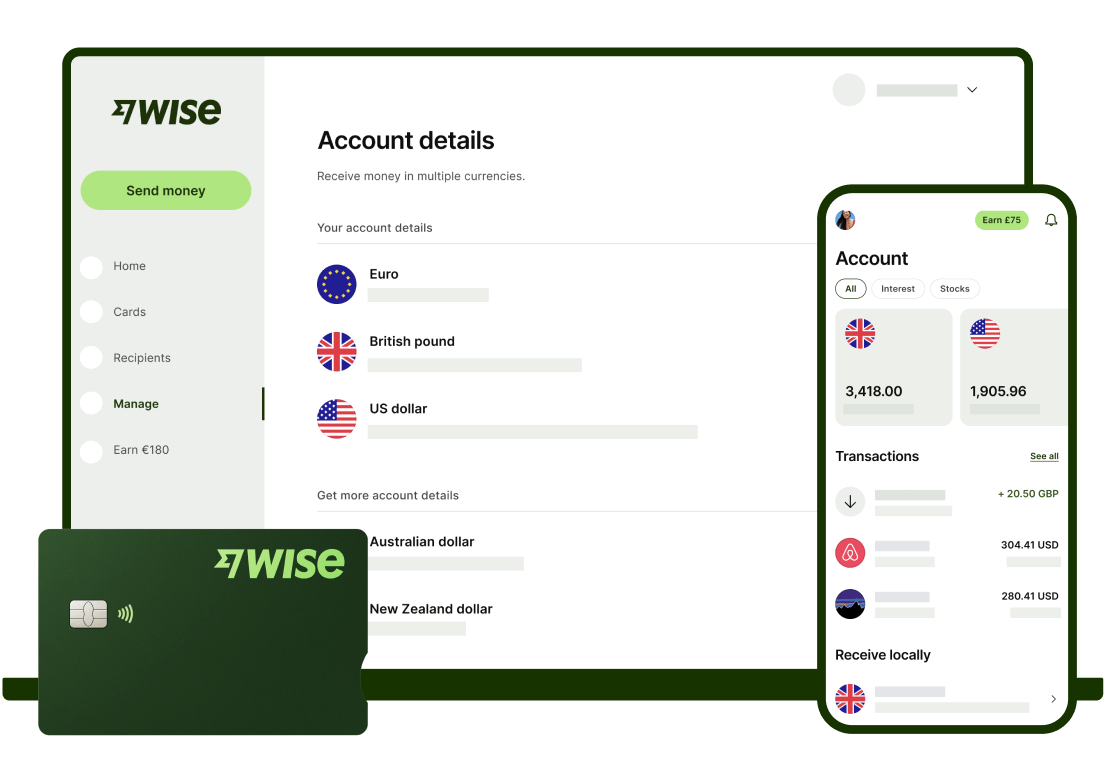

Wise Business serves as a great alternative for businesses looking to manage their international finances without a traditional bank. It’s a Money Services Business (MSB) designed to deliver many bank-like tools designed for small businesses and startups like you.

Wise Business account lets you send, hold, and manage funds in 40+ currencies and pay suppliers in 140+ countries. For easier FX and expansion, you can start by opening a UK Wise Business account and then add local USD account details (only with Wise Business Advanced) in the app so you can get paid like a local in the US.

Here’s a quick walk-through of the services/features Wise Business offers:

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

To help you choose the right bank account for US business, here are some more factors that you should be looking out for:

Understand your business structure and your eligibility status. Will you be trading under your UK company, or do you have a US LLC/corporation? Also, would your business require having a physical branch in the US, or would you be conducting your business online?

Most banks will usually expect you to have a US LLC/corporation to open an account. Additionally, you might also have to provide an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) and have a physical US business address. It’s also not unlikely for traditional banks to insist you visit their branch to open an account.

The common bank charges usually include monthly maintenance fees, transaction fees, FX fees, overdraft fees, ATM fees, and insufficient fund (or NSF) fees. Some banks also require you to maintain a minimum required balance.

Additionally, consider picking a bank that offers a significant interest rate. This helps you earn money from your cash reserve. The average interest rate for a regular savings account for $2,500 balance, according to the National Credit Union Administration for June 27, 2025, is 0.19% APY for banks and 0.32% APY for credit unions²⁰.

If your business has international operations, foreign exchange and cross-border payments are very crucial. For these types of company, consider banks that support cross-border payments without having high transaction fees and foreign exchange conversion costs. This bank should also be able to process settlements faster and offer better exchange rates. With traditional banks, you can typically expect much higher FX fees compared to digital alternatives.

Having poor customer support services can lead to frustration and a longer time to resolve issues. Additionally, check what their existing customers are saying about them on review sites like Trustpilot.

Review the bank you are considering to see if they have an online banking platform. A solid digital banking platform should let you make payments, manage your account online, view your transaction history, and generate account reports without visiting a physical branch.

Also consider financial institutions that support mobile bank apps, third-party integrations with major in-house accounting software such as QuickBooks and Xero, and multi-user access for different team members to have varying access levels.

Wise Business is an easy way to get USD account details (only with Wise Business Advanced) for non-residents, so you can begin expansion or trading in the US right away.

Opening a bank account in America can be a bit of a nightmare for non-residents. Visiting in person may not be possible, and international bank accounts require a hefty financial commitment.

If your local bank has a correspondent banking relationship, this could be a good solution for you — but it could take some time to set up. It’s worth calling your bank and seeing how they can help.

Though if you need a fast and low-cost way to send and receive USD, then try Wise. After the fast registration, all you need to verify your identity is your government ID. You can then top-up your account and start sending and receiving payments around the world!

Get started with Wise Business 🚀

Sources used in this article:

Sources last checked: 14-Aug-2025

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best joint business accounts in the UK? We compare features, fees and best usage to help you find the ideal shared account.

Read our complete comparison of the features and fees of Worldfirst vs Wise Business, written for UK businesses.

Read our comprehensive Sokin multi-currency account review for UK business customers, including pros, cons and features.

Looking for the best business accounts in Northern Ireland? Compare fees, features and benefits to find the account that supports your business best.

Read our comprehensive guide to the best UK business bank accounts for non-residents, including Wise Business, Revolut, Airwallex and Tide.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.