Xero pricing Australia: Plans, costs & features guide

Explore Xero pricing in Australia. We break down all 4 plans, hidden costs, and features like payroll & multi-currency. Find more.

When shipping goods overseas, paperwork matters. You’ll need to create commercial invoices when conducting any sort of international trade, such as sending products to customers outside Australia.

In this blog, we’ll outline exactly what a commercial invoice is and how it differs from other important documents. There’s also a step-by-step guide for filling one in, and details about the advanced invoicing features available with Wise Business.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

A commercial invoice is a legal document that facilitates international shipments and trade. It acts as both a bill of sale and a customs declaration. This makes it different from standard domestic invoices that primarily serve as a way to request payments.

When sending products overseas from Australia, a commercial invoice is one of the key export requirements¹. The document provides customs authorities with detailed information about goods — value, product description, weight, shipping terms etc. This helps them to verify that goods are legitimate and calculate any duties or tax.

They are typically used by:

A commercial invoice has multiple functions. First and foremost, it ensures smooth passage of any goods through customs. Australian Border Force uses the information in the invoice, such as the package’s contents and HS codes, to verify it and ensure it meets strict import and export regulations before crossing international borders.

There are also financial and business functions. A commercial invoice serves as a:

Shipments can be delayed or even rejected at borders without commercial invoices. That’s why it’s vital that you complete them accurately before sending goods overseas.

Both tax invoices and commercial invoices are used to request payments for goods and services. However, tax invoices are primarily used in Australia as a way to comply with Goods and Sales Tax (GST) and VAT rules domestically. In contrast, commercial invoices serve as international trade documents for customs clearance.

Businesses in Australia use tax invoices to meet their tax obligations. They are required by law for any sales above 82.50 AUD and must be issued to customers within 28 days on request².

There’s another document that’s involved in transactions and shipping: a pro forma invoice. This document is simply a preliminary bill. Think of it as a quote or offer — a list of goods or services for a potential transaction. You might use one of these to provide a buyer with a description of goods and estimated costs ahead of a sale. It’s not legally binding.

Pro forma invoices are often used when gathering quotes and estimates for different suppliers, or during the negotiation phase between two parties.

There’s quite a bit to get through with a commercial invoice compared to a basic sales document. It’s a good idea to read up on HS codes and Incoterms — things specific to shipping overseas — so you get the right details to complete all the fields accurately.

Here’s a step-by-step guide for the process:

Start by including all of your relevant details. This includes your complete, legal business name, Australian Business Number (ABN) and physical address, as well as your contact details and any relevant registration numbers. These will help customs authorities verify who you are.

Next, fill in all the details for your buyer or supplier. You’ll need to include their full name or business name, address (including postcode and country), and contact info. Make sure this matches what’s on the shipping label exactly. Any discrepancies can cause confusion and issues with shipment or delivery.

It’s easier to track shipments and file your records when you use numbers. Add an invoice number and date of issue. If there’s a purchase number, include this as well to provide context for both parties.

Now, a very important part. You need to describe your goods in detail and as accurately as possible. Avoid any vague terms like “machine parts”. Instead, specify exactly what they are, such as “stainless steel automotive brake components”. Add model numbers, too, where applicable, plus the quantity and county of origin.

HS codes are one of the unique aspects of commercial invoices. The Harmonised System is an international standard used in Australia and overseas. They classify goods and help customs to quickly identify them to determine duty rates. Make sure you include the correct ones — this is a common mistake, so double-check.

Go through the document and declare the value of each unit before calculating a total value. Always be upfront and honest with these figures. Undervaluing goods or omitting key details is a major red flag for customs and can result in significant delays and fines. Make sure to note down the currency used for the sale, too.

You need to include the terms of trade using Incoterms. These are three-letter acronyms that define the responsibilities between you and the buyer or supplier. Common terms of trade include FCA (Free Carrier) and Carriage Paid To (CPT). Also, state the reason for the export, such as sale or gift.

Finally, include any shipping costs and grand totals, including exchange rates if multiple currencies are involved. Go through one last time to ensure all of your calculations are accurate. When everything’s completed, sign the form and add a company stamp.

Here’s a sample of what a commercial invoice could look like. It’s for a tech company based in Melbourne shipping products overseas to a customer based in Singapore.

Invoice No: CI-2025-0815

Invoice Date: 15 August 2025

Export Reference: EXP-AU-2025-0456

Exporter/Sender:

Company: ABC Tech Solutions Pty Ltd

Address: Melbourne, Australia

Tel: +61 3 4567 1234

ABN: xx xxx xxx xxx

Email: exports@abctech.com.au

Buyer/Receiver:

Company: XYZ Innovations Ltd

Address: Singapore

Tel: +65 6234 5678

Email: purchasing@xyzinnovations.sg

Ship to:

Digital Innovations Ltd

Logistics Centre

Singapore yyyyyy

Shipment details:

Port of Loading: Melbourne, Australia

Port of Discharge: Singapore

Country of Origin: Australia

Shipping Method: Sea Freight

Departure Date: 15 August 2025

Est. Arrival: 22 August 2025

Reason for Export: Commercial Sale

Goods description:

| Item | Description | HS Code | Quantity | Unit Price (AUD) | Total Value (AUD) |

|---|---|---|---|---|---|

| 1 | Wireless Bluetooth Earphones | 8518.30.00 | 500 | 89.95 | 44,975 |

Terms of Sale:

Incoterms: FOB Melbourne

Payment terms: 30 days net

Currency: Australian Dollars (AUD)

Method of Payment: Bank Transfer

Invoice Summary

Total Invoice Value: AUD 44,975

Managing commercial invoices shouldn’t be a headache. With Wise, you can bill clients at home in Australia and abroad with a full invoicing service. This is included for all Business account users.

To get started, all you need to do is:

After it’s sent, you can manage everything from the Invoices section in the Payments tab. Here, you’ll be able to track all the progress using filters, as well as cancel invoices, and download them for your own records.

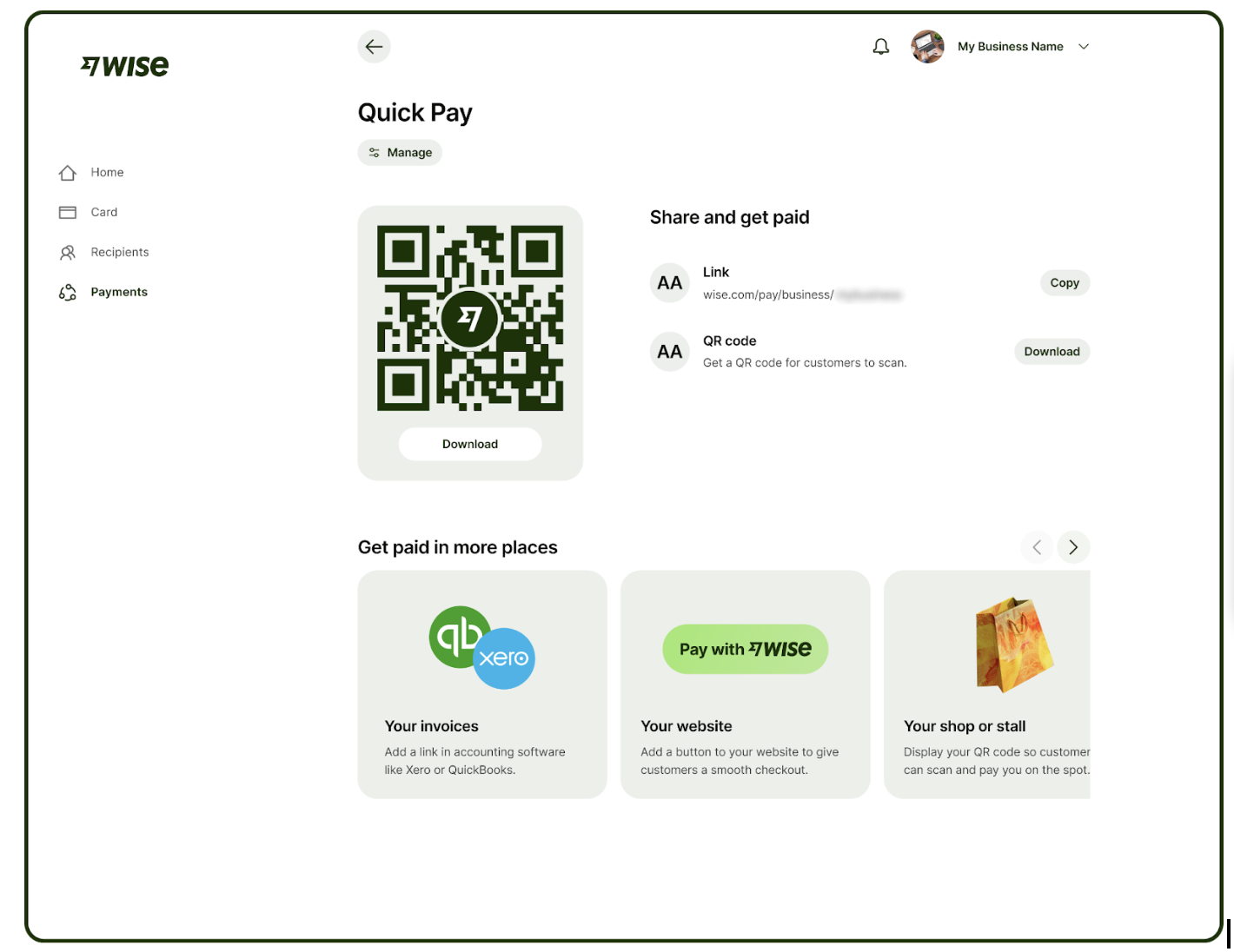

Wise helps you get paid faster, too. With Quick Pay, you can include QR codes and payment links to your invoices. And there’s integration with all your favourite invoicing and accounting tools like QuickBooks.

This level of integration is great for record keeping and reconciliation for tax reporting. It also makes it much easier to manage your business finances and cash flow.

A commercial invoice is an essential document that’ll keep your international shipments moving. It provides important information for customs authorities to verify goods and calculate duties and tax. While also doubling as a proof of sale and contract between you and the seller or supplier. Getting the details right will reduce delays and build trust and transparency between both parties.

With Wise Business, you can manage invoices from one easy-to-use platform. You’ll also be able to accept payments in 8+ currencies and keep your records in sync. It’s the smarter way to keep on top of all your cross-border transactions.

Expanding a business globally opens up exciting opportunities, but also new challenges like receiving payments across borders. Hidden foreign transaction fees and hefty currency conversions involved with international payments can eat into your profits and time.

Wise Business serves as a cost-effective solution where you can receive money from around the world at the speed and price of local payments.

Transform the way you receive payments with Wise Business:

Sign up for the Wise Business account! 🚀

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore Xero pricing in Australia. We break down all 4 plans, hidden costs, and features like payroll & multi-currency. Find more.

Wondering how to reactivate your ABN? Find out more on ABN reactivation, eligibility, required documents, and overall process.

Discover how Xero integration connects works and connects to over 1,000 apps, from ecommerce to payments. Read here.

Learn how to create a compliant tax invoice in Australia. We cover ATO requirements, GST rules, mandatory fields, and more.

Aussie guide on finding the right dropshipping supplier. Explore directories vs wholesalers, checklists, and saving on international payments.

What does it mean to buy direct from China suppliers safely. Discover platforms, steps, and best ways to pay vendors overseas.