What is Odoo? ERP features and pricing guide in Australia

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Once you start to employ people for your Australian business you’ll find you have plenty of things to think about. One smart way to streamline some of the admin involved with managing teams is to choose small business payroll systems which manage holiday and sick pay tracking, pay slips, super and tax admin, timesheets and more.

Cloud based solutions offer fairly easy ways to cut down on some of the administration involved in running payroll - but you’ll need to find the best payroll software in Australia for your specific needs. This guide walks through how payroll software for small business works - and also touches on Wise Business as a helpful tool for minimizing admin and costs when you need to pay people abroad.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

There are plenty of payroll systems for small businesses in Australia - but picking the right one for you will need some thought. Here are a few pointers on things to look out for - and we’ve got a roundup of some providers to look at coming up right after.

All of the best payroll software in Australia for small businesses is STP compliant. STP reporting is mandatory for Australian businesses¹ - and using STP-enabled software makes it easy to comply, by reporting employees' required payroll information to the ATO automatically.

Pick a payroll software that’s optimized for use in Australia and STP compliance will be in-built - just make sure you don’t accidentally sign up to a provider which offers products primarily in different markets, as this feature may not be as common.

The charging structures for payroll software for small businesses varies enormously. The good news is that this gives plenty of choice - but the bad news is that it requires a bit of work to pick apart the options which might suit your needs.

We’ve got some ideas of providers coming up in this guide, with an insight into what fees you might have to consider if you sign up.

As well as payroll software offering you peace of mind as you’ll know you’re ATO compliant at every step of the day, you can also save time and admin. Many software solutions have things like employee facing apps which allow your team to view and download their payslips, or request leave. This cuts out admin for you and puts the employee back in control - making for a happier team.

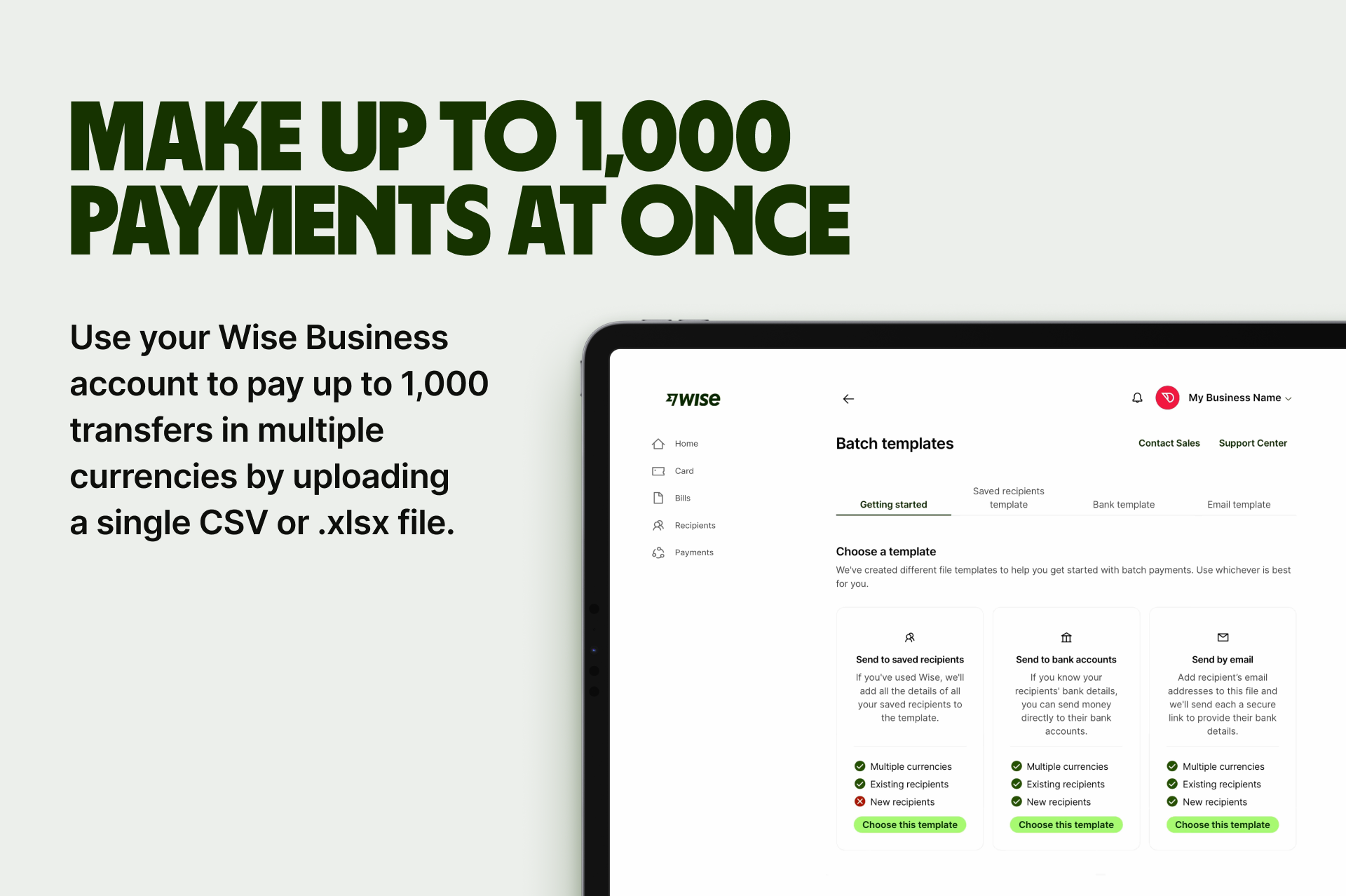

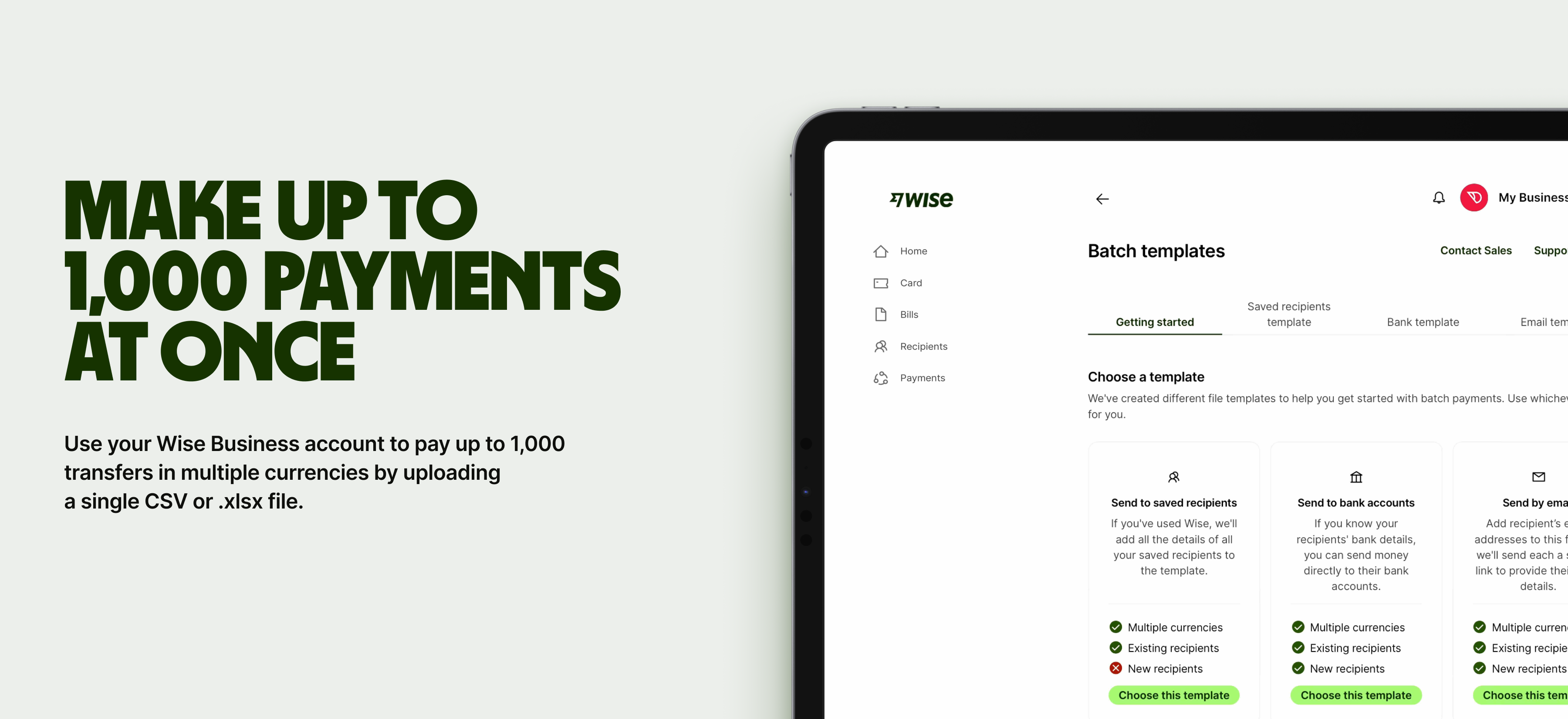

Other services, like Wise Business can also offer ways to save time, with batch payments to send salary payments to as many as 1,000 people at once, and automatic recurring transfer solutions so you can ‘set it and forget it’ - and get back to your core job growing your business.

Sign up for the Wise Business account! 🚀

Depending on the size and complexity of your business you may need fairly simple solutions for payroll, or you might benefit from extra features like tracking of sick and holiday leave, super and tax, long service awards and more. Or you might want to combine your payroll with a full suite of cloud accounting or invoicing tools.

Payroll software providers can offer end to end solutions or simple tools for smaller companies - consider a few to decide which might work for your needs.

Finally, think about your needs now and in future, for paying employees overseas. If you have remote workers, or think you may expand to overseas markets in future, a provider which can easily and cheaply add in international payments in foreign currencies is a must.

Let’s take a look at some of the options for small business payroll systems which might appeal to Australian businesses.

Here we’ve picked out 3 different choices which may appeal to businesses at different stages.

Easy Payslip could be a good fit for new companies which are looking for cheap and accessible payroll services, with local support teams.

Reckon has both standalone payroll and payroll/accounting combined packages which may suit growing businesses that need to add in extra services as time passes.

And finally, Xero, which adds payroll into all its cloud accounting packages and which can be a good solution for companies looking for end to end management of a range of company admin needs.

If all you really need to do is to create and email payslips to employees, while managing tracking and compliance for the ATO, Easy Payslip² might suit you. It’s an Australian company with local support teams, and offers payslip tools with additional options for invoicing, cash flow and reporting.

Top payroll features:

Plan and payroll pricing:

While Easy Business does offer many other services, you can buy payroll as a standalone if you’d like to:

Payroll for up to 4 employees - 9.95 AUD /month

Payroll for up to 6 employees - 13.95 AUD /month

Payroll for unlimited employees - 21.95 AUD /month

Reckon³ offers either accounting and payroll in a package together, or standalone payroll. This can make it a handy choice for growing businesses which need some services now, but may want to add in extras, or change to plans covering more perks and benefits at a later stage.

Top payroll features:

Plan and payroll pricing:

There are 3 available plans, which all have discounts at time of research (5th June 2025), to allow you to get a 30 day free trial and 75% off for your first 6 months⁴. The packages come with extras like free onboarding support, timesheets and expense management, depending on the plan you pick.

Xero⁵ is a popular provider of cloud accounting solutions in many countries, with products which cover billpayment, expense management, GST tracking and project management tools. There are specific payroll features for Australian businesses which are built into broader accounting plans, so you can get end to end support on payroll and other financial management requirements.

Top payroll features:

Plan and payroll pricing:

Payroll is built into broader cloud accounting packages, which run from the Ignite plan at 35 AUD/month through to the Ultimate 10 plan at 115 AUD/month. At the time of writing (June 5th 2025) there are deep discounts of 90% off these packages which allow you to test the water for a few months for far less. That brings the prices down to 3.5 AUD with discount through to 11.5 AUD with discount.

Packages include bill payments, invoicing, data analysis, bank reconciliations and similar, with payroll for 1 to 10 employees included depending on the plan you select.

If you have employees or contractors abroad, you could cut down on payroll costs and admin with Wise Business.

Australian businesses can open a Wise Business account online or in app, and access a broad range of tools to pay and get paid in 40+ currencies, with debit and expense cards, and ways to hold and exchange major currencies with the mid-market rate.

Wise Business helps streamline overseas business payments without foreign transaction fees, saving up to 3x compared to other providers.

Tired of hidden fees and complex processes when making overseas payments?

Start sending with a Wise Business account! 🚀

If you find the best payroll software in Australia for your specific needs, you could save on time and money - and because you’ll know you’re remaining compliant you can stop worrying about ATO filing.

Smart small business payroll software is great for your team too, as they’ll know payments will be calculated correctly, and they’ll be paid on time - plus many providers offer employee facing apps to manage leave requests, pay slip downloads and other administration, so you don’t have to.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Learn about Zoho Books, it's key features, pricing plans, GST handling, and how Zoho Books compares with Xero and QuickBooks for business accounting.

Learn what an invoice number is and how to assign it. We cover sequential formats, best practices, organization ideas, and more.

What is a liquid asset? Learn liquidity meaning, examples, and why liquid assets matter for business cash flow and stability.

Learn what Microsoft Dynamics 365 is, how its main apps work, pricing in Australia, and how it integrates with Wise Business for easier cross-border payments.

Explore Australia's payment landscape. From cards and PayID to BNPL, learn how the right methods improve customer trust, cash flow, and global reach.