What is Odoo? ERP features and pricing guide in Australia

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Dropshipping has become an accessible way to start an online business in Australia. Instead of stocking products yourself, you can partner with suppliers who handle storage, packing, and delivery — freeing you to focus on things like marketing and growth strategies.

It’s a model that’s growing fast. Australia’s e-commerce market is now worth around $40bn¹. For entrepreneurs, dropshipping is a flexible way to launch a business quickly without heavy investment. But it’s important to do it right.

This guide will detail exactly how to start dropshipping in Australia. There’s a step-by-step guide covering tips on how to find suppliers, create an online store, take care of legal registrations, manage finances, and more.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

Starting a dropshipping business is a way to enter e-commerce without managing an inventory yourself.

Dropshippers differentiate themselves by focusing on branding and added value. Typically, it’s less about the product itself and more about how it’s presented and delivered to create a unique experience for the customer. This starts with selecting a niche and building from there.

Here’s a step-by-step guide for getting a dropshipping business off the ground.

The first step is to decide what type of products you actually want to sell. This is a big one as it will dictate the direction of your business. Most people either opt for an area that they’re passionate or knowledgeable about, or double down on a niche that’s currently in high demand.

To hone in on your niche for dropshipping, you can:

Dropshipping is defined by its fulfilment model based around suppliers who will not only store your products, but package and ship them directly to customers after you make a sale. This is the backbone of the business and key to building a trustworthy brand and keeping customers happy. So you need to choose carefully.

To find reputable and reliable suppliers, look for:

Many dropshippers now source products globally, often from marketplaces like AliExpress or suppliers based in China or the US. This opens up broader product ranges at competitive prices, but involves regular international transactions. Multi-currency accounts can help here (more on this later).

You’ll need a storefront for your products. Popular choices for dropshipping in Australia include Shopify, Magento, WooCommerce, and BigCommerce. These are all quite easy to set up with user-friendly templates and interfaces that don’t require coding knowledge. They also provide the essential tools and features for managing a dropshipping business, such as:

Most of the big e-commerce platforms also have built-in integrations with dropshipping tools like Spocket and DSers to create product listings. These let you complete:

Next, use the platform to create a professional and eye-catching storefront. You should prioritise:

Finally, set your pricing strategically. There are quite a few costs to factor in, including how much you pay suppliers, shipping fees, marketing and advertising costs, payment processing fees, etc. You want to leave room for a healthy profit while being competitive.

Running a dropshipping business rather than selling products “on the side” or as a hobby means you’ll need to register everything to operate legally in Australia.

To meet all the legal requirements, you must:

| 👆 Check out our guide on how to apply for an ABN as a dropshipping business |

|---|

Now, it’s time to get your finances in order. The Australian government says it’s a “good idea” to open a separate bank account for your business, even if you’re a sole trader². Keeping your dropshipping transactions apart from personal spending makes it easier to see what’s actually coming and going out. It’ll also make tax time far less painful.

Also, think about the banking features you’ll need. Can the account handle payments from international customers? Can you pay suppliers overseas without losing a chunk of money to fees or poor exchange rates? Opting for a flexible multi-currency account with lower international transaction fees can keep more money in your business when you get started.

Finally, you’ll need to promote your store to attract customers. You can do this through:

Dropshipping businesses often manage a global chain of suppliers and customers across multiple countries and currencies.

You might be buying products in USD or EUR, while your customers pay in AUD. Each conversion or payment delay chips away at your profits, especially as providers often charge hidden fees or use marked-up exchange rates to make a profit.

Coordinating these overseas payments across multiple currencies can be confusing, too. You’ll waste time tracking payments and trying to find which ones have gone through and how much money you’ve lost to fees, slowing down your ability to reinvest and grow.

When you're running a dropshipping business, speed and reliability are key—not just for shipping products, but for paying your suppliers too. Delays with international bank transfers or confusion over fees can complicate your cash flow and strain important partner relationships.

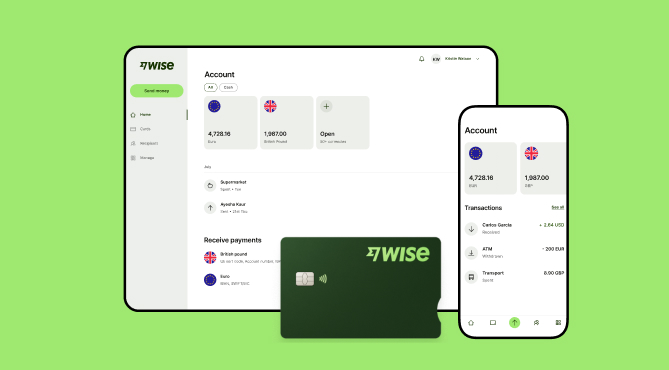

In such scenarios, Wise Business provides a more direct way to handle international payments. It lets you pay suppliers and get paid like a local in numerous countries, all from a single account, which helps simplify your finances and reduce the costs of operating a global online store.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

1. How old do you have to be to start dropshipping?

You don’t have to be an adult aged over 18 to start a business in Australia³. Minors can legally operate a business, but the government states there are a “few extra things to consider.” For example, you’ll need a tax file number (TFN) and may need consent from a parent or guardian to open a business bank account.

2. How to make money dropshipping?

You make money in dropshipping by selling products at a higher price than you pay your supplier. For example, if a supplier charges $25 for a product and you sell it for $40, you generate $15 in gross profit. However, you need to take things like transaction fees and marketing into account. The key to success is keeping customer acquisition costs low while providing a strong customer experience.

3. Is starting a dropshipping business worth it in Australia?

Yes, dropshipping is still worth it in Australia. It’s one of the lowest-risk business ventures — you don’t have to build your own inventory or store it locally. While competition is high, it’s possible to grow and succeed if you find the right niche and manage your costs.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Learn about Zoho Books, it's key features, pricing plans, GST handling, and how Zoho Books compares with Xero and QuickBooks for business accounting.

Learn what an invoice number is and how to assign it. We cover sequential formats, best practices, organization ideas, and more.

What is a liquid asset? Learn liquidity meaning, examples, and why liquid assets matter for business cash flow and stability.

Learn what Microsoft Dynamics 365 is, how its main apps work, pricing in Australia, and how it integrates with Wise Business for easier cross-border payments.

Explore Australia's payment landscape. From cards and PayID to BNPL, learn how the right methods improve customer trust, cash flow, and global reach.