If you have a Singapore business you may be considering using the Adyen¹ payment tool to take on and offline payments, or to get paid via marketplace sites. Adyen has a broad range of features and is a popular provider for payment processing services worldwide. But whether or not it’s the best option for your business will depend on the type of transactions you need to accept. This guide walks through the tool’s features, fees, and common use cases, to help you decide if it’s a match for your needs.

We’ll also touch on how Wise Business can help you save money on conversion fees if you’re taking customer payments from overseas, or working with international suppliers and vendors. More on that later.

What is Adyen payment?

Adyen is an Amsterdam based payment service provider which offers services globally. You can use Adyen to accept customer payments on and off line, including taking card payments, receiving money by local payment methods like PayNow, and getting paid through bank transfers.

Adyen payment services can be used online through low and no code options to take digital payments, and also offline with payment terminals and tools.

Aside from payments, Adyen also offers add-on services like fraud prevention tools, ways to verify the identity of customers, business accounts and working capital.

Check out our other payment gateway and payment processors reviews

➡️ Review of Stripe payments in Singapore

➡️ Review of Checkout.com

➡️ Top Shopify payment gateways

How Adyen works

Adyen offers payment processing services. That means that Adyen can help you process customer payments on and offline, and receive your funds in a merchant account which you can then transfer to your business bank account when you want to.

➡️ Further Reading: Best Singapore Business Bank Accounts in 2025

In effect, Adyen is the middle man which gets the money from the customer’s bank account, wallet or card, and into yours.

You can sign up with Adyen with a test account initially to check out the different features and services, and apply for your live account. A member of the Adyen sales team can guide you through this stage and talk you through the services which may suit your own business needs. As part of your live account application you’ll be asked to provide some paperwork to comply with law here and internationally. This can include uploading images of your:

- ID and proof of address

- Company registration documents and information

- Tax and GST information

Once everything is verified you’re able to take customer payments. The exact services you can access, and what you pay, will depend on the features you’ve integrated into your account.

| 🛒 For example, you might want to take customer card payments online if you’re an ecommerce seller here in Singapore. In that case you’ll need to add your preferred payment options - such as cards, Apple Pay or PayNow, to your website, and configure the Adyen details to show these payment options as you want them. Your customer will then see these options at the checkout and can pay conveniently. |

|---|

Your funds are deposited into your Adyen merchant account, and you can then withdraw them to your business bank account when you’re ready to and once all payments have been processed.

➡️ Further Reading: Cross-border payments: E-commerce and B2B essentials

Adyen pricing

Adyen offers a huge range of ways to get paid, and the costs involved depend on which payment methods you choose to accept. You don’t have to accept all payment types so you can set up your account to suit your needs and where your customers are primarily based. Payment options include global methods like cards and major e wallets, as well as local payment tools like PayNow and Grab.

There’s no set up fee for Adyen, and you’ll then pay per transaction. The basic fee is the equivalent of 0.11 EUR plus a variable fee which depends on the payment method. The payment methods you can select will depend on where your customers are based - to give an example here are a few of the payment options you may consider for your Singapore customers:

| Payment method | Adyen fee2 |

|---|

| Alipay and WeChat Pay | 0.11 EUR + 3% |

| Apple Pay and Google Pay | 0.11 EUR + fee based on the card used |

| Visa and Mastercard | 0.11 EUR + Interchange+ + 0.6% |

| PayNow | 0.11 EUR + 1.3% |

| GrabPay | 0.11 EUR + 2.2% to 6% depending on payment type |

*Details correct at time of research - 19th February 2025

Because there are a huge number of different payment methods offered by Adyen, you’ll want to review all of the options before you decide which to offer. As you can see, the fees can vary quite a lot. However, offering the broadest possible range of ways for customers to pay can make your business more appealing.

| 💡If you’re receiving payments in a selection of currencies, you can link different account information to Adyen to withdraw your funds without needing to convert back to SGD every time. So if you have customers in the US, and want to keep your payments in USD for example, you can link a USD account to Adyen to withdraw without conversion. You can then hold your USD for later use when paying suppliers or taxes. Providers like Wise Business offer handy ways to get account information for foreign currencies, without needing to open multiple different bank accounts. |

|---|

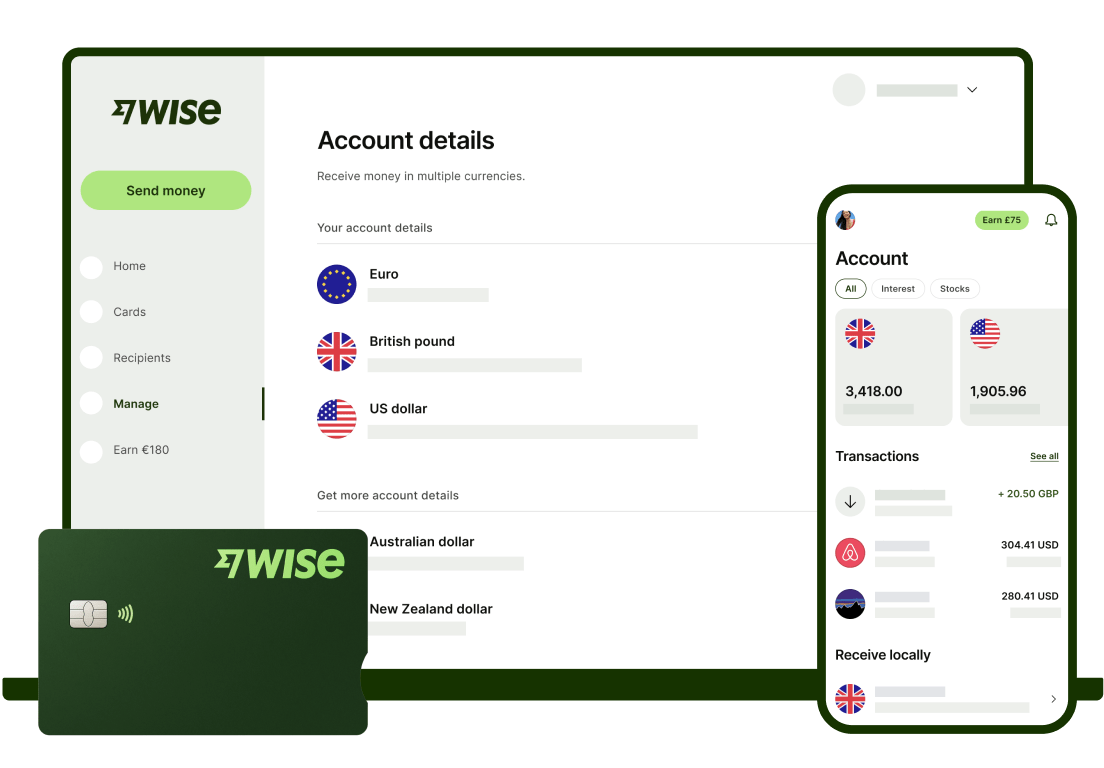

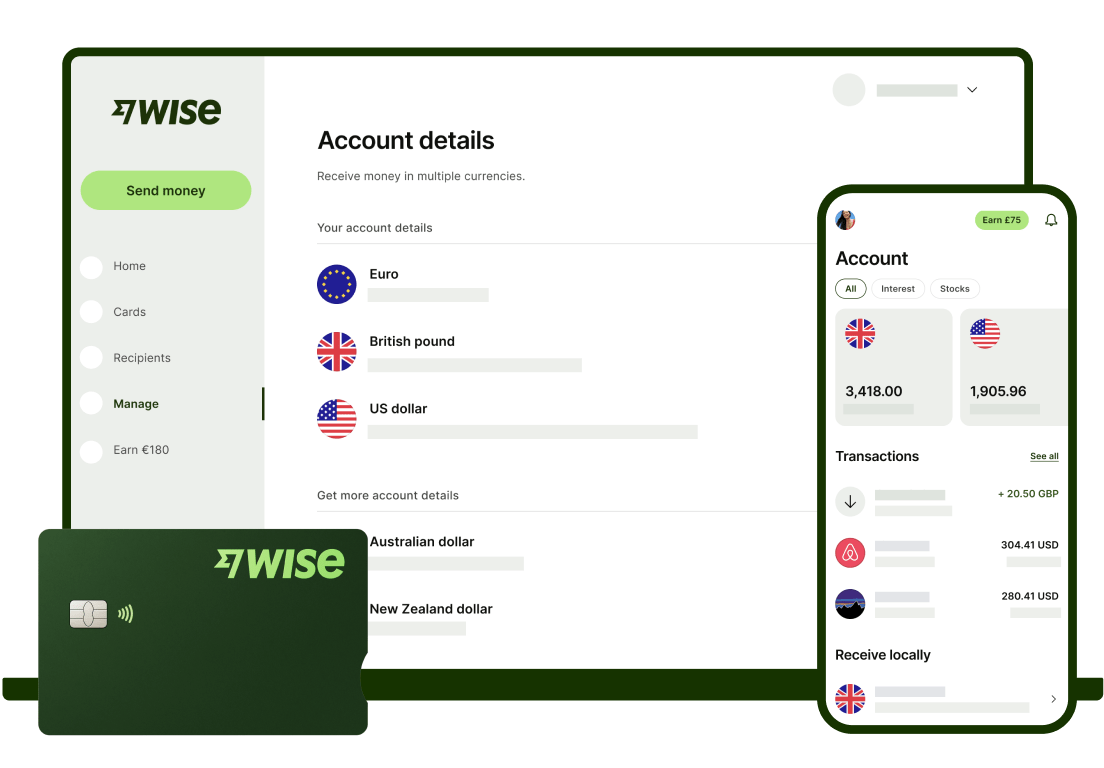

Avoid high currency conversion fees with Wise Business

Illustration of Wise Business products

If you are taking business payments using Adyen, there’s also a good chance you have some international customers, suppliers, vendors or contractors.

You can tap into the products and ideas your customers want, from suppliers globally - and you can sell to fans all over the world seamlessly.

However, running a global business also comes with the complication of higher forex risk since your international payments may incur a markup every time you switch to or from SGD.

Wise Business can help businesses working across currencies to limit exposure to high foreign exchange fees. Add your Wise account information to Adyen or your preferred payment provider - and get paid easily from abroad. Hold your balance as it is, send to cover your own business invoices around the world, or convert back to SGD with the mid-market rate, to withdraw to your bank.

Wise payment gateway

Made for ecommerce with low fees and local currencies. Coming soon.

Register for updates

What type of Singapore business stands to benefit most from Adyen?

Adyen targets its services to:

- Digital businesses,

- Omnichannel businesses which trade on and offline, and

- Marketplaces which want integrated payment options.

You might like to use Adyen if you have a fully digital Singapore business, selling online to customers around the world. Or you may want to use the services to access the flexibility of selling on and offline, depending on what your business priority is. Because Adyen can process pretty much any digital payment, it can be a good fit for many business types.

🏷️ Just remember to look at the fees for the types of payment you take frequently and ensure your current customers’ preferred payment methods are offered among Ayden's selection.

Conclusion

Adyen has smart ways to take customer payments using global and local payment methods, online and in person. This means that Adyen can be a good fit for a very broad selection of Singapore businesses which tend to prefer digital payments over cash.

| 💡 If you’re planning to use Adyen to take customer payments in foreign currencies, why not consider Wise Business to withdraw and hold your funds in global currencies like USD, GBP and EUR without needing to convert back to SGD every time? |

|---|

- Hold and manage 40+ currencies for all your international transactions

- Pay suppliers and receive payments internationally without the hefty foreign transaction fees

- Always get the mid-market rate with zero markup

- Seamless integrations with popular accounting software

- Say goodbye to monthly fees

Make the most out of your cross currency transactions with Wise Business today

***

Sources:

- Adyen

- Adyen pricing

Sources checked on 19 February 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.