Dubai Tourist Visa for Filipinos: A Step-by-Step Guide (2026)

A step-by-step guide to the Dubai tourist visa for Filipinos, covering requirements, visa types, costs, validity, and how to apply in 2026.

Digital banks offer a range of services, often including accounts to save and spend, loans and credit cards. In most cases everything is managed through a self service app, rather than a branch network. This means you can manage your money on the move easily.

Generally digital banks do not offer easy access foreign currency accounts, and can’t necessarily send overseas payments, or receive non-peso payment. If you love to manage your money digitally, but need access to a very broad range of currencies to hold, send, spend and exchange, Wise can help. Wise is not a bank, but has a range of international tools which can make overseas payments and spending simple.

| Table of contents |

|---|

A digital bank usually has no physical outlets or branches. Instead customers manage their accounts through a phone app or online. Usually you’ll get a card to allow you to deposit and withdraw funds at an ATM, and in some cases you can also deposit or withdraw cash over the counter through partner providers.

Digital banks offer various account products and services, often with interest earning options including easy access savings and time deposit accounts. You may also be able to get loans, credit cards and other financial products like insurance, depending on the specific provider you select.

While digital banks aren’t the same as traditional banks, they’re safe to use including being PDIC insured and licensed and regulated by the Bangko Sentral ng Pilipinas.

Digital banks and traditional banks work a little differently. Ultimately which suits you best will depend on your preferences and needs. Digital banks can be flexible and cheap, and often have excellent savings interest rates. However, if you need a full suite of services and prefer face to face money management in a branch, traditional may be the way to go.

Here’s a quick head to head comparison on some Digital Bank vs Traditional Bank features:

| Digital bank | Traditional bank |

|---|---|

| Usually no branch locations, manage account in an app | Branch locations available, as well as online and mobile services |

| Often low fees and good interest on account products | Fees can be higher for face to face service, interest varies a lot |

| Some service options may be limited | Full suite of financial services available from one place |

There are several digital banks in the Philippines which each offer their own accounts, features, fees and services. Here’s a head to head comparison to start with, looking at some common choices - we’ve got lots more information coming up about each shortly.

| GoTyme¹ | UNO³ | Tonik⁴ | Union⁶ | Maya⁷ | |

|---|---|---|---|---|---|

| Interest rates | 4% p.a. | 4% p.a. On easy access account, up to 5.25% p.a.on time deposit | 4% p.a. On easy access account, up to 6% p.a.on time deposit | 3% p.a. to 4% p.a. depending on balance | 3.5% p.a. basic interest, with opportunity to raise to 15% p.a. |

| Holding limit | Not specified - individual account limits available in app | Not specified - limits set at UNO discretion | Aggregate limit of 100,000 PHP/year for accounts which have not met documentary requirements | Limits depend on account type - you can open a time deposit for up to 10 million PHP online for example | Limits may apply on movement of funds from wallet to savings account and vice versa |

| Debit card features | Get your card in 5 minutes at a kiosk² Reward earning opportunities | Virtual cards only at the time of writing | 300 PHP order fee, no ATM fee⁵ Virtual cards available instantly and for free | Not available | Card is free when you deposit at least 250 PHP and spend at least 500 PHP |

| Loans | Not available | Available to 500,000 PHP to eligible applicants | Up to 20,000 PHP credit builder loan, or up to 100,000 PHP Shop Now, Pay Later options with partner merchants | Loans available based on eligibility | Various different loans, Buy Now Pay Later, and credit services available |

*Details correct at time of research - 7th March 2025

|

|---|

GoTyme Bank is a collaboration by Filipino conglomerate Gokongwei Group, and the Singapore-headquartered digital banking group Tyme. GoTyme is PDIC insured and licensed and regulated by the Bangko Sentral ng Pilipinas.

GoTyme operates through physical kiosk locations, and also with an app. This means you can always get service from a human when you need it, by visiting a kiosk, and you can also transact easily on the go with just your phone. Earn reward points when you spend with your card which you can convert to cash - including great opportunities to earn bonus points if you shop with GoTyme Bank preferred partners.

|

|---|

UNO is a licensed and insured digital bank, and offers products to allow you to save, virtual cards for easy spending, and loans which can be accessed without collateral. UNO operates entirely digitally, so you will manage your money through a self service app rather than using any branch or kiosk locations.

UNO has several different savings options, including easy access accounts which have a linked virtual card you can use to spend, and time deposits which get a better rate of interest but which require you to local away your money for a fixed term. You can also take unsecured loans with a variety of different repayment options available.

|

|---|

Tonik was the Philippines’ first neobank to secure a digital bank license from the Bangko Sentral ng Pilipinas. Deposits are insured, and you can access accounts for savings and spending, as well as loans and ways to build your credit score through responsible money management.

Loan options include up to 20,000 PHP for credit building, or up to 100,000 PHP Shop Now, Pay Later credit with partner merchants. Across all services, Tonik offers in-built app security features including biometric login options, and uses 3D Secure (3DS) from Mastercard SecureCode for online shopping protection.

|

|---|

Union is a digital bank backed by UnionBank of the Philippines. It's the only one of the digital banks we’ve featured which is aligned so closely with a fully fledged traditional bank.

The digital products available from Union focus on savings and loans, rather than day to day account usage. There’s no debit card advertised for example, so you could only pay into and withdraw from your accounts through digital transfer methods like PESONet and InstaPay. If you want to add in additional account features you may decide to use the main UnionBank which has a full suite of financial products available.

|

|---|

Maya Bank is the most popular digital banking app in terms of users. As with all of the digital banks we’ve looked at, it’s safe to use and deposits are insured by PDIC up to 500,000 PHP per depositor.

You can open accounts for savings and spending - which can easily link to your Maya wallet if you use this for day to day transactions. It’s very easy to move money from your wallet to a savings account or vice versa. There’s no maintaining balance to worry about, so you can use your account as and when you need to. Maya Bank also offers loans including personal loans, flexi loans and installment plans, and options for credit cards. This builds a broad range of financial services which can support both longer term goals like saving, and everyday transactions.

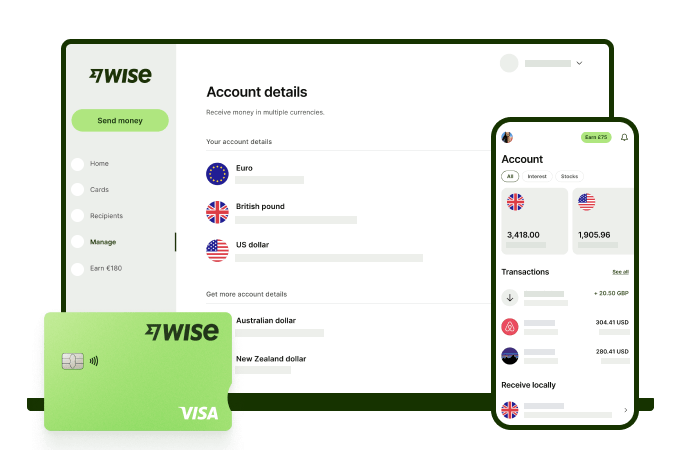

Wise is not a digital bank - but it is a safe global provider of money transfers and multi-currency account services, fully licensed and regulated in the Philippines, and trusted by millions of customers around the world.

The Wise account is an easy way to hold and exchange 40+ currencies, including PHP, USD, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.57% and absolutely no markups. Plus, you can order a Wise card for convenient spending at the same great rate, without any foreign transaction fees. At times you need cash, you can also make up to 2 free ATM withdrawals to the value of 12,000 PHP when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in PHP and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Use the app to view your balance across all currencies at a glance, get instant transaction notifications, send money to others easily, and freeze or unfreeze your card if you need to. It’s simple and stress free - and lets you keep on top of your finances no matter what you’re up to.

Do check respective bank websites for the latest information and promotions

Wise Pilipinas is regulated by the Bangko Sentral ng Pilipinas. For any questions or concerns, check out our Help Centre, or log into your account to talk to us by phone, email or chat.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A step-by-step guide to the Dubai tourist visa for Filipinos, covering requirements, visa types, costs, validity, and how to apply in 2026.

Working abroad or getting paid in foreign currency? Learn about the Metrobank OFW Savings account requirements and options to receive and remit money.

Working abroad or getting paid in foreign currency? Learn about the PNB OFW Savings account requirements and options to receive and remit money.

Are you an OFW looking for a BPI savings account? Learn about the requirements, fees, how to open an account online, and remittances.

Learn more about requirements and how to open different Landbank account types including joint account, savings account, and more.

BPI¹ has a full range of account types including savings, checking and USD products. There are variable requirements in place for BPI accounts which usually...