How to make money online and from home: For beginners, students and more (MY)

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Open to residents with a registered address in the following countries: United States of America, Singapore, Malaysia, Australia or New Zealand.

As China’s most popular ewallet, the chances are you’ve already heard of Alipay. This guide shows you how to use Alipay in Malaysia, including getting started with your account, and Alipay top up. We'll also introduce Wise, a possibly cheaper way to send money abroad or spend in CNY compared to your bank and other e-wallets.

Table of contents

You can use Alipay without a Chinese bank account in Malaysia. You can just use your bank card to add money to your Alipay account.

Getting set up with Alipay is actually fairly straightforward. Here are the basic steps you’ll need to take.

Registering with Alipay is fairly easy if you work through the online prompts. It’s worth knowing in advance that to get full access to your account, you need to verify your name and personal details using your passport. So have your passport handy before you get started!

To sign up to Alipay in Malaysia you’ll need to take the following steps:

Once your Alipay account is up and running you need to add funds. You can do this by linking a bank card to your Alipay account.

Here’s a step-by-step guide on how to top up Alipay in Malaysia:

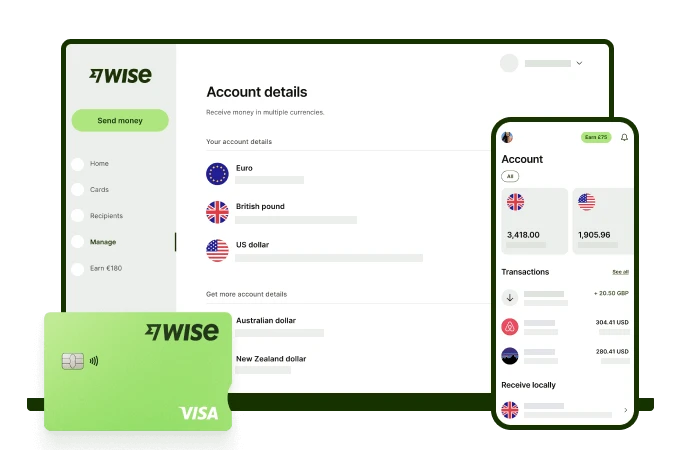

| 💳 Did you know that you can link the Wise card to top-up your AliPay account? Convert and hold CNY in advance at the mid-market rate or let Wise's auto-conversion do it for you! |

|---|

At the time of writing it’s not possible to make an international transfer with Alipay from Malaysia. That’s because you need a Chinese ID document to send international payments with Alipay.1 However, Alipay is constantly tweaking the services and functionality available, so you may want to keep an eye on the latest developments in the app to learn more.

If you're an expat or traveller, you might need to send money abroad regularly. Alipay probably isn’t going to be suited to this - so where should you turn?

A crucial thing to remember when sending money abroad with banks is to always check exchange rates. The true cost of an international transaction isn’t just the upfront transfer fees. Here’s how it really works:

As you can see, in this case, your recipient will usually get more in the end if you make the payment through Wise who only uses the same exchange rate you'd find on Google - the mid-market exchange rate.

It’s good to know that with Wise, you can also send money directly to Alipay accounts in China - a great way to get CNY to your friends and family there!

To send money with Wise:

- Create a free account

- Choose an amount to send

- Add recipient’s bank details

- Verify your identity

- Pay for your transfer by bank transfer or debit/credit card

And that is it! You can track your transfer in your account and your recipient will also be notified when a transfer reaches them. Moreover, with Wise, you can do more than send money abroad:

No monthly charges or minimum balances required 😉

Join 11 million people who use Wise and save 1 billion GBP (=5.6 billion MYR) a year compared to using a bank.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Alipay is a convenient way to spend money online with Chinese retailers, as well as a useful tool for mobile payments here and abroad. Follow the steps outlined above to open and top up your Alipay account. And don’t forget you can also choose Wise to send money cheaply to Alipay accounts in China, and your friends and family around the world.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Learn more about the RHB Multi Currency Debit card in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

We compared the top Affin Bank cards in Malaysia. Whether you’re looking for points, fees or rewards on travel spend, find out which credit card is for you.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Want to know how much transaction fees you’re paying when using your Malaysian credit card overseas? Learn more about the types of fees and how to avoid them.

Learn more about the Maybank World Elite Mastercard in Malaysia, including benefits, requirements, fees and whether it’s worth getting.