How to make money online and from home: For beginners, students and more (MY)

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Credit cards can make it easier to spread the costs of a large purchase over several months, and can also be a smart way to build a good credit score with responsible use. If you already have an Affin Bank¹ deposit account you may be considering applying for an Affin Bank credit card for day to day spending.

This guide examines 5 popular Affin Bank credit cards in Malaysia, looking at their key features, important fees and the Affin Bank credit card benefits you get when you spend. We'll also introduce the Wise card, a handy travel companion to make seamless card payments when you're overseas.

| Table of contents |

|---|

We’ll look at each of these Affin Bank credit cards in more detail in just a moment - but first, a head to head comparison of the 5 popular cards we've selected. We’ve chosen cards with different fees, eligibility requirements and benefits, so you can weigh up the type of card that may suit your needs.

| Card name | Annual fee⁷ | Minimum income | Foreign transaction fee⁷ | Rewards |

|---|---|---|---|---|

| Affin Aura credit card² | No fee | 24,000 MYR | Network rate + 1% | Low finance charge available |

| Affin Duo credit card³ | Waived for 3 years, then 75 MYR | 24,000 MYR | Network rate + 1% | 3% cash back or 3x reward points on dining, groceries and petrol |

| Affin Duo+ credit card⁴ | Waived for 3 years, then 100 MYR | 48,000 MYR | Network rate + 1% | 3% cash back or 3x reward points on select travel and online spend |

| Affin World credit card⁵ | Waived for 1 year, then 500 MYR | 80,000 MYR | Network rate + 1% | 3x rewards for overseas spend, travel perks |

| Affin Invikta credit card⁶ | No fee | 120,000 MYR | Network rate + 1% | 5x rewards for overseas spend, travel perks |

*Details correct at time of research - 2nd September 2025

Each Affin Bank credit card has its own benefits, which means that shopping around is the best way to get the right fit for your needs. In general, using a credit card is secure and convenient, and can help you build a strong credit history. There are also times when using a credit card is necessary, such as when you need a card to act as a guarantee if you hire a vehicle or check into a hotel.

Aside from this, Affin Bank credit cards may also offer these perks:

There are many different Affin Bank credit cards available - here we’ve selected 5 which may appeal to different customer needs, to give you a flavour.

The Affin Aura credit card has a finance charge of just 8% in the first year, with ways to keep the costs down with responsible repayments from year 2 onwards. There’s no annual fee and the minimum income requirement is one of the lower, at 24,000 MYR. This could make it a great starter card while building a credit history.

It’s worth noting that this card still has a high cost for ATM use, as well as a foreign transaction charge - so may not be the ideal option for frequent travellers.

When you apply for the Affin Duo credit card you’re actually issued with two different cards - one on the Visa network and one on Mastercard. The Mastercard option has 3x reward points on dining, groceries and petrol. Points last for 3 years and can be redeemed against merchandise, airmiles and vouchers. You also get a Visa card which offers 3% cash back on spending.

Having two different cards means you can select the one which offers the best rewards for your transaction type, keeping things flexible.

The Affin Duo+ credit card offers two different cards - one on Visa and one issued by Mastercard. These cards also offer either 3% cash back on Visa spending, or 3x reward points on select travel and online spend when you use your Mastercard. This could appeal to travelers as you can accrue points fairly easily on spending with airlines, duty free, hotels and overseas transactions, as well as on e-Commerce/online spending.

Bear in mind that even though you get more points for overseas spending, you still have a 1% foreign transaction fee, which may mean this is a better card for booking your local hotels and trips, rather than for overseas use.

| 👀 Wondering how credit cards from different banks compare? Check out our comparison of the best credit cards in Malaysia |

|---|

The Affin World credit card has a higher minimum income at 80,000 MYR but offers premium level perks including golf privileges, airport lounge access, concierge services and charity contributions. You’ll get 3x rewards for overseas spend which you can then redeem against airmiles and other lifestyle benefits like hotel vouchers.

The Affin Invikta credit card is a high end card which has a corresponding minimum income requirement of 120,000 MYR. There’s no annual fee to pay, and this card also offers 12x entry to airport lounges, green fees for golfers and 5x rewards on overseas spending. While this can mean you mount up your rewards quickly when you spend in a foreign currency, remember there’s also the 1% foreign transaction fee added to all overseas spending.

You can apply for an Affin bank credit card by completing the application form⁸ which requires you to enter your personal information as well as details of your income, employment, financial situation and other relevant information.

To apply you must be 21 years old or more as a principal card holder, and 18 or over as a supplementary card holder. If you earn 36,000 MYR or under you may only have credit cards from 2 banks or card issuers in total. The application will include a credit check - if Affin Bank is not able to offer you the card you apply for based on your credit score, you may qualify for a different card instead.

After you submit your application for an Affin Bank credit card, a member of the bank team will get in touch to talk through your options and the next steps. If you have questions in the meantime you can call into an Affin Bank branch or reach out to the support team by phone or email.

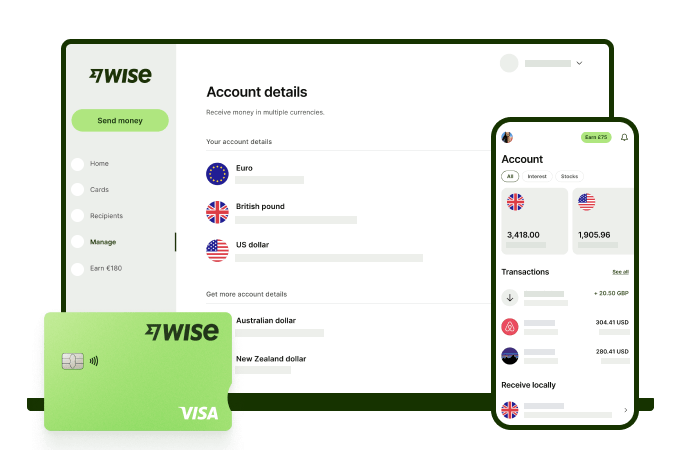

Make seamless foreign currency payments and transactions with low fees and the mid-market rate with Wise.

The Wise account is an easy way to hold and exchange 40+ currencies, including MYR, USD, GBP, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.77% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 1,000 MYR when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in MYR and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Get the most out of every ringgit and save more when you use Wise.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Learn more about the RHB Multi Currency Debit card in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Want to know how much transaction fees you’re paying when using your Malaysian credit card overseas? Learn more about the types of fees and how to avoid them.

Learn more about the Maybank World Elite Mastercard in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

We compared the best credit cards in Malaysia that have free access to the Travel Club Lounge. More on benefits, fees, and requirements.