Best Ways of Paying International Contractors from the UK

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

Canada has the 9th largest economy in the world.¹ It’s dominated by the service industry, but with a healthy slice of gross domestic product (GDP) coming from primary industries like logging. A high level of economic freedom means that Canada is home to some of the largest businesses in the world, with a healthy number of the Forbes Global 2000 based there. But Canada is a great place for small and medium enterprises (SME) too, with over 1.07 million SMEs registered there.²

If you're thinking of starting a new business in Canada as a UK entrepreneur, you need to know how. Here’s a helpful guide to get you started, covering everything from entity types to the steps for registering a company.

And while you start the process of expanding or launching overseas, make sure to check out Wise Business - a powerful multi-currency account, which could help you manage company finances in Canada, the US, the UK and worldwide.

Get started with Wise Business🚀

The main types of corporate entities in Canada are:

Sole proprietorship is intended for very small (or ‘one-man’) businesses, and your business interests are taxed alongside any personal income. This means you only have to do one tax return for yourself and the business, but this can increase your liability overall.

A partnership is a popular option, but has a similar liability issue made more complex by the fact that any partner in a business can be held liable for all the debts of that entity.

Corporations are the most common type of business structure in Canada, mainly because they are limited liability. This means the business is taxed separately to the individuals who own it. However, to get this benefit you're required to keep detailed accounts (which come at a cost), and comply with all relevant legislation.

The cooperative is a less common structure which is both owned and controlled by the members.

If you’re not sure which business structure is right for you, it’s best to get professional legal advice to help you make the right decision.

Setting up a business in Canada is fairly straightforward. Most of the process can be completed online, and there’s no minimum capital requirement.

You must, however, register at both federal and provincial level. Documents will be needed (which may vary according to the business structure you have chosen), typically including:

You may also need to register your business for value added tax (VAT).

To register your business you must first visit the Business Registration Online (BRO) page. This is where you can register for a Business Number (BN) and then transfer to your provincial registration centre after registering for national programs.

The process varies slightly between regions, so make sure you understand the requirement for the province in which you're registering your business.

You're encouraged to apply online to register your business. BRO has a helpful list of what you’ll need here. The information you need to have prepared in advance is set out clearly which can help to simplify the process.

Here’s a quick outline of the steps involved in registering a business in Canada:

The process to register costs $200 CAD and is impressively efficient. It takes only a short time to complete the online forms, and you'll have your corporate registration number within a day. You can even choose to speed this up further, paying an additional $100 CAD for the express service which takes just 4 hours.³

| 💡 Learn how to open a business bank account in Canada |

|---|

For some types of business activities you need further permits beyond simply registering your business.

The Government of Canada has a handy permit search by Canadian region tool, for the permits that might apply to your business. You can then get details of how to apply for any permits you require to operate legally.

As soon as you have employees, you have certain responsibilities under Canadian employment law. Details are set out on the ‘Employer Obligations’ section of the Government of Canada website. For example, you must hold a completed TD1 tax form for each employee, and are responsible for deducting pension contributions, income tax and employment insurance from them. More detail of the deductions required can be found on the Canada Revenue Agency website.

As a business owner, there are federal taxes that apply to your enterprise. It’s your responsibility to understand and manage these payments, as well as any provincial or territorial taxes that may apply. It could be a good idea to get professional tax and legal advice to help you understand your obligations.

The Government of Canada website is an excellent source of information for starting and running a business.

It also has a Business Benefits Finder tool, where you can find details of grants, funding, advice and government support (such as tax credit) you may be eligible for. Simply enter some details about the field in which you work, and you'll find any government programs for financing, or other support available.

There’s also the Canadian Accelerator + Incubation Network, which is an umbrella operation helping foster links between start up businesses, government, industry, academia and other stakeholders in the growth of small business. The CAIN website hosts information about topics such as getting a Startup Visa, and can be a helpful resource for anyone planning on moving to Canada for work or to start a business.

Once you’re in Canada and ready to get going, look for local networking events on sites such as Meetup, Eventful and Eventbrite. Each province also has a ‘Small Business Network’ which run online and offline meetups and other events. Here you can meet like minded people and build your customer and business contact book.

Every business needs a great plan and a little luck - but with help from your new network and friends, your business will hopefully get off to a flying start.

| 💡 See more about Canada's Start-up Visa✈️ |

|---|

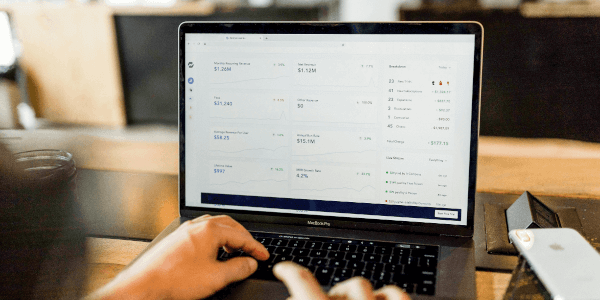

If you’re a global company operating between Canada, the UK and elsewhere, Wise Business can help you cut the costs of currency exchange with mid-market rates and low, transparent fees.

Open a Wise Business account and you can manage your company’s finances in 40+ currencies all in one place, including CAD, USD, GBP and all other major currencies. You’ll be able to pay suppliers and staff in CAD, as well as receiving payments in multiple currencies.

Wise payments are fast and secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

With Wise Business, you’ll also benefit from the following features:

It’s quick and easy to open a Wise Business account in Canada, with a fully digital application, verification and on-boarding process. Check out the requirements here.

Register with Wise Business🚀

\

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Sources used in this article:

Sources last checked on date: 16-Sep-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.

Learn how UK startups can raise venture capital from US investors. Covers Delaware flips, pitching, legal requirements and practical fundraising tips.

Some of the most successful startups of the past ten years, including Klarna, Synthesia and Mistral AI, have come out of the European tech ecosystem. However,...