12 Best Online Marketplaces in the World to Sell from the UK in 2026

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

If you run a small business then you’ll need a simple, cost-effective and reliable way to pay your employees. There are a number of managed payroll services available to save you the time, headache and risks of trying to do it yourself – and you may save money too.

In this article we’ll explore some managed payroll services for small businesses in the UK.

If you don’t need a managed payroll service, but need to send money across borders, for example to pay contractors and freelancers, Wise Business could be a useful solution. It’s a multi-currency account that allows businesses to send payments to 140+ countries with low and transparent fees.

💡 Learn more about Wise Business

The payroll companies we’ll be looking at all offer ‘managed’ payroll service. This means choosing the best payroll services for small businesses is more than just a software decision. You’re effectively outsourcing your payroll department.

The degree to which the service is managed will vary, with some providers focusing on automating processes and others providing a more hands-on service.

To help you find the right fit for your business, we’ll be examining core features, simplicity, customer service and price. Because most providers offer custom pricing, benchmarking across the sector isn’t possible.

In this article, we’ll be looking at:

| Provider | Trustpilot score | Monthly fee | Best known for |

|---|---|---|---|

| IRIS | 3.9 from 2,700 reviews 1 | £39 per month for cloud-based, 2 enterprise packages on request | Diversity of products |

| ADP UK | 1.8, from 2,747 reviews 3 | On request | Payroll at scale |

| MHR | 2.9 from 3 reviews 4 | On request | Public sector focus 5 |

| Moorepay | 4.2 from 1,500 reviews 6 | On request | Customer service |

| OneAdvanced | 2.7, from 260 reviews 7 | On request | Simplicity |

| PayEscape | 4.7, from 141 reviews 8 | On request | Accredited support staff |

| Deel | 4.8, from 6,937 reviews 9 | $29 per employee, per month 10 | Ease of use |

We’ll be looking at a range of factors to compare payroll services, including:

According to conflicting information on the Iris website, either 1 in 6, or 1 in 8, people working in the UK get paid via Iris software.11 Let’s assume one of these is the up to date number. Either way, it’s a lot, and points to the fact that Iris is one of the world’s major providers of payroll and other business critical software.

Iris offers a comprehensive range of software for accountancy, HR and education alongside its suite of payroll services for small business.

Like many of the small business payroll services we’re looking at here, Iris primarily offers custom pricing. While this might be a good thing if it helps small businesses avoid paying for extras they don’t need, it makes it trickier when you’re trying to gauge an industry benchmark.

One thing Iris does offer is a free entry level product called Iris Payroll Basics. This is suitable for small businesses with 10 employees or fewer. It’s real time information (RTI) compliant and HMRC recognised.2 However, it will only remain compliant for the 2025/2026 year and will be discontinued after that. For now, it could be a useful way for smaller UK businesses to test out Iris before committing to a paid plan.

For those that do graduate to a paid plan, the next cheapest one we identified is Iris Staffology, which starts at £39 per month.2 This cloud-based product covers as many as 10,000 employees.2

It’s mainly targeted at businesses of all sizes in the construction industry,13 and features include:

Iris Software has a good Trustpilot rating of 3.9, with customers praising the customer service and ease of use. It’s worth noting that this Trustpilot profile is for the Iris Software business as a whole and includes ratings for other products and services.

ADP provides award-winning cloud-based ‘human capital management’ (HCM) solutions covering payroll, HR, time tracking, tax and benefits. It doesn’t advertise its monthly fees online, favouring the almost industry standard custom pricing model.

Prices appear to be mainly influenced by the size of your organisation, with ADP splitting businesses from sole traders to global giants into the following tiers:13

A little tweaking of the search parameters on the website reveals that ADP offers 3 payroll products for businesses in the 1-199 category. These are: 13

ADP doesn’t have a great Trustpilot rating and there are some common complaints in the reviews.3

It appears that customers struggle most with the following issues:

For small UK businesses looking for a provider that can support in the adoption and implementation phase, ADP might not be the perfect fit. While ADP does offer a large array of products and solutions, it appears to be best suited to organisations that are well versed in using payroll software already or that have the expertise in-house to handle any of these challenges.

UK-based MHR has been around for 35 years and is well known in the UK for serving the nation’s public sector organisations.5 Again, there’s no price guidance on the website, but what you will find quite easily are details about MHR Assist.14

MHR says their team provides training and support in short bursts, helping their users get the most from their software. MHR also offers a comprehensive knowledge centre, full of information about things like implementation, as well as broader topics like compliance and the future of work.15

In terms of products and services, MHR is another that favours the custom approach. As well as not advertising its fees, the product offer is tricky to decipher. MHR does promote an app called People First, which incorporates payroll, as well as advertising payroll as an “AI-enhanced” standalone solution which covers everything from pensions to P45s.16

The best way to get a feel for whether MHR is the right payroll service for you is to book a demo.

Before you do that, it might be worth checking out what the customers who’ve left reviews on Trustpilot have to say. It’s got a rating of 2.9, albeit from just 3 reviews.

Although 3 is a very small sample size, this is a claimed profile and MHR has responded to one of the reviews. It’s also worth remembering that customers are more likely to leave a review of a product or service when frustrated, so the low review numbers could suggest there are plenty of happy customers who didn’t feel the need to leave a review.

Recognised by HMRC and accredited by the CIPP’s Payroll Assurance Scheme,17 Moorepay’s award-winning payroll software is built around easy use and accuracy.17 The software allows users to automate things like:

The whole solution appears optimised for simplicity, time efficiency and compliance.

Moorepay’s website has a page entitled Pricing but they don't offer upfront costs, another provider working on the custom model.

To their credit, Moorepay sees this as a way to offer more flexibility and scalability. And the ‘book a demo’ approach at least means there are no misleading or confusing claims.

Moorepay has an impressive Trustpilot rating of 4.2 stars from 1,500 reviews.

A theme that stands out from the reviews is that customers are thanking Moorepay employees by name for providing excellent customer service. Other themes identified on Trustpilot include advice, service and response, suggesting Moorepay is committed to delivering good customer service.

OneAdvanced shares some key characteristics with Moorepay, notably that it appears to be focused on simplicity and ease of use.

The app screenshots on the website suggest a small business payroll service designed to be flexible, accurate and compliant, while being easy to use for small business owners unfamiliar with the complexities of payroll administration, and employees too, who just want to see the most important information quickly.

OneAdvanced doesn’t advertise its prices, and invites potential users to book a demo.

The payroll service includes the following features: 18

While OneAdvanced doesn’t enjoy the same high Trustpilot rating as Moorepay, with 2.9 out of 260 reviews, some of the themes are comparable. Even some of the critical reviews thank individual members of staff by name for their support.

PayEscape stands out for a couple of reasons. Firstly, and perhaps most importantly, all of their staff are trained by either the Chartered Institute of Payroll Professionals (CIPP) or the Chartered Institute of Personnel and Development (CIPD).19 The company promotes its emphasis on service and customer support. This is a genuine point of difference.

Another reason PayEscape stands out is that it offers fully-managed payroll services for small businesses with a strong focus on simplicity.20

PayEscape payroll service features include: 20

Deel does advertise its fees. Its payroll service starts at $29 per employee, per month.10

So if you’re not comfortable investing time setting up a demo without knowing the rough investment required, Deel has solved that problem immediately while you can still set up a 30-minute demo, too.

Deel is relatively distinct from the other small business payroll services we’ve looked at. Having been founded in 2019, it’s relatively new compared to some of the other firms we’ve reviewed, such as Iris, founded in 197822 and MHR, founded in 198423 respectively.

Think of Deel as a tech company that specialises in payroll and other outsourced human resources services, rather than a traditional payroll and HR provider with comprehensive technology.

It has the look and feel of a tech company too. The website is simple and the information is presented in the way you’d expect from a subscription service, with easy to compare tiers.

Deel is the highest rated payroll provider we’ve looked at in this article, with a 4.8 Trustpilot score from nearly 7,000 reviews.9 Common themes include ease of use, speed and responsive support.

Features include:24

For a small business managing freelancers or employees around the world, local tax compliance is essential.

Decide first, whether your business needs hands-on support or if your team is equipped to handle implementation. This decision alone will rule out some providers. Next, look at things like cross border payments, and global payroll. If you’re not operating or hiring outside of the UK, you may not need these features yet.

Although it can be frustrating not to be able to view prices, all of the payroll companies mentioned above offer demos, so you can get to know the product before committing.

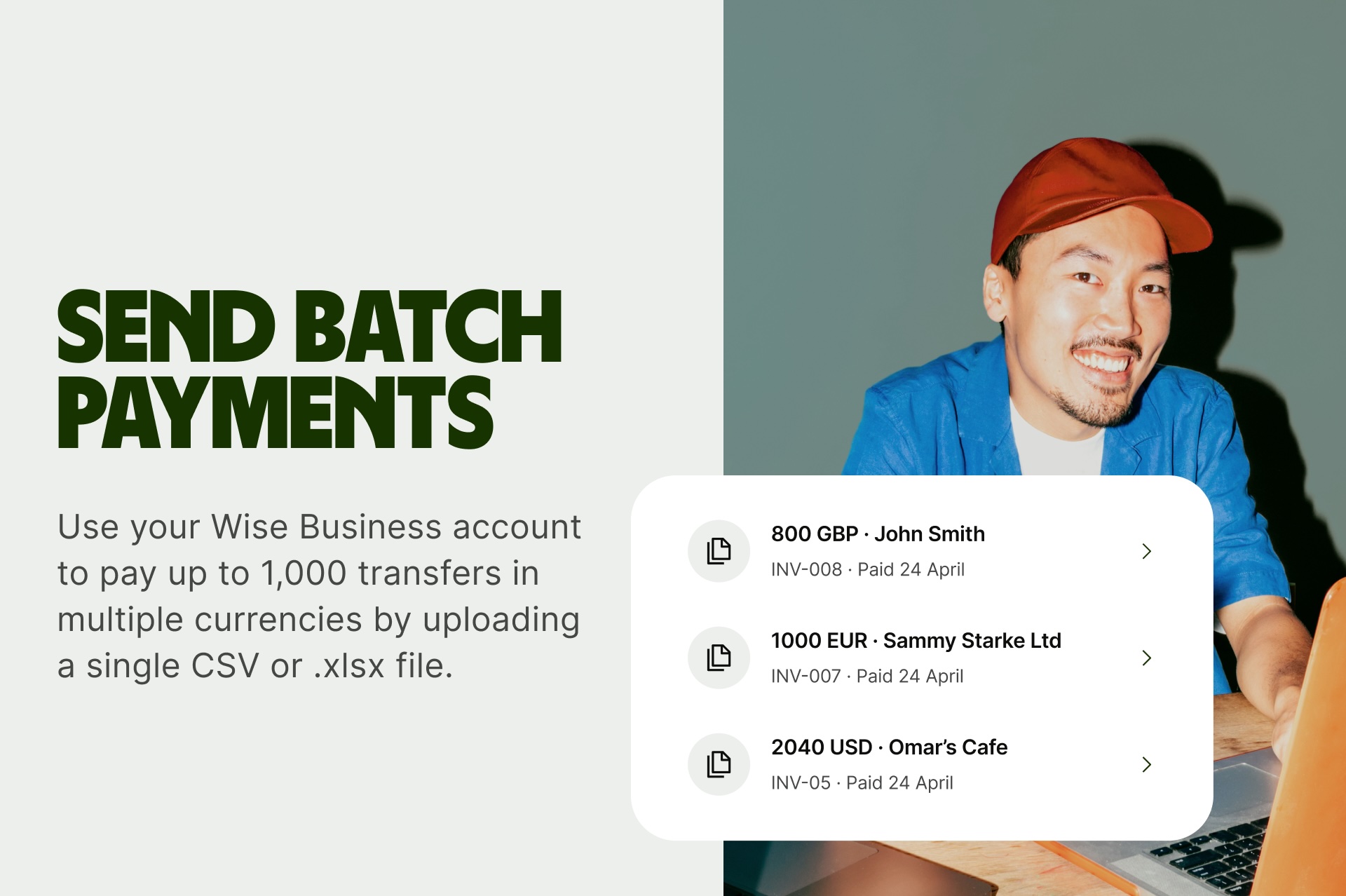

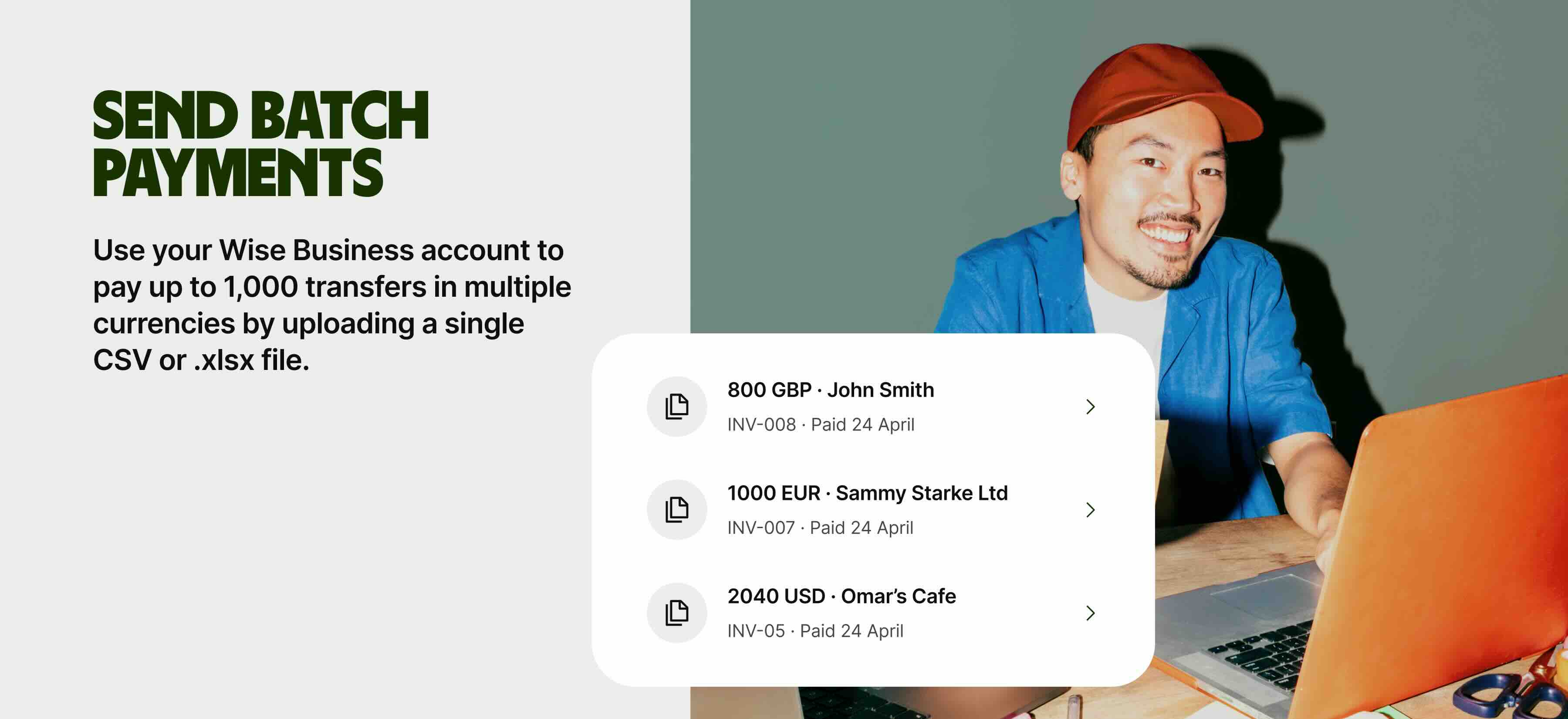

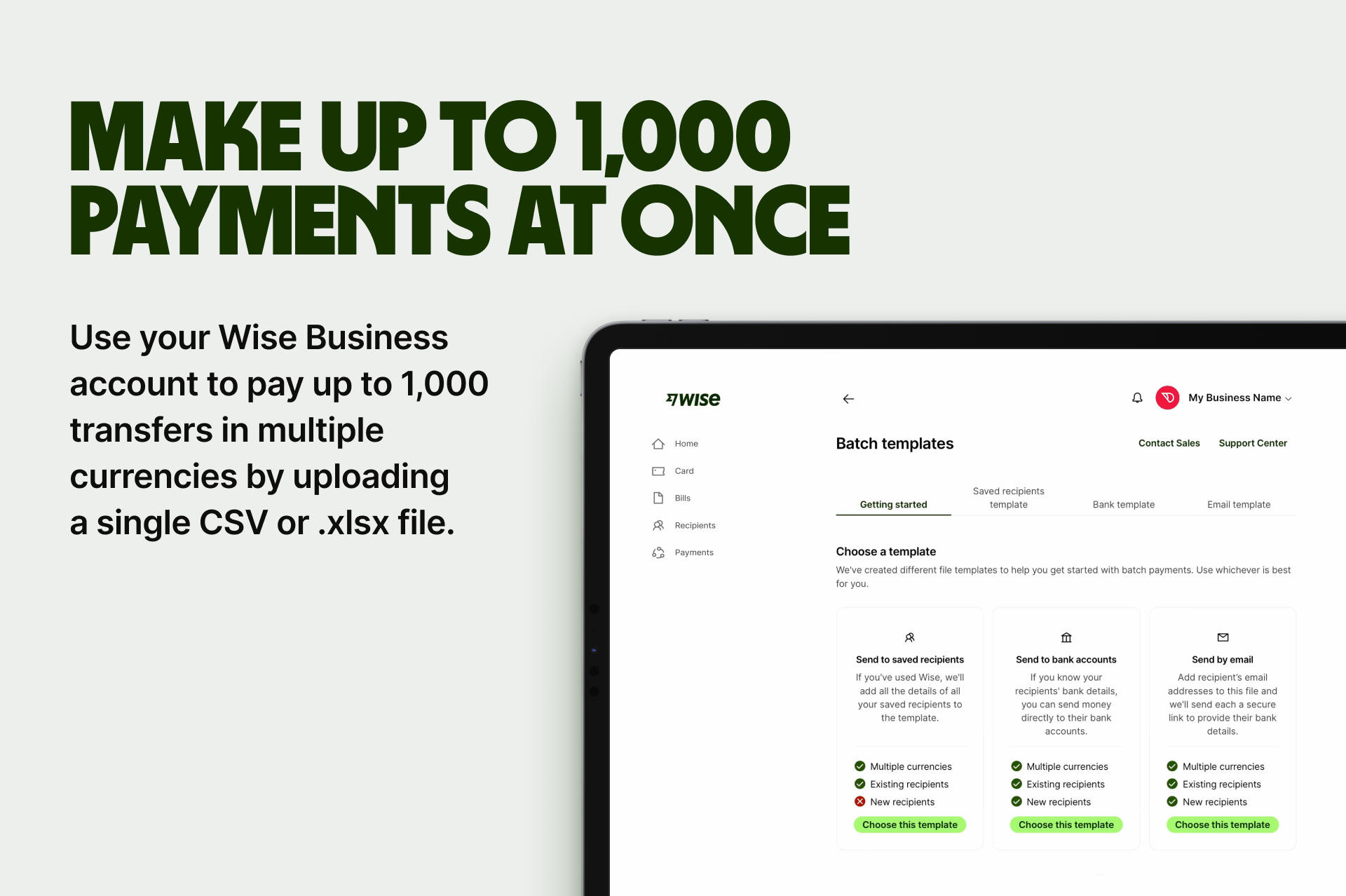

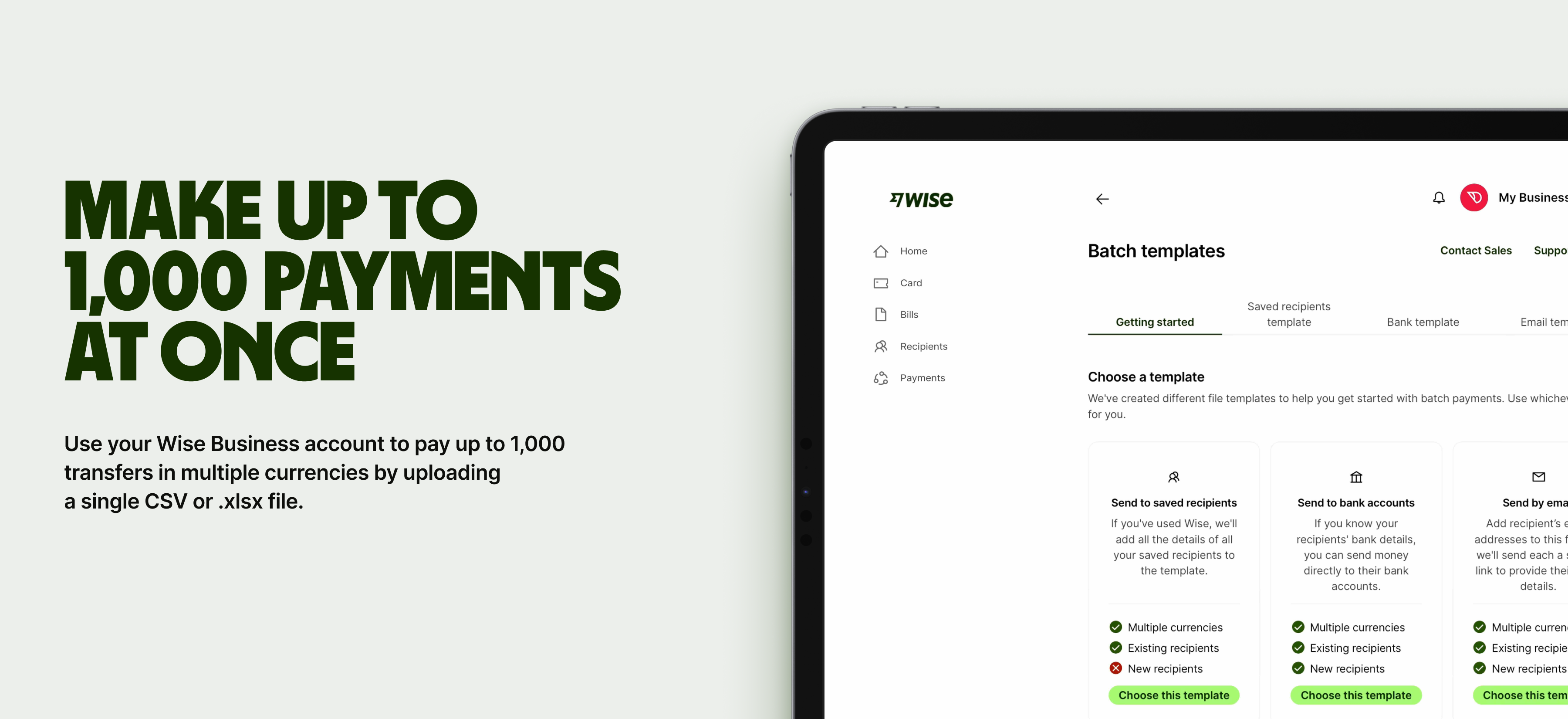

If you are looking for a way to send payments for employees, contractors or freelancers overseas, Wise Business can be a great option.

Open a Wise Business account and you’ll be able to pay your staff in 40+ currencies in just a few clicks.

You can easily make batch payments when paying multiple people at once, and even automate the process using the Wise API to save more time.

Wise payments are fast and fully secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Although it can be challenging to identify pricing benchmarks, Moorepay estimates as a general rule that you can run managed payroll services from around £6 per payslip.25

Using a managed payroll service like the above means that you’re not just buying software, the provider runs the software and the core operations for you.

Outsourced is generally interchangeable with managed. It means the service provider effectively acts as your payroll department.

—-

You should now have a better idea of the features to look out for when choosing a payroll service for your business. You’ll also have an understanding of whether your small business would benefit from outsourcing payroll. And if not, it can still be straightforward to run international payroll, thanks to platforms like Wise.

Sources used for this article

Sources last checked 04/06/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.

Learn how UK startups can raise venture capital from US investors. Covers Delaware flips, pitching, legal requirements and practical fundraising tips.

Some of the most successful startups of the past ten years, including Klarna, Synthesia and Mistral AI, have come out of the European tech ecosystem. However,...

Learn about the corporate tax system in Mozambique, its current rates, how to pay your dues and stay compliant, and best practices.