5 Best business bank accounts in Canada for UK businesses to consider

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

Looking for a business bank account with invoicing? While many business accounts can help you streamline your transactions and hold money safely, finding one with invoicing software that meets your business needs can be challenging.

In this guide, we will review the best business bank accounts with invoicing for UK businesses. We will compare their cost, features, integrations, and share tips to help you choose the right one.

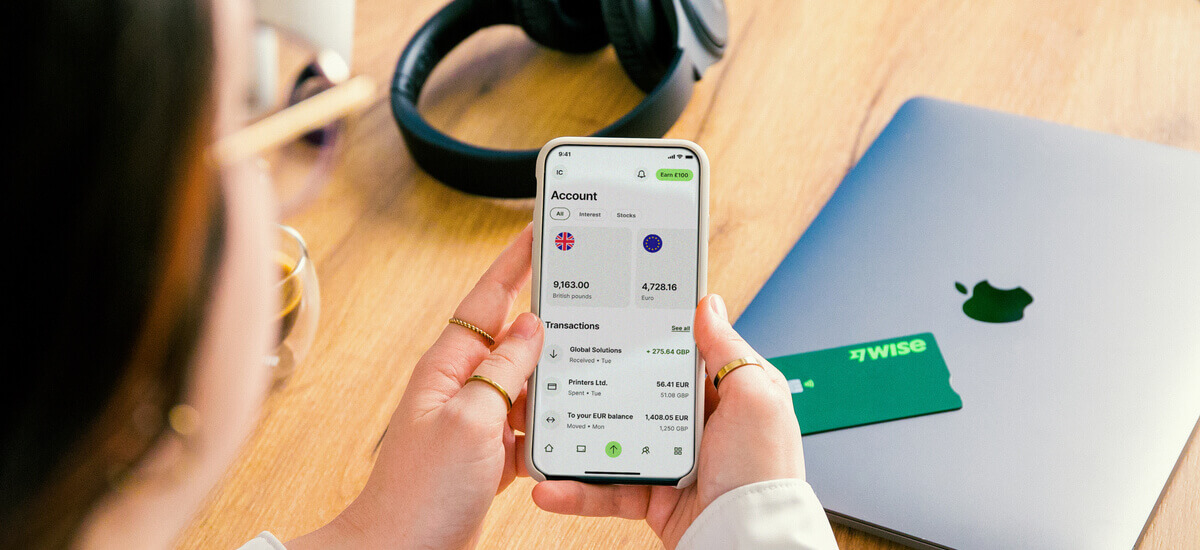

We will also show you a non-bank alternative, Wise Business. With Wise Business you can create and send invoices, receive money in 18+ currencies, and manage your business finances at ease.

💡 Learn more about Wise Business

Invoicing is an important part of any business, and getting a business account with invoicing will help you get paid faster and reduce the stress of juggling between apps. In this guide, we will compare the best business accounts with invoicing, and we will review both bank and non-banking providers, including:

| Bank/ Provider | Trustpilot score | Monthly fee | Best known for |

|---|---|---|---|

| Wise Business | 4.4 from +270k reviews¹ | £0 (one-time account opening fee of £45² | Global invoicing and international payments |

| Tide | 4.1 from +26k reviews³ | Free plan: £0, Smart plan: £12.49 + VAT, Pro: £24.99 + VAT, Max: £69.99 + VAT⁴ | Automated book keeping and invoicing for SMEs |

| Starling | 4.2 from +45k reviews⁵ | £0⁶ | Affordable personal and business banking |

| Revolut Business | 4.6 from +270k reviews⁷ | Basic plan: £10, Grow: £30, Scale: £90⁸ | Money management and investing |

| ANNA Money | 4.4 from +4k reviews⁹ | Pay as you go: £0, Business: £19.90 + VAT, Big Business: £49.90 + VAT¹⁰ | Accounting and tax filing for UK businesses |

| Zempler | 4.2 from +14k reviews¹¹ | Business Go: £0, Business extra: £9, Business pro: £9¹² | Online banking for UK small businesses and sole traders |

We will compare business bank accounts with invoicing based on the following criteria:

Wise Business is a multicurrency account that lets businesses of all sizes send and receive money in 40+ currencies at the mid-market exchange rate. Its invoicing feature makes it easy to create professional invoices in just a few clicks. You can also integrate Wise Business with popular accounting software to sync transactions and manage your finances more efficiently. Wise business has a Trustpilot score of 4.4 from +270k reviews².

“Wise has very fast transfer and deposit time, one of the best rates in the market, great business account for international transactions and invoicing” – John

Check out all requirements to open a Wise Business account.

Manage all your international invoices in one place with Wise Business. Enjoy transparent fees and seamless online payment processing, so you can focus on expanding your global reach.

Get started with Wise Business 🚀

Tide is a comprehensive business platform that offers an FSCS-protected bank account for UK SMEs. With Tide, you can easily manage your business’s transactions, expenses, bookkeeping and invoicing, with no recurring fees, making it one of the best business bank accounts with invoicing.

Tide has a Trustpilot score of 4.1 from +26k reviews⁴.

Tide offers business bank accounts to freelancers, sole traders and directors of limited companies. These businesses/owners should:

Invoicing plans¹⁴:

General plans⁵:

Still uncertain about Tide? Check out our full Tide Accounting review

Starling Business is a fully regulated FSCS business bank account with invoicing. Unlike non-banking options, Starling offers the benefits of a traditional bank account, such as free account setup and physical services like cash deposits and check handling, while also providing you with digital banking services.

Starling Bank has a Trustpilot score of 4.2 from +45k reviews⁶.

Starling offers business accounts on a case-by-case basis. You might be eligible if:

We cover Starling’s fees in full in our Starling fees guide

Revolut is an all-in-one business management platform that helps businesses transact in multiple currencies, manage spending, save, and invest money. Its invoicing feature makes billing simple by automatically adding VAT and giving your clients multiple ways to pay. Revolut has a Trustpilot score of 4.6 from +270k reviews⁸.

To open a Revolut Business account, your company must be registered in the UK or EEA region as a:

You can also build a custom plan that meets your business needs by reaching out to the Revolut team.

Check out our full Revolut Business account review and our Wise Business vs Revolut Business guide

ANNA money is a business account designed to help UK businesses with invoicing, Tax filing, bookkeeping, and expense management. It's both affordable and comprehensive, making it one of the best business accounts with invoicing for sole traders and startups. Anna Money has a Trustpilot score of 4.4 from +4k reviews¹⁰.

“ANNA money understands how tough running a small business is, but they allow me to do everything via my phone. They do all my invoicing and debt collection” – Peter Mccormack

Find out more about ANNA Money in our full ANNA business account review

Zempler is a business bank account with invoicing that offers online banking for sole traders and startups in the UK. Zempler has full FSCS regulation, and you can receive money and make transfers for free. With its invoice generator, you can edit, send and manage invoices quickly and easily.

You can receive money for free on each of these plans.

The right business account for your business depends on your business needs and budget. Here are some things to consider when choosing a business bank account with invoicing:

Wise can help UK businesses, freelancers and sole traders get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency with different payment methods. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

Integrated invoicing feature streamlines the accounts reconciliation process by automatically matching incoming payments to invoices using references, amounts and customer details. They also provide real-time status updates so you can easily see customers who have paid or are yet to pay.

A bank account with built-in invoicing provides additional features and benefits that standalone platforms do not. With a bank account, you can send and receive payments directly, reconcile payments faster and see your cash flow in real time without having to switch between apps.

Business accounts handle multicurrency payments and exchange rates by letting you send invoices in multiple currencies. Oftentimes, you'll receive the payments in your corresponding currency balance, so no conversion is needed. When conversions are needed, business accounts use the official exchange rate (plus a fee) or the midmarket exchange rate.

While some integrated invoicing tools allow users to receive payments for free up to a certain limit, most charge a fixed fee or a percentage of the payments received.

Most business accounts provide full customisation options to help you create professional invoices that reflect your brand. You can add a logo, change fonts, adjust colours, layout, and include personalised messages or payment terms in your preferred language.

Integrated business accounts offer a wide range of payment methods, including bank transfers, debit and credit cards, payment links and sometimes digital wallets. This way, customers can easily pay you in the most convenient way for them.

A business account with invoicing simplifies your accounts receivable management by offering invoicing and banking on the same platform. You can create and send invoices directly, automatically match payments, and receive those payments into your bank account. Other features like automatic reminders and recurring invoicing will also help you stay on top of your AR processes and improve cash flow.

A business bank account with invoicing helps you manage business finances from payments to invoicing and accounting, all from one place. The best account for your business will depend on your specific needs and budgets. A good way to start is by listing out what you need, then comparing it with the services and pricing each provider offers to make the right choice.

Sources used in this article

Sources last checked on 22/09/2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

Learn about some of the best business bank accounts in Australia, covering fees, features and account types.

Discover some of the best business bank accounts in the US, covering FX fees, eligibility and features.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Here’s an in-depth review of everything you need to know about OFX business accounts in the UK, From fees, plans and key features.

Read our essential guide to supported Airwallex countries and currencies, for sending, spending, receiving and opening an account.