Guide to navigating cross-border mergers and acquisitions (M&As) for UK businesses

Navigate the complexities of cross border mergers and acquisitions with expert guidance. Discover strategies for successful international M&A deals.

If you've hired talent outside the UK - or thought about it, one of the challenges you've probably realised is managing payroll. How do you efficiently pay talent in the US, South Africa and the Philippines without violating tax laws and misclassifying workers? How do you stay on top of payments, manage payroll efficiently, and convert currency with ease?

In this article, we outline some of the best global payroll providers that offer the support and technology needed for small businesses like yours to hire international talent with ease and accuracy.

While you're looking for a global payroll provider, check out Wise Business. Wise Business can help you pay freelancers, make cross-border payments, and set up batch transfers to pay employee salaries, all for a one-time set-up fee of £45. Wise also offers payment links, which let you request invoices and integrate with accounting software like QuickBooks and Zero to facilitate payroll. It keeps you in complete control of your cross-border finances.

Get started with Wise Business 🚀

Hiring global talent gives you access to a broader talent pool, increased innovation, and possible cost savings. Depending on how you handle it, its risks could outweigh its perks.

For example, handling global payroll can easily get complex and overwhelming since you’re handling payments for talent in different time zones, under various tax laws and in different currencies. Read more on how to manage payroll effectively.

Payroll providers simplify these complex tasks by offering:

Here's a rundown of top global payroll providers with their key features, prices and Trustpilot scores:

| Provider | Key features | Price and fees | Trustpilot score |

|---|---|---|---|

| ADP | Full-service payroll for 1-1000+ teams (140+ countries)¹ Federal, state, and local tax compliance and expert support¹ HRIS and ERP integrations² | Contact ADP³ | 1.6/5 from 2,812 reviews⁴ |

| Rippling | Tax compliance support⁷ Payroll tasks automation⁷ Integrates with 500+ tools⁷ | Custom Quote⁸ | 4.6/5 from 1,523 reviews⁹ |

| Deel | EOR services¹⁴ 110+ API integrations¹⁴ Automated payment processing¹⁴ | From $15/employee/month to $599 per month depending on plan and business needs¹⁴ | 4.7/5 from 7,470 reviews¹⁵ |

| Remote | Multicurrency payments (including Stablecoins)¹⁹ Manage employees in over 100 countries¹⁸ Payroll and tax law compliance¹⁸ | From $29/employee/month to $999 per year depending on plan and business needs ²⁰ | 4.7/5 from 2,378 reviews²¹ |

| Workday | Payroll software integrations²² Access to local requirements for over 100 countries through payroll partners and certified integrations²² Payroll analytics and customizable reports²³ | Contact the workday sales team to get a pricing quote²³ | 1.1/5 from 390 reviews²⁴ |

| Bamboo HR | Hire across 90-plus countries without local entities²⁸ Local tax and payroll compliance support²⁸ Integrations with global payroll providers²⁸ | Free Trial available Custom pricing ²⁸ | 3.9/5 from 114 reviews²⁹ |

| Multiplier | Instant Employment Contracts³² Inbuilt HRIS³² Multi-country payroll³² | From $40 to $400 per month depending on plan and business needs.³² | 4.9/5 from 2192 reviews³⁴ |

We chose the best global payroll providers based on their features and services, coverage, price, and customer reviews. It’s worth keeping in mind pricing models - pay per employee plans might suit smaller businesses better but not larger companies with bigger workforces.

ADP helps over 1.1 million businesses around the globe to manage people³. With 75 years’ experience, they’ve built a robust suite of HR and payroll services for businesses of different sizes³. ADP offers multi-country payroll services with comprehensive local and global coverage, helping businesses like yours hire talent from different locations while complying with local tax and employment laws⁵.

The award-winning HR platform lets managers and HR support multiple currencies and convert pay rates within its ADP Workforce Now product⁶.

Some features of ADP include: ¹ ² ³

Contact ADP to get pricing details¹.

ADP has a Trustpilot score of 1.6 from 2,812 reviews. Note: *(At the time of writing, there was a near-equal number of users giving ADP a 5-star rating (43%) and a 1-star rating (44%) on Trustpilot)*⁴.

Rippling offers a robust HR management software offering human capital management, payroll, spend management and IT services. Designed to help businesses manage teams across borders, Rippling’s payroll tool can help you replace managing a global workforce with multiple tools with one dashboard that connects multiple HR and Payroll software in one interface⁷.

Rippling lets you calculate and transfer payroll taxes and benefits based on national, local and industry requirements¹⁰. Rippling supports over 50 unique currencies¹¹.

Here are some of Rippling’s features⁷ ¹² ¹³:

Rippling has a 4.6-star rating from 1,523 Trustpilot reviews⁹. You can contact Rippling for a quote as its pricing isn’t explicitly stated on the website⁸.

Deel helps businesses manage employees across 150+ countries on one dashboard¹⁶. With a team of local compliance experts in 130+ countries, Deel offers up-to-date information and expert support on employment and tax laws for businesses¹⁷. This is necessary to help businesses hiring globally avoid lawsuits, legal fees, misclassification of workers and reputational damage.

Some of Deel’s features include: ¹⁴ ¹⁵ ¹⁷

Deel has 4.7 star ratings out of 7,470 reviews

Here's a breakdown of Deel’s pricing¹⁴:

Remote is an extensive HR and payroll platform that offers onboarding, benefits, compliance and payroll services. It is designed for global teams that want to stay tax compliant locally, while managing payroll-related tasks on one dashboard¹⁸.

Remote also offers automated salary payments in stablecoins like USDC and local currencies for contractors and employees in certain countries¹⁹.

Some features of Remote include: ¹⁸ ¹⁹

Remote receives payments in different currencies, including Great British pounds. Pricing includes²⁰:

Remote has a Trustpilot star rating of 4.7 from 2,378 customer reviews²¹.

Workday offers HR, legal, IT, AI, finance, and planning services to businesses across the globe. Using its payroll tool, you can automate and manage payroll for your global team across up to 180 countries, using a centralized dashboard²². Workday Payroll software also lets you automate tax calculations using updated regulations and a configurable engine to ensure accurate payments.

Below are some major features Workday Payroll tool offers:

Contact the Workday sales team to get a pricing quote²³. Workday has a Trustpilot score of 1.1 star rating from 390 reviews.²⁴

Bamboo HR serves over 34,000 businesses across the globe, offering HR related services, including payroll and global employment²⁵. Its payroll software lets you efficiently manage employees and contractors across different continents.

You can get quotes for Bamboo HR’s Core, Pro, and Elite product offerings through its website²⁶. The company accepts credit cards and ACH for customers on monthly plans and wire transfers and checks from customers on annual plans. BambooHR also offers a free trial and volume discount as your talent pool grows²⁶.

Some features of Bamboo HR’s payroll are: ²⁷ ²⁸

Bamboo HR has a Trustpilot star rating of 3.9 from 114 reviews²⁹.

Multiplier is ideal for businesses hiring contractors and employees in multiple countries, paying in various currencies and has to stay compliant. Founded by Sagar Khatri, Amritpal Singh, and Vamsi Krishna, who had to leave their countries to find work abroad, Multiplier is a global HR platform that helps businesses manage people across 150 countries³⁰. It also provides visas in over 140 countries and assists in visa management³¹.

Some of Multiplier’s features include³²:

Some of its immigration related services are³¹:

Multipliers’ pricing plans include³²:

Multiplier has a 4.9 star rating on Trustpilot from 2192 reviews³⁴.

Finding the right payroll provider for your brand depends on your unique business and payroll needs at the moment.

Here are a few ideas to get you started on choosing the right brand for you:

While you’re planning to partner with a payroll provider, consider using Wise Business.

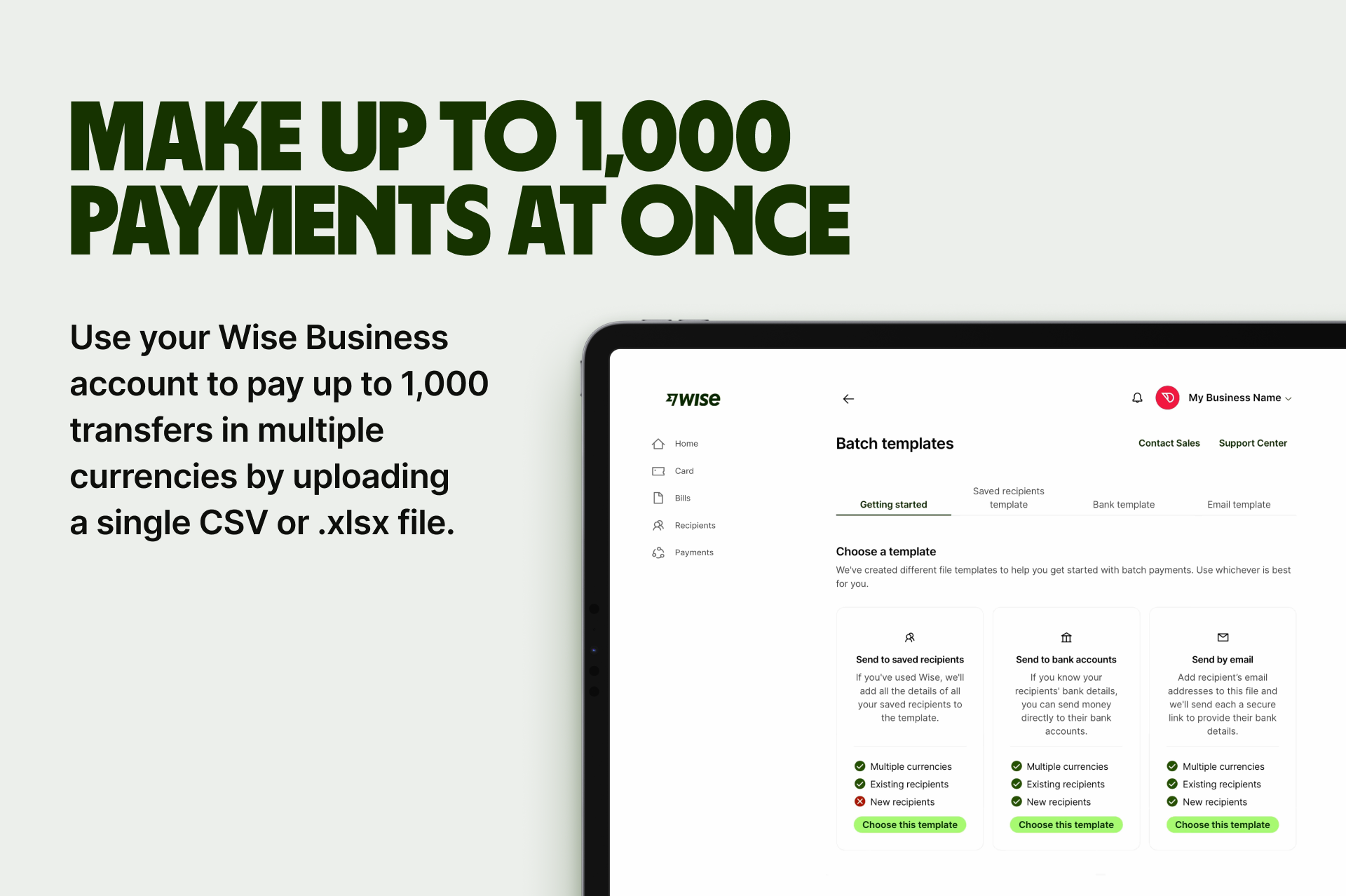

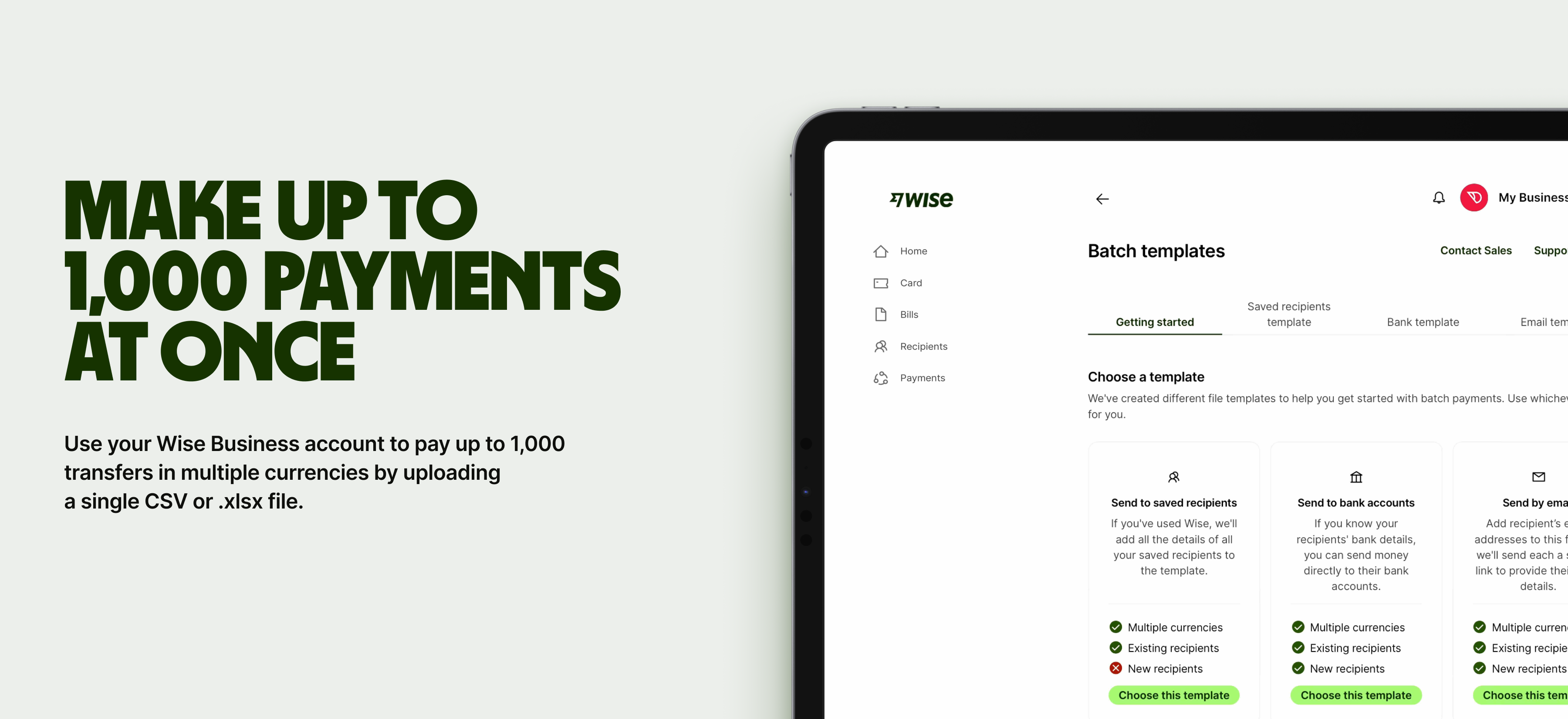

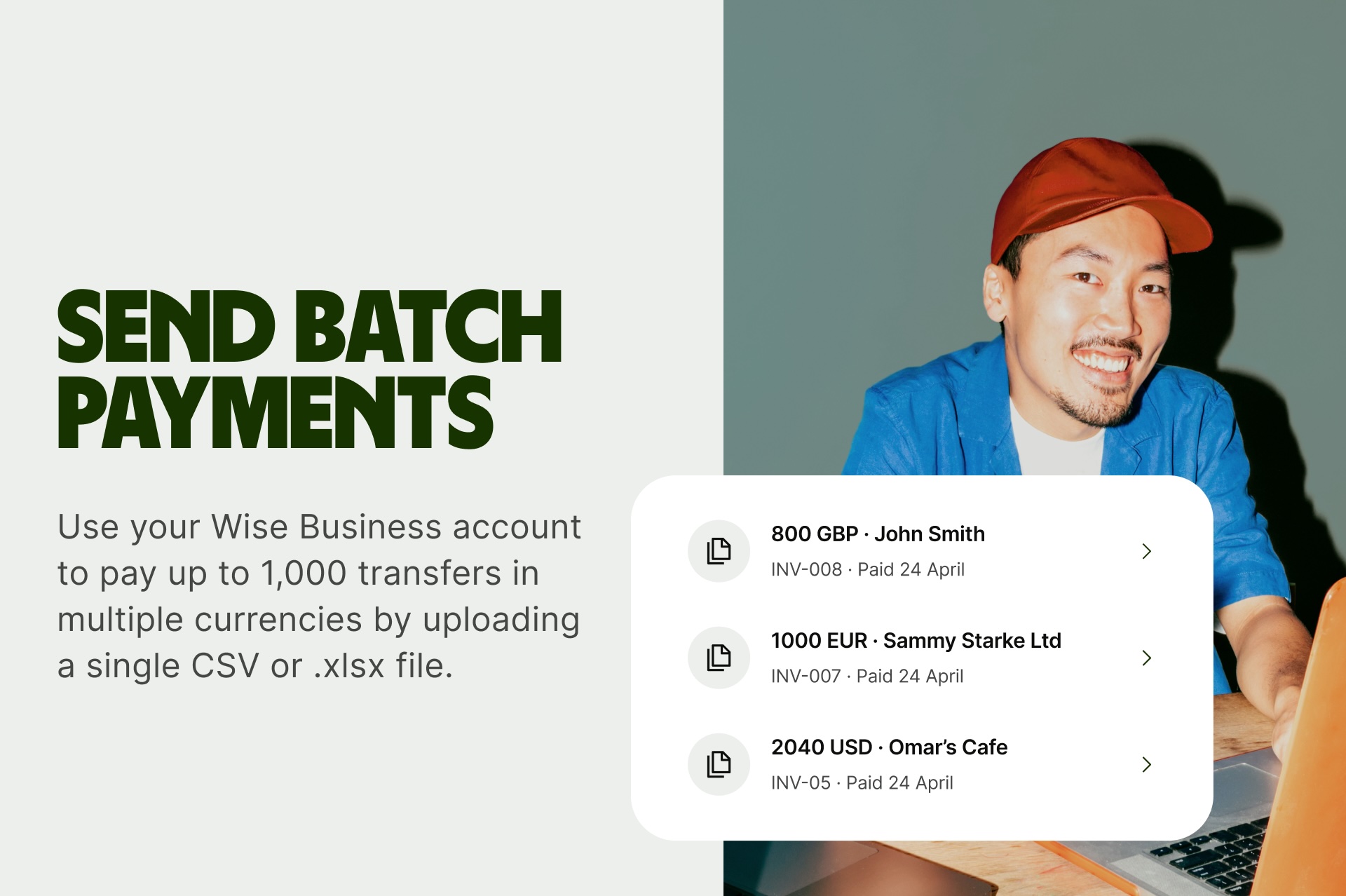

Open a Wise Business account and you’ll be able to pay global employees and contractors in their own currency. You can send 40+ currencies in just a few clicks using the Batch Payments tool or even automate the process entirely using the Wise API.

Wise payments are fast and secure (even for large amounts). Best of all, you can make an account for only a £45 one-time set up fee, no monthly rolling costs. You’ll only pay low, transparent fees and always get the mid-market exchange rate.

And that’s it - with the right payroll providers, you can hire global talent and sleep at night knowing that your SME is tax compliant and pays talent on time. Though payroll providers are helpful, you need to forecast the cost implications of investing in one and plan adequately to avoid a cash flow crunch.

It varies depending on the provider and plans you choose. Some packages start from as low as $29 per employee/contractor per month to as high as $699 for EOR services.

It’s important to consider the currency your payroll provider bills in, using Wise Business to pay for subscriptions outside of your local currency can help you save on FX fees per month.

It depends on your business needs at the moment. If you operate a small business with a few contractors or freelancers hired, using Wise Business might be a cost-effective and beneficial alternative.

Sources used in this article

Sources last checked: 15-Sept-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Navigate the complexities of cross border mergers and acquisitions with expert guidance. Discover strategies for successful international M&A deals.

An essential guide on how to start a business in Poland from the UK, including info on getting on the company register in Poland.

An essential guide to registering a company in Finland from the UK, including how to get on the Finland company register.

An essential guide on how to start a business in Greece from the UK, including info on getting on the company register in Greece.

The essential guide to set up a company in Germany, including how to register, choose a legal business structure, costs and much more.

The essential guide to set up a company in Denmark, including how to register, choose a legal business structure, costs and much more.