If you own a UK business which has an Australian branch or subsidiary you’ll need to get familiar with all the local legal and reporting requirements. This includes understanding GST codes and reporting GST collected correctly to the Australian government.

This guide to Australian tax codes explained for a UK audience covers the basics of GST as well as a list of Australian tax codes. We also want to remind you that you can always get local professional advice in Australia if you’re still unsure about your specific business obligations.

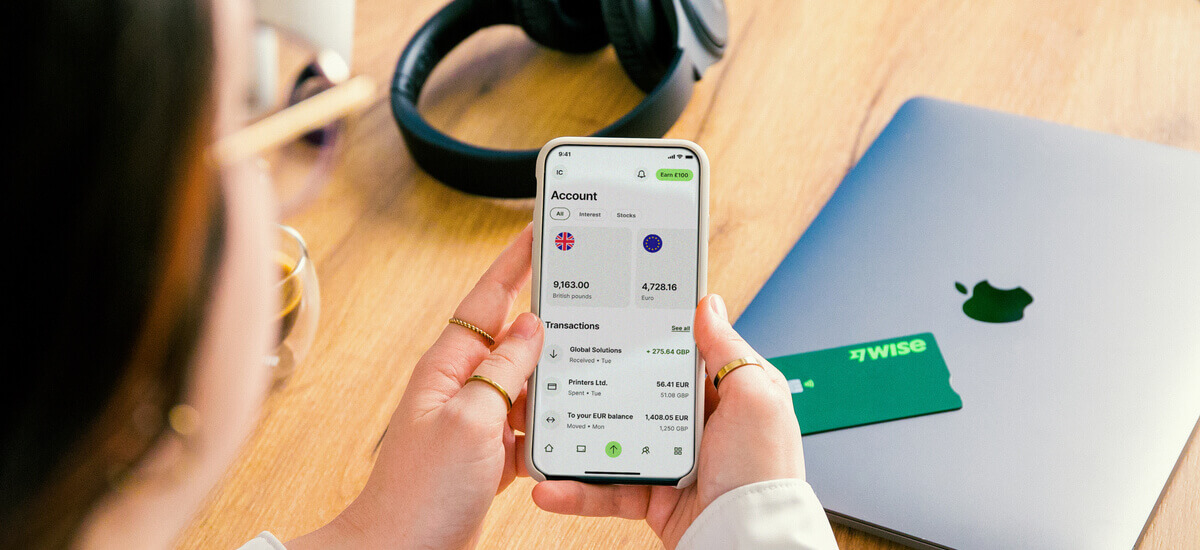

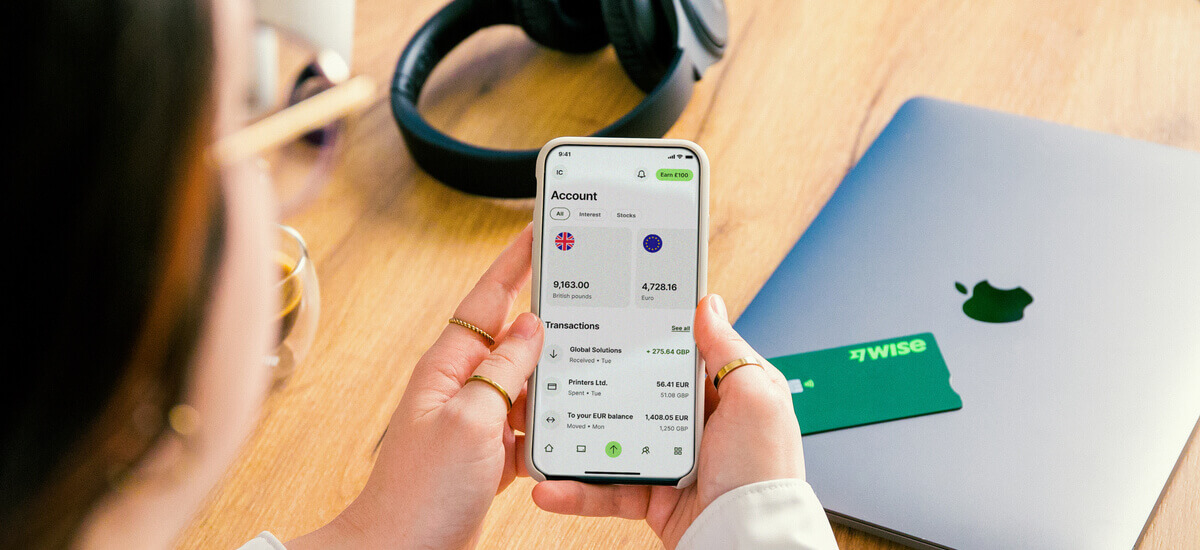

We’ll also touch on Wise Business which offers an easy to use international account with low fees and the mid-market exchange rate - ideal for UK businesses trading with Australia.

💡 Learn more about Wise Business

What do tax codes mean in Australia?

GST1 is a tax similar to VAT in the UK, which is applied on sales of certain goods and services in Australia. When you hear people talk about tax codes in Australia there’s a good chance they’re describing the codes used to correctly report GST on sales.

GST sales, and other tax information in Australia must be reported using the BAS system (Business Activity Statements)2.

Using incorrect tax codes here is a common reason for businesses trading in Australia to discover they’re paying too much or too little GST, or incorrectly accounting for other taxes3. That means that understanding tax codes in Australia is pretty important if you’re a UK business with an Australian branch or subsidiary.

How do Australia tax codes work?

The most likely place you’ll hear about Australian tax codes is in relation to GST. Australian registered businesses with an annual turnover of 75,000 AUD or more are obliged to register for GS, so you’ll need to collect and account for this, and then pass on the money to the government as part of your reporting duties.

GST is usually set at 10%, but there are some differences, which means that picking the right code when accounting is essential. If you’re using a cloud based accounting solution for your Australian business you’ll probably be provided with a list of Australian tax codes which is compatible with the BAS system, and you’ll code transactions against this when managing your accounts.

List of Australian tax codes

Different accounting solutions use their own codes which are compliant with the Australian government BAS requirements. To give an example, here’s a look at the key Australian tax codes used in Netsuite5:

| Rate | Description | Rate | Tax Type |

|---|

| UNDEF-AU | Unknown code | 0.0% | GST |

| ADJ-AU | GST adjustment | 0.0% | GST |

| TS-AU | Taxable supply | 10.0% | GST |

| ITS-AU | Input taxed supply | 0.0% | GST |

| TFS-AU | Tax free supply | 0.0% | GST |

| EXPS-AU | Export supply | 0.0% | GST |

| CPF-AU | Capital purchase - not subject to GST | 0.0% | GST |

| CPT-AU | Capital purchase - GST is charged | 10.0% | GST |

| CPI-AU | Capital purchase - input taxed | 0.0% | GST |

| NCF-AU | Capital purchase - items which are free of GST | 0.0% | GST |

| NCT-AU | Non-capital purchase - items on which GST is paid | 10.0% | GST |

| NCI-AU | Non-capital purchase - input taxed | 0.0% | GST |

| -AU | Transactions which are not for the supply of goods or services | 0.0% | GST |

| LCT-AU | Luxury car sales | 25.0% | LCT |

| WET-AU | Equivalent to former Sale Tax charged on wholesale value of wine sales | 29.0% | WET |

| ABNW | ABNW | -48.5% | ABN |

| PAYGW-AU | Amounts withheld from Pay As You Go for employees who fail to provide a Tax File Number (TFN) | -48.5% | PAYG |

FAQs - Australian tax codes

How does GST work in Australia?

GST stands for ‘Goods and Services Tax’ which is a broad-based tax of 10%. Businesses that have $75,000 or more in turnover must register for GST with the Australian Taxation Office (ATO) and collect this tax.

What is a Business Activity Statement (BAS)?

A BAS is a form businesses in Australia need to submit to ATO to report and pay various tax obligations, including GST. Accurate use of tax codes ensures correct reporting on the BAS.

What are common GST tax codes used in Australia?

While specific codes can vary between accounting software as listed above, common GST tax codes include:

- GST: For taxable sales and purchases with GST included.

- GST Free: For sales and purchases exempt from GST.

- Input Taxed: For supplies that don't include GST in the price, and GST credits can't be claimed.

- Export Sales: For goods and services sold overseas, generally GST-free.

- Capital Acquisitions: For purchases of capital items that include GST.

How do I determine the correct tax code to use?

The correct tax code depends on the nature of the transaction. It's essential to understand the GST status of your sales and purchases. If you need guidance to properly fill your BAS it is a good idea to consult with a tax professional or refer to the ATO's guidelines.

What happens if I use the wrong tax code?

Using incorrect tax codes can lead to errors in your BAS, resulting in overpayment or underpayment of taxes.

In case of underpayment of taxes, this may attract penalties or interest charges from the ATO. Regularly reviewing and reconciling your accounts can help prevent such issues.

Manage your international business finances with Wise

Wise Business can be a helpful solution for UK business with Australian branches, which need to manage money across pounds, Australian dollars and more.

Wise Business accounts come with GBP account information to take payments from UK customers - but also offer local account details for a selection of foreign currencies including Australian dollars, euros and US dollars. You’ll be able to hold and exchange 40+ currencies in your Wise Business account, which also comes with easy ways to send payments to 160+ countries, and the option to order linked debit and expense cards for yourself and your team.

Best of all, for businesses managing their money across currencies, Wise offers mid-market exchange rates and low transparent fees whenever you convert, send or spend. That can keep down your overall operating costs and mean you keep more of your profits, in the UK and in Australia.

Get started with Wise Business 🚀

If you trade in Australia you’ll need to learn about GST, how to account and pay, so you can stay on the right side of the law and fulfil all your legal obligations. As with all tax requirements - at home and abroad - GST can be a little complicated. That means it’s worth getting professional advice from a local tax accountant so you’ll know you’re doing everything needed. Use this guide to get you started, and check out Wise Business to make it easier to pay and get paid in AUD as well as many other global currencies.

Sources used in this article:

- Australian government - GST

- Australian government - BAS

- Australian government - BAS tips

- Netsuite tax codes for Australia

Sources last checked December 30, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.