Overfør penge til udlandet

- Low fees — fees get cheaper the more you send

- Lightning fast — money typically arrives in seconds

- Perfectly predictable — lock in an exchange rate for your international transfer

Overfør penge til udlandet

- Low fees — fees get cheaper the more you send

- Lightning fast — money typically arrives in seconds

- Perfectly predictable — lock in an exchange rate for your international transfer

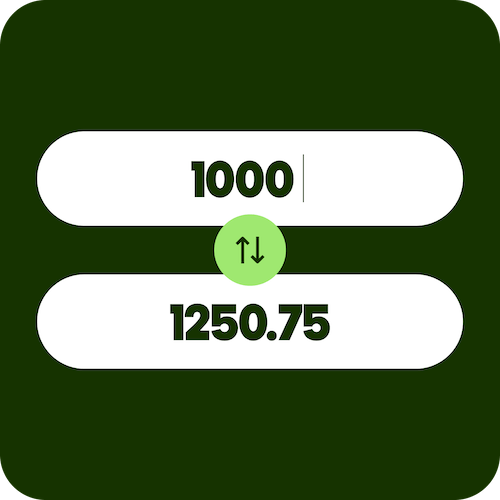

See how much it costs to send money abroad

The total cost of a transfer is the fee plus exchange rate. If your provider says there’s no fee, check their exchange rate against the one Wise offers. You might be paying more than you think.

Rabobank |  BNP Paribas |  Wise |  Sabadell | |

|---|---|---|---|---|

Recipient gets (Total after fees) | 21.267,49 MAD | 21.160 MAD | 21.130,30 MAD | 20.720,21 MAD |

Exchange rate (1 EURMAD) | 10,7195 | 10,6599 | 10,8069 | 10,4753 |

Exchange rate markup | 16,18 EUR | 27,20 EUR | 0 EUR | 61,36 EUR |

Transfer fee | 16 EUR | 15 EUR | 44,74 EUR | 22 EUR |

Total transfer cost | 32,18 EUR | 42,20 EUR | 44,74 EUR | 83,36 EUR |

We’re always honest with our customers. And honestly, we’re not the cheapest this time. But, we’re working hard to continue to lower our prices.

How to send money internationally fra Danmark

Indtast beløb, der skal sendes i EUR.

Betal med EUR med dit hæve- eller kreditkort, eller send pengene fra din netbank.

Choose your recipient.

Vælg, hvem du vil sende penge til, og hvilken udbetalingsmetode du vil bruge.

Send EUR, modtag MAD.

Modtageren får penge i MAD direkte fra Wises lokale bankkonto.

Larger transfers. Lower fees. Premium support.

Pay less when you send over 25,000 USD or equivalent. Plus get dedicated support from our expert team

How we keep your money safe

Every transfer you make is protected with HTTPS encryption and 2-step verification. And we run millions of checks each day to protect every transaction from fraud.

- Rock-solid technologySuper smart Wisers have built our industry-leading security systems from scratch over the last 12 years.

- People who care, 24/7With over 1,000 anti-fraud specialists, and real human help available every minute, we’re on hand when you’ve got questions.

- Your money, not oursYour money is safeguarded, and held completely separate from ours, so it’s available to you all the time.

Best ways to send money internationally with WISE

The best way to send Euro to Moroccan dirham is by using money that's in your Wise account. It's cheapest and usually arrives in seconds. Bank transfers are also cheap, but can be slower.

Wise-konto

Wise-konto

If you have a Wise multi-currency account, you can use money in your account to fund your transfer. It’s cheap and fast — just set up your money transfer as you normally would, and choose a Wise account transfer when paying.

Bankoverførsler er normalt den billigste løsning, når det kommer til finansiering af din internationale pengeoverførsel med Wise. Bankoverførsler kan være langsommere end debet- eller kreditkort, men de giver dig normalt den bedste værdi for dine penge. Læs mere om, hvordan du kan bruge bankoverførsler som betalingsmulighed.

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process. Read more about how to pay for your money transfer with a debit card.

Paying for your transfer with a credit card is easy and fast. Wise accepts Visa, Mastercard and some Maestro cards. Read more about how to pay for your money transfer with a credit card.

PISP (Payment Initiation Service Provider) payments are instructions you give Wise to make a bank transfer directly from your bank account — without having to leave our app and log in to your online banking. This option is as cheap as a manual bank transfer, but it isn’t supported by all banks yet.

If you’ve enabled Apple Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Apple Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.

How to receive money

When you transfer with Wise, you can receive to local bank accounts — no need for a Wise account. And since our price is transparent, you know exactly what you’ll get on the other side.

IBAN

IBAN

You can make easy IBAN transfers from both inside and outside Europe. All you need is the recipient’s name and account details. Learn more about IBAN transfers.

Swift

Swift

To send a quick and secure Swift payment, all you'll need is your recipient’s IBAN number. It’s that easy. Learn more about Swift payments.

E-mail

E-mail

To make payments using only email, all you need is your recipient’s email address. Learn more about Email transfers.

Cheapest way to send money abroad fra Danmark

The cheapest way to send EUR to MAD is by using money that's in your Wise account and costs 194,37 EUR. We use the mid-market exchange rate — the fairest rate — and always show your fees upfront.

EUR

MAD

| Sending EUR | Transfer cost | ||

|---|---|---|---|

| Wise-konto | 194,37 EUR | ||

| Bankoverførsel | 208,36 EUR | ||

| Hævekort | 554,65 EUR | ||

| Kreditkort | 296,72 EUR | ||

| PISP | 194,68 EUR | ||

| Apple Pay | 328,84 EUR | ||

Fastest way to send money abroad fra Danmark

Sending money with Wise is super fast: 74% of transfers arrive in under 20 seconds, and 95% in less than a day. How long it takes depends on how you pay.

EUR

MAD

| Sending EUR | Bør ankomme | ||

|---|---|---|---|

| Wise-konto | senest torsdag 5. marts | ||

| Bankoverførsel | senest fredag 6. marts | ||

| Hævekort | senest torsdag 5. marts | ||

| Kreditkort | senest torsdag 5. marts | ||

| PISP | senest torsdag 5. marts | ||

| Apple Pay | senest torsdag 5. marts | ||

Send money fra Danmark with the Wise app

Looking for an international money transfer app? Send money on the go with Wise.

Cheap transfers abroad

Uden skjulte gebyrer får du altid middelkursen med Wise.

Track exchange rates

Save your favourite currencies to check how the exchange rate changes over time.

Real-time notifications

Know exactly what you’ve spent, as soon as you spend it.

Send money fra Danmark with the Wise app

Looking for an international money transfer app? Send money on the go with Wise.

Cheap transfers abroad

Uden skjulte gebyrer får du altid middelkursen med Wise.

Track exchange rates

Save your favourite currencies to check how the exchange rate changes over time.

Real-time notifications

Know exactly what you’ve spent, as soon as you spend it.

4,3 / 5 on Trustpilot from 280.668 reviews

Do more with Wise i Danmark

You can use Wise for much more than just sending money. Here is what's available, based on where you live.

Receive money fast

Get paid easily in other currencies with global account details.

Save on spending abroad

Pay and withdraw cash worldwide without any foreign transaction fees.

Earn returns

Earn returns every working day, and spend them instantly. Capital at risk, growth not guaranteed.1

Ofte stillede spørgsmål

See where Wise works

- Send penge

- Account details

- Opbevar og veksl penge

- Interest is offered through Wise Assets Europe AS, authorised and regulated as an investment firm by the Estonian Financial Supervision Authority (Finantsinspektsioon). We do not give investment advice, and you may be subject to pay tax. If you're not sure, seek qualified advice. You can find more information about the funds on our website.