Mission Update

Min fees. Max ease. Full speed.

Your money is moving at full speed — and so are we. Learn more about faster transfers and smarter updates since July.

74% instant

Your global transfers arrive before you can say ‘it’s on its way.’ That’s 20 seconds or less. That’s up from 33% only 5 years ago.

Your money’s moving at full speed — and getting even faster

Major speed increases in the past 5 years

Percentage of transfers sent in 20 seconds or less

Saving you money is our mission

7x cheaper in France, Spain, or New Zealand.

Experience more with Travel Hub

From India, to anywhere

Big news for Indian students

Get your money where it needs to go

India’s ultimate forex card is coming soon

Live-track your Swift transfers like a parcel

Passkeys for peace of mind

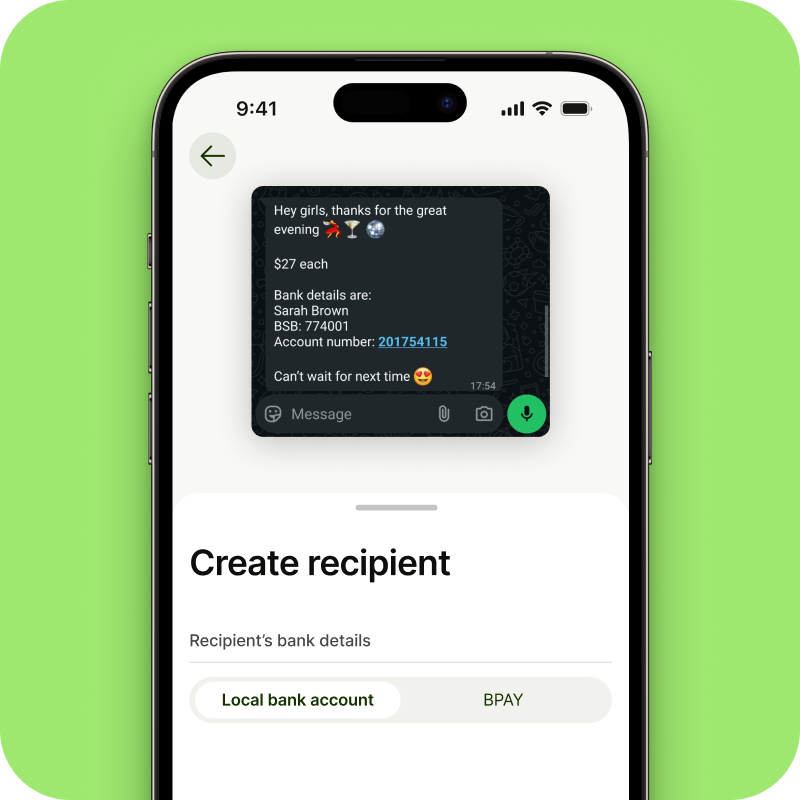

AI makes paying friends faster

Singapore, grow your EUR and GBP

Czech and Dutch are here

UAE, we’re on our way

Learn more

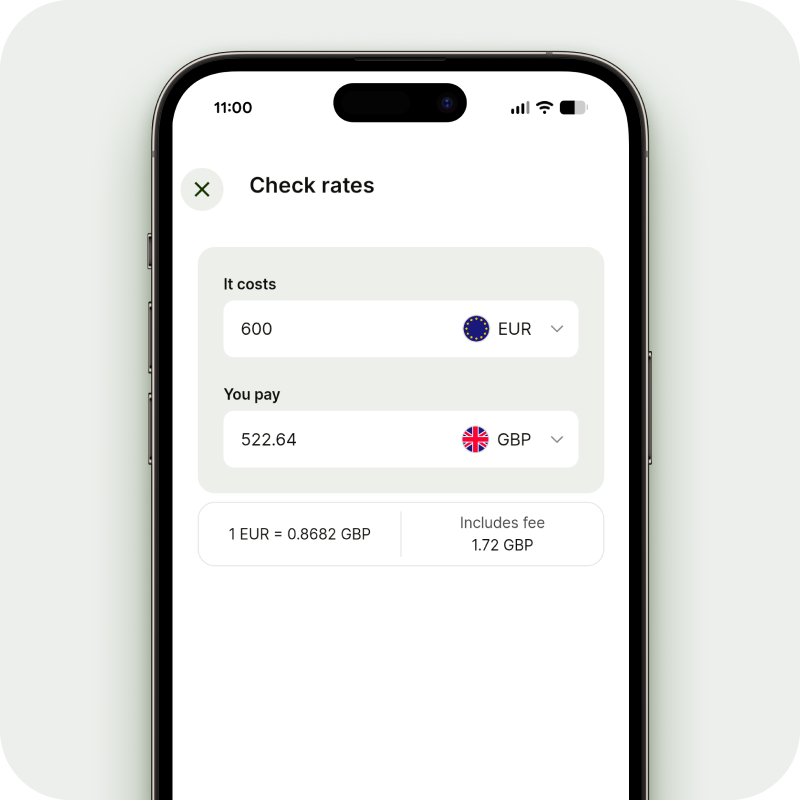

Hidden fees? That’s silly

We also teamed up with content creator, Joshua Pieters, to show just how outrageous hidden fees really are.

Checking in on global transparency progress

Fighting fraud, one story at a time

Wise Business

Philippines, meet your new business account

New ways to get paid in Hong Kong

Create invoices in 23 languages

Get paid by cards and Apple Pay in the US

Logos for Businesses

Set card limits that fit your team

Automated statement downloads

Bringing quick and clear payments to millions more

Wise Platform

We also took the stage at events like BaFinTech, Nordic Fintech Week, and our own Wise Connect in San Francisco to push for a more open, connected payments world where transparency and collaboration help everyone move their money better.

¹ Transaction speed claimed depends on individual circumstances and may not be available for all transactions.

² The price provided is a global average based on a fixed basket of representative currencies as of Q3 2025 and may not reflect specific prices for consumers in their regions. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing information.

³ Capital at risk.This fund has returned a 2.76% annual average on GBP and 1.39% on EUR annual average over the last 5 years, excluding Wise and fund manager fees. The current rates do not guarantee future growth and your return may increase or decrease. For the full 5 year past performance of funds, Terms of Use for your region or visit please visit our website.