Pty Ltd: What It means for Australian businesses

Learn what does PTY LTD mean in Australia and how it compares to other business structures. What are theequirements to start a PTY LTD in AU? Find out more!

As a business owner, it’s always good to stay on top of what services and technologies are out there that can help you grow and sustain your company. One area that’s always worth keeping an eye on is finance. Having the right business accounts and financial service partners can help reduce fees and make the money side of things easier to manage.

To that end, we’re going to take a look at the Revolut Business account. This blog will explore how it works for Australian customers, including the fees, processes, and features. We’ll also let you know a little bit about Wise, another provider who might be able to help with managing global finances.

| Table of contents |

|---|

Revolut Business is a digital-first financial platform that allows Australian-registered companies (sole traders, Pty Ltd, etc.) to open business accounts online and access fast local and international transfers. One of Revolut’s “essentials” is a multi-currency account for holding and managing 30+ currencies¹. But there are other tools too, including corporate debit cards and expense tracking.

The service is designed, first and foremost, for managing multiple currencies and streamlining (and saving money on) cross-border payments. Revolut states that customers save around 6% when using its Business account².

Common Revolut use cases for Australian businesses include:

It’s free to sign up for a Revolut Business account, but the entry-level tier is a paid service.

Revolut says it’s “not yet a bank” in Australia, even though it does offer many of the features you’d normally associate with one³.

Instead, Revolut operates under an Australian Financial Services License (AFSL) and partners with licensed banks to hold customer funds securely. While it doesn’t currently have a full banking license, the current setup means money is kept safe in trusted financial institutions.

Revolut Business packs in a range of features and tools to make managing international business finances simpler and more efficient for Australian customers.

Here’s what you get when signing up:

Yes, you can send money to businesses using Revolut Business. Like other transfers, you’ll need the account details for the intended recipient. To send money, you click on “Transfers” and “Send money” from the main dashboard, where you then enter the business’s account details.

Revolut says there are transfer limits for more popular currencies like USD and NZD, but it doesn’t list these on the site. It says the max transaction size is shown in the app prior to the transfer, and that it’s not possible to increase it.

However, it does list a few limits for “specific” currencies. For example, transfers in the Indian rupee (INR) to India have a limit of GBP 5,000⁴.

One downside is that you’ll need to add the recipient again if you want to send a new transfer in a different currency⁵. This extra step can be frustrating if you’re sending money, for example, to the same supplier in multiple currencies. With Wise Business, you can usually pay the same recipient in different currencies without having to re-add them each time.

A couple of other caveats with Revolut:

Revolut is primarily a subscription service. There are four tiers catering to different needs and business requirements: Basic, Grow, Scale, and Enterprise⁶. Each of these has a monthly fee, which you’ll need to pay to retain access to the account.

The entry-level Basic service starts from $10 AUD per month and includes the “essentials” to run a business. The higher-end Scale service will set you back $79 AUD per month for higher allowances and a full suite of tools. There isn’t a set price for Enterprise, which offers a “custom” build for larger corps.

Here’s an overview of what you get with each tier.

| Service | Basic | Grow | Scale |

|---|---|---|---|

| Monthly fee | From $10 per month | From $21 per month | From $79 per month |

| Currencies supported | 25+ | 25+ | 25+ |

| Global and local account details | Yes | Yes | yes |

| Exchange at interbank rate allowance | $1,000 | $15,000 | $75,000 |

| No-fee local transfers | 10 | 100 | 1,000 |

| No-fee international transfers | 0 | 5 | 25 |

| Revolut cards | Yes | Yes | Yes |

| ATM withdrawal | 2% of withdrawal amount | 2% of withdrawal amount | 2% of withdrawal amount |

It can take a few days for both inbound and outbound transfers to be completed. Revolut’s guidance states a maximum time frame of 5 days, excluding weekends and bank holidays⁷. However, both domestic AUD transfers and international transfers via SWIFT will usually be settled after 2 business days. If you’re sending money to another person or business using Revolut, these transfers are “instant.”

Revolut says it’s “quick and easy” to open a Business account. All you need to do is complete a short online form and upload a few personal and business documents, which should take around 10 to 15 minutes⁸. They will then review your application and give you the green light within 24 hours if everything goes as planned.

Revolut states most accounts can be set up and approved within one day.

Here’s a quick step-by-step guide for what to expect:

| 👆If you’re currently looking for a dedicated bank account for your business, check out our complete guide on free business bank accounts in Australia |

|---|

Now we’ve covered Revolut in detail, let’s take a look at how it compares to Wise Business, another financial services provider, but with a different approach to pricing and fees.

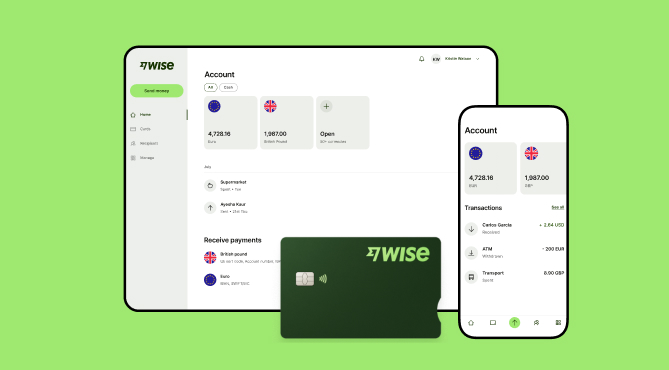

Like Revolut, Wise Business offers multi-currency capabilities. However, one of the key differences is that Wise Business doesn’t have paid tiers. There are no monthly fees, just a one-time 65 AUD fee if you want to get local account details. This is great for scaling as there are no hard caps or limits as your business expands.

With that in mind, here’s an overview of how Wise Business compares to Revolut’s mid-tier Grow Business account.

| Service | Revolut Business Grow6 (AUD | Wise Business (AUD |

|---|---|---|

| Monthly fee | From $10 | $0 |

| Multi-currency features | Yes, hold and exchange 25+ currencies | Yes, hold and exchange 40+ currencies |

| AUD transfers from an AUD bank account | 100 free inbound & outbound transfers per month, then $0.20 per transaction | Free to receive money, variable free from 0.63% to send money |

| Foreign currency transfers and transfers to AUD accounts outside of Australia | 10 free transfers per month, then $10 per transaction | Variable free from 0.63% |

| Local account details | AUD, EUR | 8+ currencies including AUD |

| Debit cards | Yes, physical and virtual | Yes, physical and virtual |

| ATM withdrawal | 2% of withdrawal amount | 2 free withdrawals per month up to $350, then $1.50 per withdrawal +1.75% |

This article is provided for general information purposes and has been prepared without taking into account your objectives, financial situation, or needs.

Running a business that crosses borders isn’t easy. When making regular transactions overseas, there are hidden fees and poor exchange rates to contend with, and the limitations of bank accounts that can’t process more than a handful of currencies.

Wise Business breaks down those barriers. It’s designed for businesses like you that trade internationally, offering an easier way to send, receive, and manage money in 40+ currencies — all from one dashboard under one account.

With Wise Business, there’s never any additional hidden markups on the mid-market exchange rate. What you see is what you get.

Our fees at a glance:

Wise Business makes light work of moving money back and forth between Australia and other countries. It works for both large and small transactions, too. If you’ve got a complex chain of money transfers, Wise lets you handle everything with ease. There’s no minimum limit — you can send payments from $1, and you get a discount for large transactions valued over $40,000 AUD during each monthly period. You can even send up to $5,000,000 AUD per transfer.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what does PTY LTD mean in Australia and how it compares to other business structures. What are theequirements to start a PTY LTD in AU? Find out more!

If you’re on the hunt for a suitable business credit card in Australia, there are several offerings available. A mutual or ‘customer-owned’ bank, Heritage...

If you’re a business owner in Victoria seeking a low-rate business credit card solution, Bank of Melbourne (BOM) may be worth considering. Existing...

If you run a business that deals with international trade, you know the importance of finding a service provider that makes international payments and foreign...

If you’re the owner of a business or run the finances of one, you might be considering business debit cards. These cards are usually connected to the...

Whether you have your own business already, or are looking to start one, there might be a time where you may need to seek out overseas suppliers to fulfil...