How to delete your Paysend account: US guide

Need to delete your Paysend account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

When you need to send money to family or friends abroad, Remitly promises convenience and low fees. But while the initial quoted fee might look competitive, the real cost of your transfer often lies hidden in the fine print. Dig into the numbers, and you'll find that Wise offers a fundamentally more transparent approach, a full range of extra features, and potentially a much better value.

Both Wise and Remitly exist to help you move money internationally. Remitly often focuses on flexible delivery options and promotional rates, while Wise is engineered around one core principle: transparency. That means using the fair, mid-market rate and charging a low, transparent fee so you’ll always know what you’re paying.

If you care about the total cost and not just the headline fee, keep reading to learn what makes Wise the smart way to send money across borders.

It starts with a deal – and who doesn’t love a discount? Remitly’s new customer offer (typically a special exchange rate and $0 transaction fee) can make it feel like a no-brainer to try out their service.

The thing is, the offer you see at first probably isn’t what you’ll see the second, third… or even twelfth time. You see the promotional rate, but the regular rate isn’t shown on the homepage until you come back to send money again. And since most people who send money abroad do so on a repeated basis, even if you saved money on your initial transaction, you might end up spending a lot more than you expected over time.

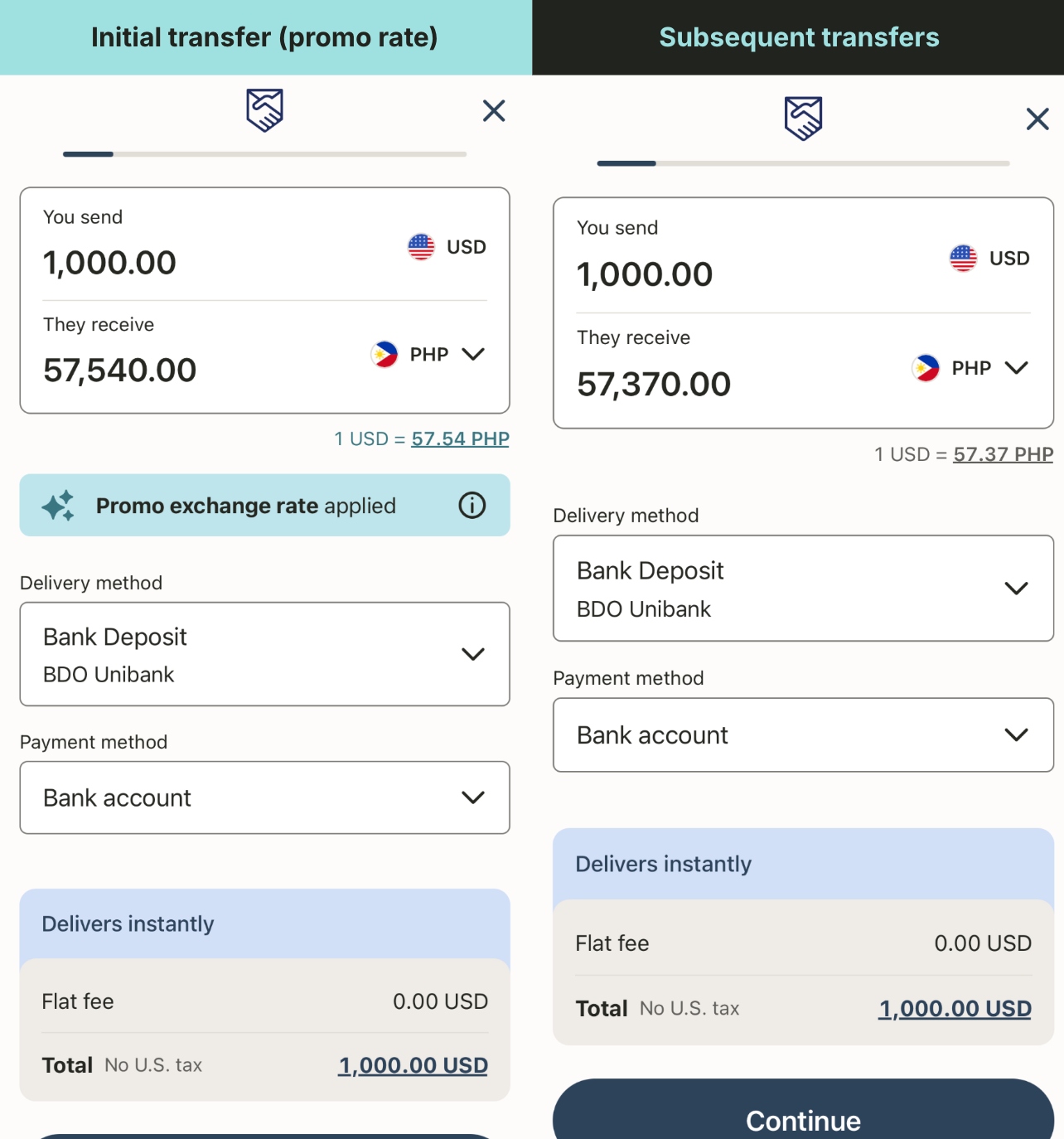

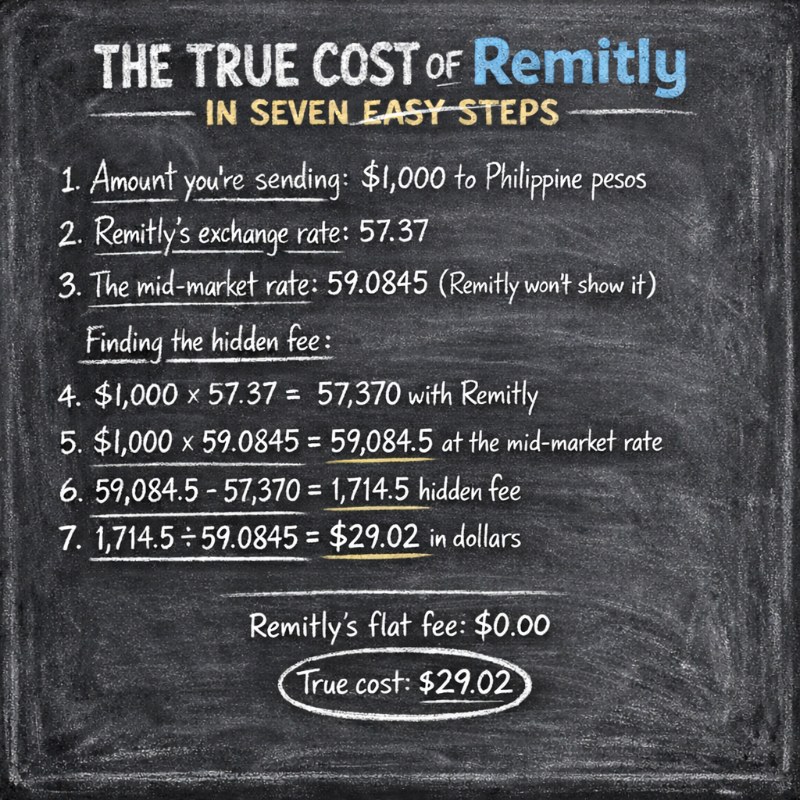

In the example below, a new customer wants to send 1,000 USD to the Philippines. They browse Remitly’s website and see “zero fees” and a rate of 57.54 PHP per dollar. But when they come back to send a second transfer of 1,000 USD, the rate drops to 57.37. Even though Remitly still shows zero fees on the second, non-promotional transfer, there’s actually a hidden cost of 29.02 USD baked into the exchange rate.¹

Remitly’s offer for new vs. returning customers: USD to PHP

Remitly charges a flat fee on some international transfers ranging from $0.99 to $6.99 or more, while many transfers are even advertised as having zero fees as in the example above. But even in those cases you are still likely to encounter hidden costs. That’s because Remitly’s low fees don’t show the amount you’ll truly pay for their service.

The hidden cost is lurking in Remitly’s exchange rate, which includes a markup from the mid-market rate. That’s the “real” exchange rate that banks and money transfer services use to trade between themselves, similar to the rate you see when (for example) you search “convert $100 to euros” on Google.

While it’s true that all providers charge some sort of fee, hiding it in the exchange rate makes it really hard for you as the consumer to figure out what you’re paying and compare providers to each other.

Figuring out how much you’re really paying²

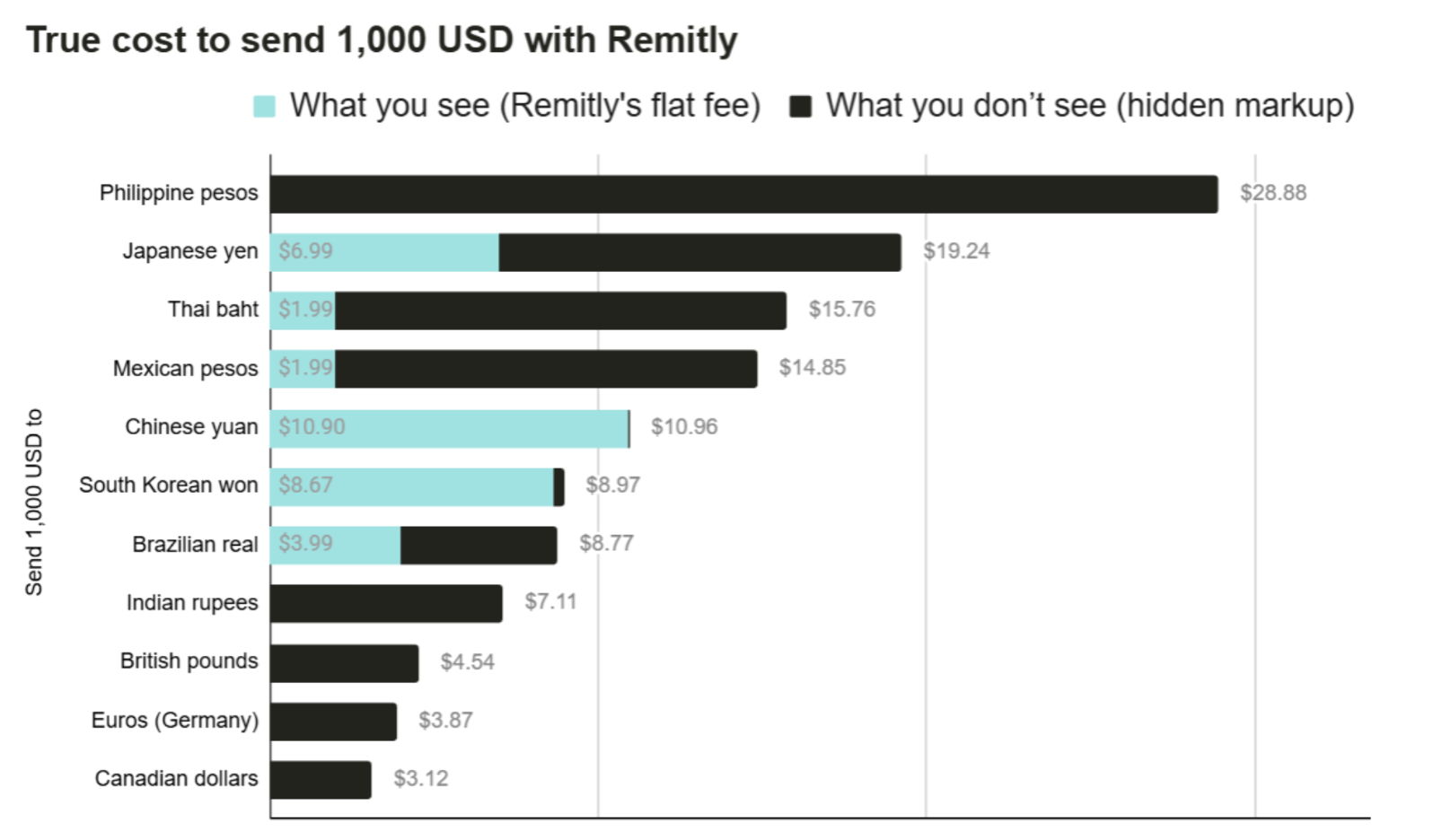

We did the math for a set of 10 popular currencies and found that while the fees displayed in the Remitly app ranged from 0.00 to 10.90 USD, the true cost ranged from 3.12 to 28.88 USD.

For eight of those 10 currencies, the majority of the true cost was actually hidden in the exchange rate, with Remitly’s “flat fee” making up only a small portion.

True cost of sending 1,000 USD to popular destinations with Remitly³

Wise doesn’t hide fees behind bloated exchange rates or unclear promotional offers. You get the real exchange rate every time. The fee is shown up-front before you send, so there are no surprises.⁴ Even if you get a discounted fee, the regular rate is shown alongside it so you’re never left guessing next time.

Total fees are clearly shown in the Wise calculator

And because Wise’s pricing is transparent, it’s also predictable. If you send money every month for bills, investments, or family support, you can budget with confidence. You’ll always know exactly how much will arrive, and exactly what you’re paying in fees—no hidden deductions or rate drops eating into your transfer.

With the Wise Multi-Currency Account, you can also:

- Get local account details to get paid like a local in 20+ currencies

- Save on currency conversion fees when you travel with the Wise Multi-Currency Card

- Receive interest on your USD, GBP and EUR balances by opting in to our interest feature

If you’re sending money home once or twice a year, and you’re happy to hunt for new customer offers, Remitly might do the job.

But if you send money more than once, or just want to know what you’re really paying, Wise can save you a lot more in the long run.

With Wise there’s no guesswork. Just money without borders and a price you can plan for.

Notes

1: The original amount of 1,000 USD is equivalent to 59,084.5 PHP at the mid-market rate of 59.0845 and 57,370 PHP at Remitly’s non-promotional exchange rate of 57.37. The difference of 1,714.5 PHP is equivalent to 29.02 USD at the mid-market rate. Rates collected on 12 December 2025.

2: Data collected on 12 December 2025. The mid-market rate was collected from Wise.com at approximately the same time on the same day as the Remitly information.

3: Data collected 12 December 2025; calculation below:

| Send 1,000 USD to | Send 1,000 USD to | Send 1,000 USD to | What you see (Remitly's flat fee) | True cost with Remitly |

|---|---|---|---|---|

| Philippine pesos | 59.0845 | 57.37 | 0.00 USD | 29.02 USD |

| Dominican pesos | 63.48 | 61.83 | 2.99 USD | 28.98 USD |

| Japanese yen | 155.86 | 153.95 | 6.99 USD | 19.24 USD |

| Thai baht | 31.595 | 31.16 | 1.99 USD | 15.76 USD |

| Mexican pesos | 18.0116 | 17.76 | 1.99 USD | 15.96 USD |

| Chinese yuan | 7.0552 | 7.0548 | 10.90 USD | 10.96 USD |

| South Korean won | 1474.74 | 1474.3 | 8.67 USD | 8.97 USD |

| Brazilian real | 5.419 | 5.3931 | 3.99 USD | 8.77 USD |

| British pounds | 0.7481 | 0.7447 | 0.00 USD | 4.54 USD |

| Indian rupees | 90.584 | 90.22 | 0.00 USD | 4.02 USD |

| Euros (Germany) | 0.8518 | 0.8485 | 0.00 USD | 3.87 USD |

| Canadian dollars | 1.3768 | 1.3725 | 0.00 USD | 3.12 USD |

4: Please see Terms of Use for your region and visit Wise Fees & Pricing for the most up to date pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Need to delete your Paysend account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to delete your Sendwave account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Wondering is EverBank safe? Our full guide explains security features, fraud protection, FDIC coverage, and tips to protect your money and data.

Wondering is Santander safe? Our full guide explains security features, fraud protection, FDIC coverage, and tips to protect your money and data.

Wondering is Vanguard safe? Our full guide explains security features, fraud protection, FDIC coverage, and tips to protect your money and data.

Wondering is TD Bank safe? Our full guide explains security features, fraud protection, FDIC coverage, and tips to protect your money and data.