DeepSeek Pricing for Singapore Businesses in 2025: Rates, Features, and How to Save

DeepSeek pricing guide for Singapore in 2025, covering token rates, API costs, examples, and tips to save on your SaaS bill every month.

Managing overseas payments is a daily reality for many Singapore businesses — from paying SaaS (Software as a Service) subscriptions in USD to covering marketing spend in AUD or GBP.

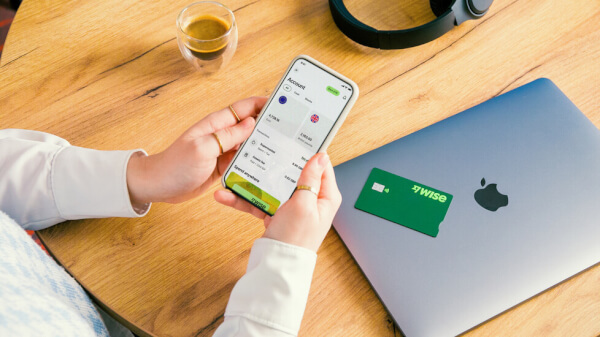

That’s where a multi-currency business card can make life easier.

The WorldFirst card (also called the World Card) is a virtual Mastercard linked to your WorldFirst account, designed for online payments in more than 150 currencies. It’s built for SMEs that want to spend directly from currencies in their existing funds and avoid unnecessary foreign transaction fees.

In this guide, we’ll unpack what the WorldFirst card offers, its key features, and who it’s best suited for. We’ll also explore a popular alternative, the Wise Business Card, which lets Singapore companies pay for ad-hoc business expenses, especially those of a cross-border nature at mid-market exchange rates and no foreign transaction fees.

| Table of contents |

|---|

The WorldFirst card — officially called the World Card — is a virtual Mastercard that links directly to your World Account. It’s designed for online business payments in 150+ currencies, across 210+ countries and territories, wherever Mastercard is accepted.

You can spend without foreign exchange fees when paying from one of 15 supported currency balances, including SGD, USD, GBP, EUR, JPY, and AUD.¹

For other currencies that you don’t hold a balance in, WorldFirst will convert the amount using its exchange rate, which includes a foreign exchange markup of up to 0.6% above the mid-market rate, and show the final conversion rate and fees clearly in your account before you pay².

Right now, the WorldFirst card is virtual-only, but a physical card, Apple Pay, Google Pay, and employee card options are all marked as “coming soon.” Each business can create up to 25 cards, making it easy to separate spend across teams, campaigns, or suppliers. Built-in controls let you set limits, freeze cards, and download statements for easier reconciliation.

| Feature | Details |

|---|---|

| Set up a WorldFirst account | Free |

| Order World Card | Free (up to 25 cards per business¹) |

| Spend overseas | 15 currencies with no foreign exchange fee when spending from the same balance — AUD, CAD, CHF, CNH, CZK, EUR, GBP, HKD, JPY, MXN, NZD, PLN, SEK, SGD, USDForeign exchange conversion fees for other currencies: Shown in your account before payment when converting; WorldFirst does not list a fixed markup |

| Cashback | Earn up to 1.2% cashback on eligible online business transactions (e.g., digital marketing, SaaS, travel, e-commerce). Cashback is credited in USD to your World Account the following month. Valid for spends made 1 July to 31 December 2025 under the WorldFirst Cashback Promotion³. Terms and exclusions apply. |

| Monthly/annual fee | None |

| ATM withdrawals | Not supported (virtual card for online use only) |

| Expense management | Free (coming soon) |

Details correct at time of research — 15 October 2025

Corporate cards aren’t just for large companies anymore — they’ve become a core tool for SMEs and startups that need tighter expense control. In Singapore, where overseas payments and SaaS subscriptions are common, a dedicated business card helps you simplify expense tracking and stay on top of cash flow.

With a corporate card, you can:

If the WorldFirst card doesn’t offer every feature you need (like physical cards, ATM withdrawals, or additional integrations), you can explore other corporate card alternatives in Singapore. These include traditional options such as the Citi Business Card or Maybank Business Platinum Mastercard, as well as fintech solutions like YouBiz, Airwallex, and Aspire.

You can compare your options in our guide to the best corporate credit cards in Singapore to find the best match for your business needs.

While many corporate cards in Singapore help manage company expenses, the WorldFirst card stands out for its global reach and tight integration with multi-currency wallets.

The WorldFirst Card is built for businesses that already manage revenue or expenses across borders (especially those using the World Account to hold multiple currencies) and want rewards on eligible online spend.

Applying for the WorldFirst Card in Singapore is straightforward; you’ll just need a verified World Account to get started.

The WorldFirst card gives Singapore businesses an efficient way to manage cross-border payments without juggling multiple accounts. For companies already using the World Account, it’s a natural extension, letting you spend directly from 15 supported currency balances, issue up to 25 virtual cards, and maintain tighter control over online expenses.

Pros

Cons

If your business makes frequent online purchases, SaaS payments, or ad spends, the WorldFirst card lets you save on foreign exchange and earn cashback at the same time. But if you also need physical cards, cash withdrawals, or lower, transparent conversion fees, the Wise Business Card remains one of the most versatile options.

| 💡Whether you're paying for overseas business transactions such as your SaaS subscriptions or travel expenses, the Wise Business Card lets you spend online or in-store in 40+ currencies and 150+ countries. With transparent pricing and no foreign transaction fees, Wise ensures there are no hidden fees eating into your profits. |

|---|

➡️Get your Wise Business Card today

Sources:

Sources checked on 15 October 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

DeepSeek pricing guide for Singapore in 2025, covering token rates, API costs, examples, and tips to save on your SaaS bill every month.

Azure OpenAI pricing guide for Singapore teams, including models, Batch API discounts, add-ons, and practical steps to save on your next bill.

Wise Business card review for Singapore SMEs — learn about its practical use cases, trade-offs, and whether it fits your business needs.

Looking for the best Mailchimp alternatives for your Singapore business? Here are our top picks.

Everything you must know to manage and process payroll in Singapore wisely.

How does WhatsApp Business pricing work for Singapore companies? Explore 2025 pricing, WhatsApp APIs, and how to save money on international subscriptions.