Review of Statrys: Great Business Account for Singapore Companies?

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Owned and operated by only one person, a sole proprietorship is considered Singapore's “simplest” business structure. While it’s not legally required in Singapore, sole proprietors should still maintain a separate business bank account to reap many short- and long-term financial benefits (more specifics to follow in a bit).

This article reviews some of the best business bank account options available for Singapore-based sole proprietorships to help you choose one that is best suited to your needs. We’ll also touch on some non-bank providers, including Wise Business, as an alternative way for sole proprietorships and growing small and midsize enterprises (SMEs) here to manage international payments efficiently.

There are 4 main business entity types in Singapore¹:

| ➡️ Learn more about Singapore's different business entity types ⬅️ |

|---|

While it’s not legally required for Singapore-based sole proprietorships to maintain separate business bank accounts, doing so still presents a few benefits for your business, including:

Did you know that Wise offers both personal and business accounts?

➡️ Learn more about the differences between the Wise Personal and Business accounts here

Here’s an overview of the accounts we’ll review — there’s more detail coming up later on each.

| Business account | Minimum balance | Monthly account fees | Currencies supported | Payment options | Digital banking features |

|---|---|---|---|---|---|

| Aspire Business Account² | No minimum balance | No monthly account fee | 30+ currencies supported | Free local transfers; International payments from 8 USD; Conversion fees from 0.4% apply to forex transfers | Fully digital provider |

| OCBC Business Growth Account³ | 1,000 SGD | 10 SGD (waived for first 2 months) | SGD | 80 free FAST and 80 free GIRO per month; 30 SGD flat fee for telegraphic transfers | OCBC Velocity digital banking service available |

| Wise Business⁴ | No minimum balance | No monthly account fee; One-time 99 SGD fee for full account services | 40+ currencies supported | Free local transfers; Conversion fees from 0.26% apply for forex transfers | Fully digital provider; Set up in minutes |

| DBS Business Multi-Currency Account (Starter Bundle) ⁵ | No minimum balance | 10 SGD | 13 currencies supported | Unlimited free FAST and GIRO for payments made via DBS IDEAL; 30 SGD flat-fee for outward telegraphic transfers | DBS IDEAL online and mobile banking services available |

| Maybank FlexiBiz Account⁶ | 1,000 SGD | No monthly account fee | SGD | 0.5 SGD FAST payments; 0.2 SGD GIRO payments; Variable fees for outward telegraphic transfers | Business Internet banking (BIB) service available |

| Airwallex⁷ | No minimum balance | No monthly fees | 20+ currencies supported | Payments using local transfer methods are free; SWIFT payments are 20-35 SGD Conversion fees from 0.4% apply to forex transfers | Fully digital provider |

| UOB eBusiness Account⁸ | 5,000 SGD | 2.92 SGD (35 SGD annual account fee) | SGD | Up to 60 free FAST and 60 free GIRO payments per month | UOB Infinity or UOB SME digital banking service available |

| GXS Biz Account⁹ | No minimum balance | No monthly account fee | Information not available online — contact GXS for more information | Free local FAST and PayNow transfers; No hidden fees for international transfers | Fully digital provider |

*Details accurate as of 20 February 2025

**Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information

The Aspire Business Account² has no minimum balance and no monthly fee, making this a popular choice for new businesses looking to avoid ongoing costs.

Local transfers are free.

It supports 30+ currencies, with international payments from US$8 and forex conversion fees from 0.4% — a potentially good pick if you have overseas customers, contractors, and/or suppliers (e.g., retail business that sources goods from overseas).

➡️ Check out our Aspire Business Account Review here

The OCBC Business Growth Account³ has a relatively low minimum deposit requirement of S$1,000 (a S$15 fall-below fee applies if your monthly average balance is lower than this). It charges an account fee of S$10 monthly, which is waived for the first 2 months.

The account operates in SGD only, and the first 80 FAST payments and the first 80 GIRO payments monthly are free; the 81st FAST payment onwards is charged at S$0.50 per transaction, while the 81st GIRO payment onwards is charged at S$0.20 per transaction¹⁰.

The OCBC Aspire Business Account may make sense if your sole proprietorship only transacts locally and in relatively small volumes (e.g., home-based bakery).

➡️ Check out our review of the different business accounts OCBC offers

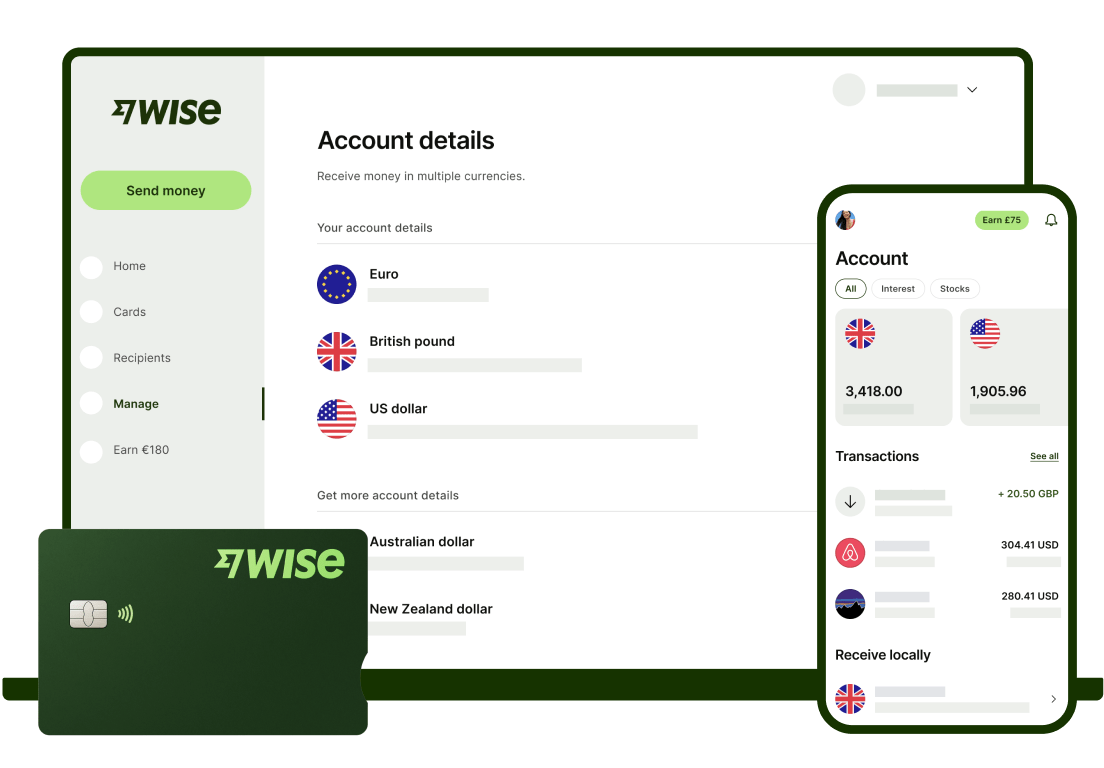

Illustration of Wise Business products

Wise Business⁴ is a fully digital provider offering international accounts that can hold and exchange 40+ currencies.

You can open your Wise Business account online or in the Wise app for free and pay a one-time fee of 99 SGD to get full feature access, including making fast and secure international payments with conversion fees from 0.26%.

| 🚀 This can make choosing Wise Business a no-brainer if your sole proprietorship handles large and/or frequent cross-border payments (e.g., you’re a service provider, like a digital marketing agency, with a global client base). Best of all, there is no minimum balance or ongoing charges to worry about — just low, transparent fees for the services you use. |

|---|

Learn more about Wise Business

The DBS Business Multi-Currency Account⁵ supports 13 currencies and can be opened as a starter bundle if your sole proprietorship has been incorporated in the last 3 years.

With the starter bundle, you’ll pay a reduced monthly account fee of S$10 and no service fee. There is also no minimum balance.

📝 While local payments made through FAST and GIRO are free, a 30 SGD flat fee applies for every telegraphic transfer, which means that this bank account will probably only make sense if your Singapore-based sole proprietorship only transacts locally (or handles very few international payments). An example is if you’re a freelance tutor.

➡️ Read more about the DBS Business Muti-Currency Account here

Maybank’s Flexibiz Account⁶ has a minimum balance requirement of S$1,000 (a S$10 fall-below fee applies if your daily average balance falls below this). The account has no monthly fee and charges low fixed fees for local payments using FAST and GIRO, with variable fees for international transfers, depending on where you’re sending money.

As Maybank is a Malaysian bank, sending payments to Malaysia generally can be cheaper than transferring funds to another country. This means the Maybank Flexibiz Account could be a good choice if you mainly transact locally and in Malaysia (e.g., if you’re a home-based bakery that sources your ingredients and packaging materials from Malaysia).

➡️ Here’s everything you need to know about Maybank Singapore business banking products

The Airwallex⁷ business account supports 20+ currencies with no minimum balance or monthly fee. It offers free local transfers, but processing international payments using SWIFT will cost S$20-35 per transaction¹¹. Conversion fees from 0.4% also apply to forex transfers.

Like the Aspire Business Account, this business account is worth considering if you have overseas customers, contractors, and/or suppliers (e.g., you run a retail store and ship your products internationally).

➡️ Check out our full review of the Airwallex business account

Of all the business bank accounts covered in this article, UOB’s eBusiness Account⁸ has the highest minimum balance requirement of S$5,000 with a fall-below charge of S$15 (waived for account opening month and subsequent 11 months).

📝 The UOB eBusiness Account can be a good pick if you only transact locally and are confident of maintaining a monthly balance of S$5,000.

➡️ Learn more about the many other UOB business bank accounts on offer here

The GXS Biz Account⁹ is a simple current business account aimed at sole proprietors.

Such unpredictable foreign transaction costs make the GXS Biz Account worth considering only if your business primarily transacts locally (e.g., you run a home-based craft business).

➡️ Check out our review of the GXS Biz Account here

As a sole proprietorship in Singapore, you may have limited access to capital and face tight cash flow; so, when choosing a business account, here are a few things you should keep in mind:

You can choose from many business account options (both bank and non-bank ones) as a sole proprietorship in Singapore.

When deciding between accounts, it’s essential to consider not only your limitations as a sole proprietorship but also

💡 Wise Business has several aspects that make it ideal for businesses just starting out — like your sole proprietorship — as well as those who’ve established their business model and are looking at growth now:

| Thrive and Grow with Wise Business | |

|---|---|

| 🚀 Always Get the Mid-Market Rate No more hidden markup fees or foreign transaction fees - We give you the exact mid-market exchange rate + a transparent, low conversion fee. | 🌍 Global Multi-Currency Account that Feels Local Send money to over 70 countries and manage multiple currencies without breaking a sweat. Get account details to receive payments in GBP, EUR, AUD and more currencies just like a local |

| 💸 Pay Once, Unlock Forever Forget about monthly charges or annual fees. With Wise Business, you can unlock the full suite of features for a one-time fee of 99 SGD | 💼 Batch Payments Brilliance Too many invoices? Power through up to 1,000 invoices in just one click with our Batch Payments Tool |

| 💳 Command Your Cash Flow with Wise Business Cards Give your team their own corporate debit cards to keep expenses clean and easy to monitor. Need more control? Approve payments, set spending limits, and freeze your card if you've lost it. | 📄 Free Invoicing Tool Level up your invoicing game with our free tool. Create and send professional invoices that not only get noticed but get paid. |

Get Started with Wise Business

Sources:

Sources checked on 20th February 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Learn how Alipay Business works in Singapore, its fees, benefits, and alternatives to help you manage multi-currency payments faster and more transparently.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.