If you’re an entrepreneur or business owner in Singapore, you’ll want an easy way to pay suppliers and get paid by customers and clients. Digital accounts with multi-currency functionality can be a smart option, allowing you to transact across currencies and connect with people around the world more easily.

Payoneer Singapore¹ offers digital accounts for businesses - if you’re considering opening a new business account, this Payoneer review is for you. We’ll cover all the key points about Payoneer fees, the Payoneer card, and how to use your account. And to help you decide if it’s the right match for you, we’ll also compare Payoneer with another couple of great business account options, including the Wise business account. Let’s get right into it.

What is Payoneer?

Payoneer offers digital account services to business owners around the world. Over 5 million people and businesses already use Payoneer, to get paid by customers and clients, pay suppliers and staff, manage business spending using the Payoneer business card, and more. You’ll be able to open and operate your account online or in the Payoneer app, and your account can come with local receiving details to get paid from a range of different countries.

Payoneer also has integrations with a range of ecommerce sites and networks, so you can get paid from places like Fiverr and Upwork direct to your account, in the currencies of your choice. That makes Payoneer a strong choice if you’re getting paid online and want to connect to customers around the world more easily.

Does Payoneer work in Singapore and is it safe?

The two most important questions are possibly:

- Does Payoneer work in Singapore

- Is Payoneer safe?

Luckily, the answers are yes, and yes. Payoneer is available for business customers in Singapore, and it’s also covered by multi-jurisdictional licenses which allow it to trade safely around the world. That means Payoneer is regulated by bodies like FinCEN in the US and the Central Bank of Ireland in the EEA, to keep customer accounts and funds safe.

Payoneer multi-currency business account features

So - what can you actually do with a Payoneer account? Here’s a run through of all the key features - we’ll cover Payoneer fees a little later.

Local bank account details abroad

When you open your Payoneer account you can also get receiving details to get paid by local transfer in a range of currencies:

- Singapore dollars

- US dollars

- Euros

- Canadian dollars

- Japanese yen

- Hong Kong dollars

- British pounds

- Australian dollars

Once you have funds in your account you can convert them to the currency you need, to withdraw to your local Singapore bank account, or an account held in a different currency. You can even add multiple different international bank accounts to withdraw in the currencies of your choice, whenever you need to.

If you want to switch between currencies there’s a fee of 0.5% of the transaction value, and if you’re withdrawing to a different currency you’ll also usually pay a fee of up to 2%.

Sending business payments internationally

With your Payoneer Singapore account you can send international business payments to 190+ countries. You’ll also have the facility to send bulk payments to up to 200 people at a time, making it easy to pay contractors or staff in just a few clicks. Payments sent to other Payoneer accounts usually arrive within just a couple of hours and don’t have a Payoneer transfer fee.

Funding payments with your Payoneer balance is possible if you already hold funds - and if not, you can pay using a linked card or bank account. Paying with a card or linked account costs between 1% - 3% depending on how you arrange your transfer.

Requesting payments from clients

When it’s time to get paid you can send payment requests to customers in 150+ different countries. You’ll be able to give customers different options to make sure they can pay in a way that’s convenient for them:

- Credit or debit card

- ACH debit

- Local bank transfers

- SWIFT transfer

- Payoneer balance

It’s important to note that some payments can only be received from certain types of payers:

- Credit or debit card - available to individuals and companies worldwide

- ACH debit - available to individuals and companies in the US only

- Local bank transfers - available to companies n the country of the receiving account only

- SWIFT transfer - available to companies worldwide

- Payoneer balance - available to Payoneer account holders worldwide

Fees apply when receiving payments, and vary based on the payment type. More on that later.

Payoneer card

If you’re eligible you’ll also be able to apply for a Payoneer card which is linked to your account and allows you to spend your Payoneer balance in person, online and by phone. The card can be issued in a range of currencies including USD, EUR, GBP and CAD. There’s a fee to pay, but once you have one card you can order one for a different currency without a fee.

Costs apply to the card when you transact in a foreign currency or make cash withdrawals - the full detail on Payoneer card fees is coming up next.

Payoneer fees in Singapore

There’s no cost to create a Payoneer Singapore account, but you’ll come across a few transaction fees when you use your account to pay or get paid². Here’s what you need to know.

Payoneer fees - the basics

| Payment type | Payoneer Singapore fee |

|---|

| Payoneer annual fee - waived if your account is active | 29.95 USD |

| Account opening fee | Free |

| Currency conversion between balances within your account | 0.5% |

Payoneer fees - getting paid

| Payment type | Payoneer Singapore fee |

|---|

| Getting paid by another Payoneer customer, from their Payoneer account | Free |

| Getting paid directly by clients | 3% fee for credit card payments 1% fee for ACH transfers from the US |

| Getting paid by marketplaces and networks liken Fiverr, AirBnB or Upwork | Fees vary based on the individual site |

| Getting paid via receiving accounts | Free for most currencies 0% -1% for USD depending on payment type |

Payoneer fees - withdrawing your funds

| Payment type | Payoneer Singapore fee |

|---|

| Withdraw to a bank account - withdraw into a local account from a different currency (eg. withdrawing USD to a SGD denominated account in Singapore) | Up to 2% of withdrawal value (third party fees may also apply) |

| Withdraw to a bank account - withdraw into a local account from a currency held in your Payoneer account (eg. withdrawing GBP to a GBP denominated account in the UK) | 1.5 GBP / 1.5 EUR / 1.5 USD |

| Withdraw to a bank account - withdraw into non-local currency (eg. withdrawing USD to a USD denominated account in Singapore) | Up to 2% of withdrawal value (minimum fee may apply if no currency conversion is involved) Third party fees may also apply |

Payoneer fees - Payoneer card fees

| Payment type | Payoneer Singapore fee |

|---|

| Annual Payoneer card fee | 29.95 USD |

| Transactions in a currency you hold | No fee |

| Transactions involving currency conversion | Up to 3.5% |

| Transactions in which merchant country is different to card issuing country (cross border fee) | Up to 1.8% |

| ATM withdrawal | 3.15 USD/ 2.50 EUR / 1.95 GBP |

| ATM balance advice | 1 USD/ 0.87 EUR / 0.65 GBP |

Payoneer fees - making payments

| Payment type | Payoneer Singapore fee |

|---|

| Pay another Payoneer account from your Payoneer balance | Free |

| Pay to someone’s bank account from your Payoneer balance | Up to 2% (third party fees may also apply) |

| Fixed fee to pay someone in the same currency as your Payoneer balance | 1.5 GBP / 1.5 EUR / 1.5 USD |

| Batch payments | 2% of transfer value |

| Make a payment without holding Payoneer balance | 1% for bank or ACH transfer 3% for credit card payments |

How to open a Payoneer account?

Opening a Payoneer account is pretty easy and can be done online or through the Payoneer mobile app. The exact details and paperwork you’ll need will depend on the specific account you want and the type of business you have. Registered business owners - for example - will need to provide business registration information to get started and verify their accounts:.

Here are the basic steps:

- Head to the Payoneer website or app

- Click Register

- Confirm the account type you want to open based on your business

- Confirm the monthly transaction value you expect to need

- Click to continue, and enter your personal and business details following the online prompts

- Complete the security step to secure your account, get verified if required and you’re done!

How to contact Payoneer customer service

You can get customer support by logging into your Payoneer account, or searching on the Payoneer help section. Alternatively, try³:

- International phone support: 1-646-658-3113

- Web Form: payoneer.custhelp.com/app/ask/

- E-mail: to CustomerServiceManager@Payoneer.com

- In Writing: Payoneer Inc. 150 West 30th Street, Suite 600, New York, NY, 10001

Payoneer vs PayPal vs Wise - comparison between popular business accounts in Singapore

Payoneer isn’t your only option if you’re looking for a digital way to manage your business finances across currencies. Let’s look at a few of the features of Payoneer compared with alternatives PayPal and the Wise business account.

| | Payoneer | PayPal⁴ | Wise Business |

|---|

| Account opening fee | None | None | Free to create account, one time 54 SGD fee for full features |

| Receiving account currencies | 8 currencies | PayPal accounts can handle a range of currencies, but you’ll then need to withdraw to your linked local bank account | 9 currencies: SGD, USD, EUR, GBP, AUD, NZD, HUF, TRY and CAD |

| Send payments to | 190+ countries | Any PayPal account holder | 80+ countries |

| Currency conversion fees | 0.5% - 2% depending on the transaction type | Usually 4% - 4.5% Fee varies depending on how you fund the transfer | From 0.41%, conversion uses mid-market exchange rate |

| Linked card available | Yes | Yes | Yes |

| Account dormant fee | 29.95 USD/year | None | None |

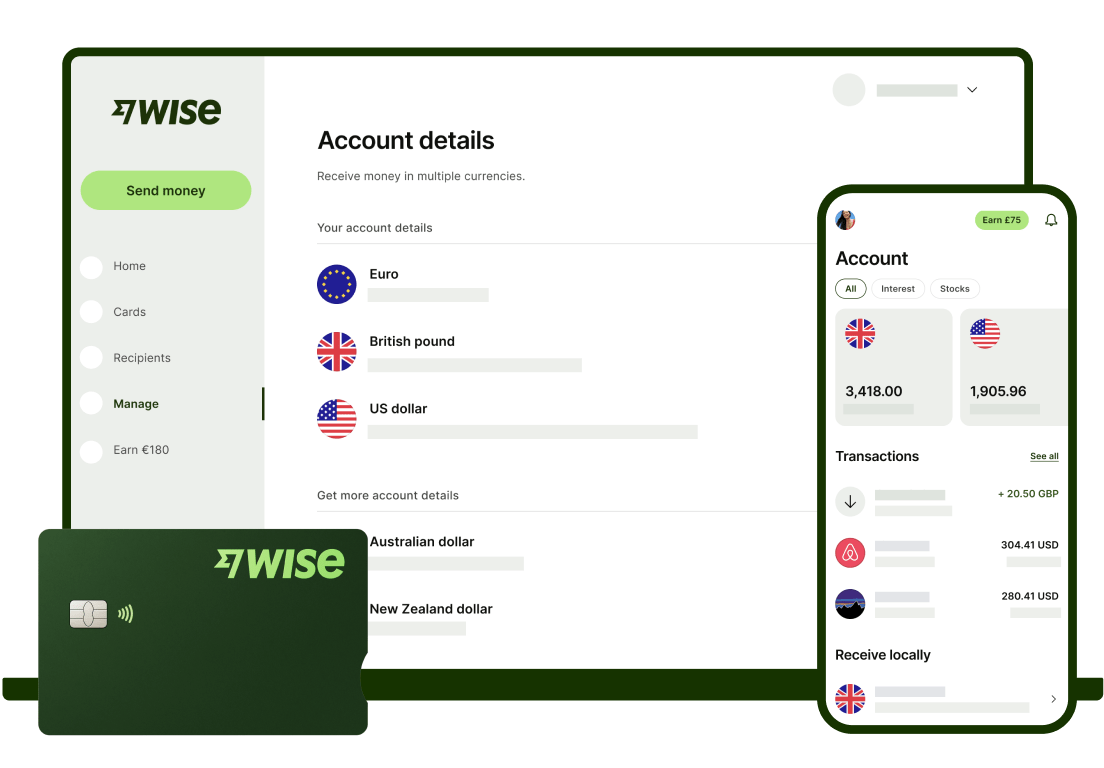

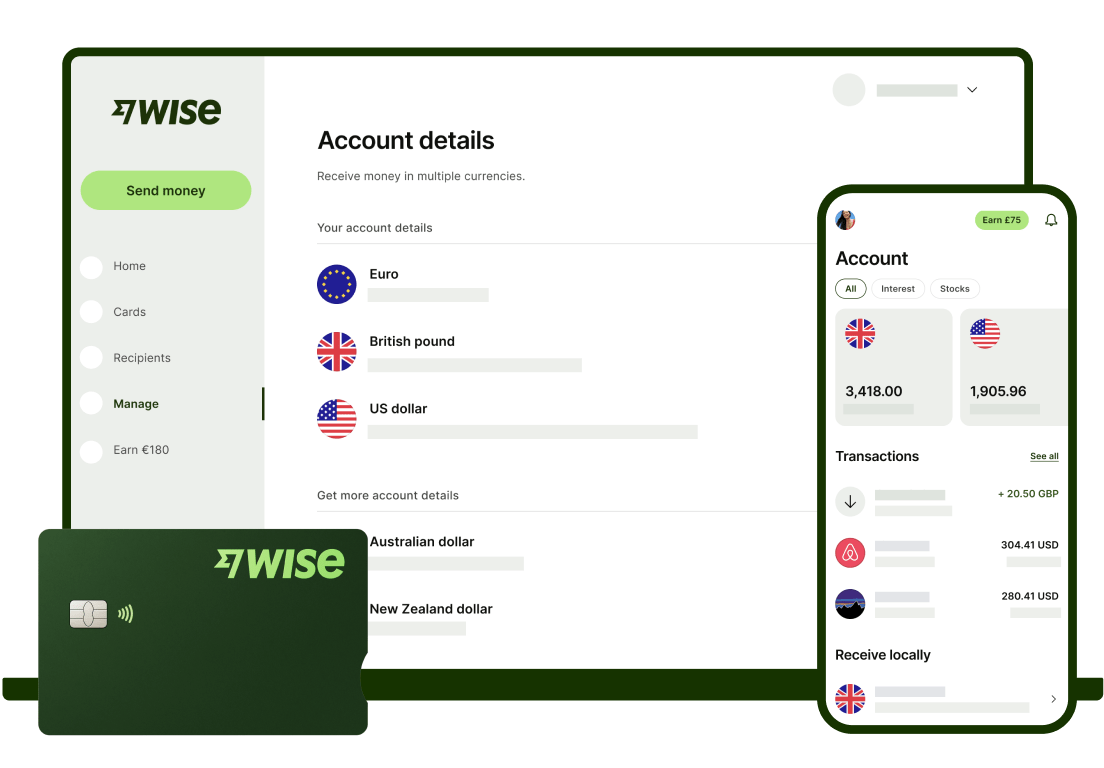

Wise is a smart choice if you’re looking for a way to pay and get paid internationally, with the option to hold and exchange 50+ currencies (with the mid-market exchange rate), get paid like a local from 30 countries, and spend all over the world with your linked Wise debit card.

Illustration of Wise Business products

Still not sure about which account might suit your business best? Check out the Wise business account, or read more about PayPal for business here.

Summary

So there you have it - all you ever needed to know about Payoneer Singapore, plus a little look at alternatives like the Wise business account and PayPal as a bonus.

Shopping around to find the right business account for your needs just makes good sense. You could cut your costs, grow your profits, and connect with more customers around the world, simply by picking the right account partner for your needs. Check out Payoneer against a range of alternatives including Wise, to find your perfect match.

Learn more about Wise Business

Sources:

- Payoneer Singapore

- Payoneer Singapore fees

- Payoneer - contact us

- PayPal Singapore business fees

Sources checked on 26.05.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.