Review of Statrys: Great Business Account for Singapore Companies?

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

An expense claim is a process by which employees get reimbursed for work-related costs they’ve paid out of pocket.

When employee expense claim management runs smoothly, the books stay clean and people get paid on time. When it doesn’t, receipts disappear, approvals get stuck, and month-end turns chaotic.

This guide breaks down the expense claim process, explains what qualifies as a valid expense, and shows how an expense claim system (or expense claim software Singapore teams use) streamlines everything.

You’ll also see how pairing software with the Wise Business Card removes most reimbursements entirely, so employees spend directly while finance stays in control.

| Table of contents |

|---|

An expense claim is a formal request to be reimbursed for business costs an employee has paid personally.

A reimbursement is the company’s payment to that employee after approval, while a disbursement covers expenses paid directly in the company’s name (for example, by an authorised agent).

Handled well, expense claims protect budgets, reduce out-of-pocket stress for staff, and leave a clear trail for audits. Handled poorly, they slow teams down and mask overspending until it’s too late.

For a claim to go through, it should:

Most day-to-day claims fall into a few familiar buckets.

For Singapore teams, this usually involves travel and accommodation, meals and entertainment related to work, office supplies and peripherals, communications and software (such as mobile plans and SaaS), and training or certifications related to the role.

The list below outlines the most common expense claim categories, helping employees understand what typically qualifies and allowing finance to keep records tidy.

Work trips typically include airfare, train or bus tickets, car rental, and hotel stays. In Singapore, local travel often covers Grab/taxi fares and public transport for meetings, site visits, or airport transfers.

Before digital tools, the expense claim process was mostly manual — paper receipts, spreadsheets, and back-and-forth emails. It still works for small teams, but as the volume of claims increases, the cracks start to show.

Even with clear rules, expense claims can still get messy. Errors, missing details, or unclear spending reasons lead to rejections or long approval chains. Knowing the usual pitfalls helps keep things smooth.

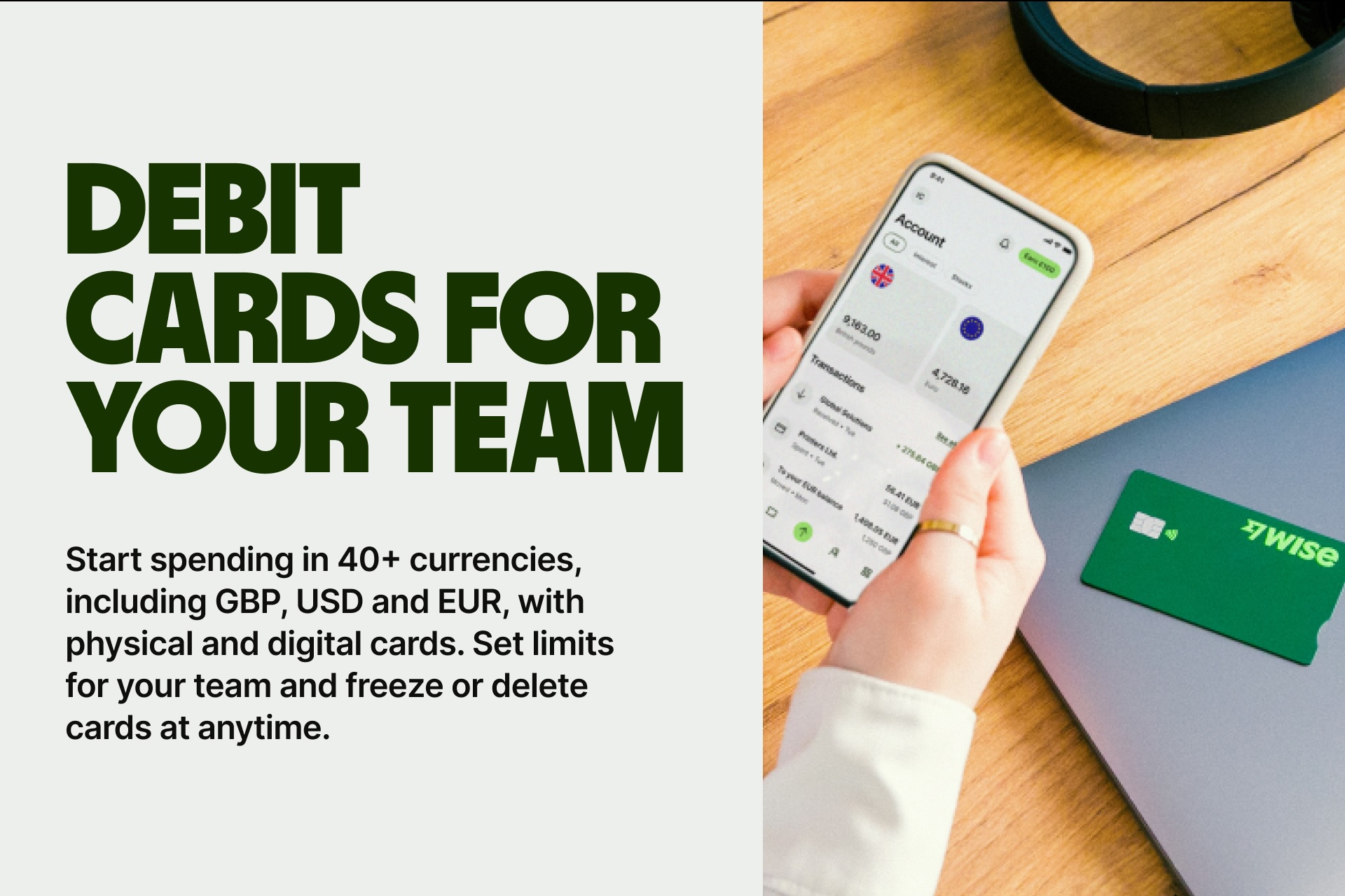

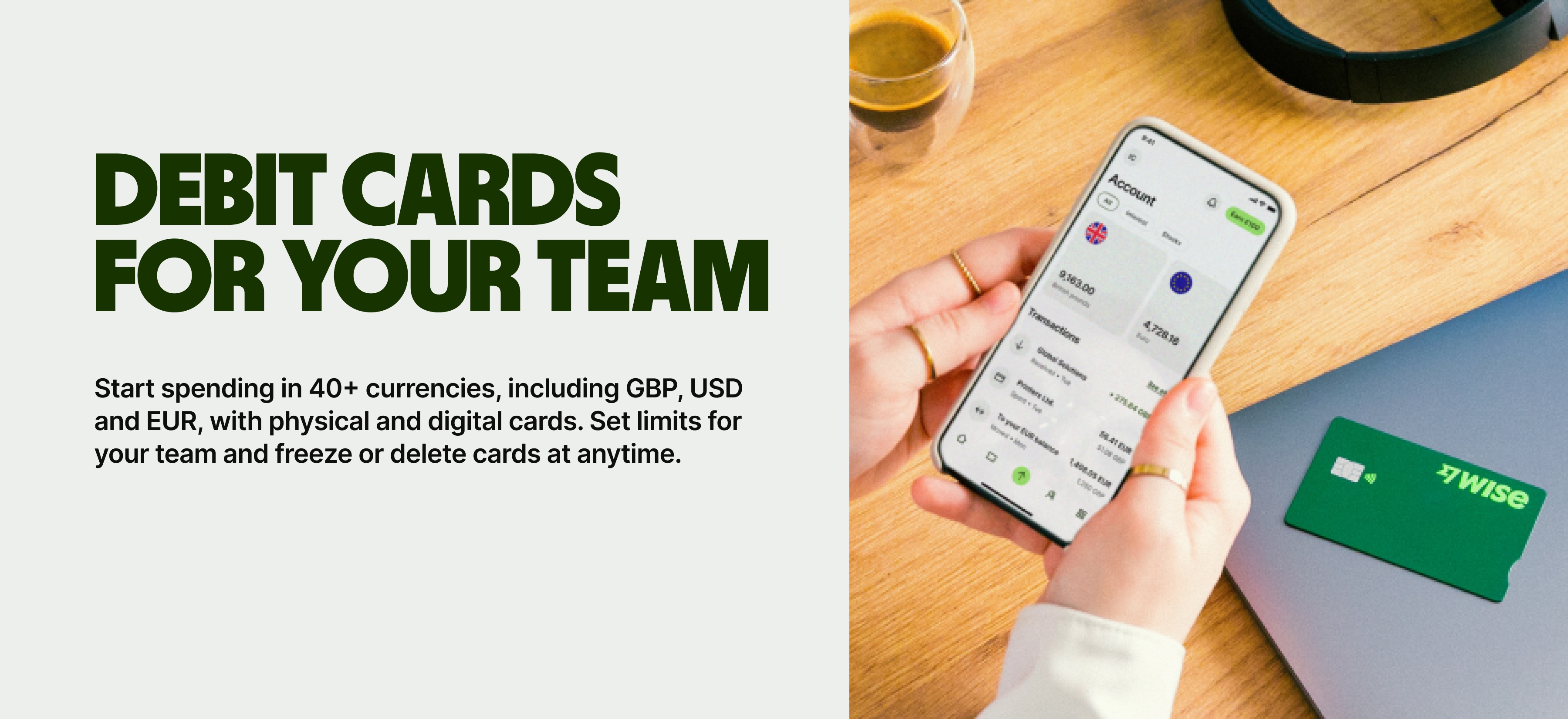

| 💡Need to manage your team’s expenses more efficiently? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly. |

|---|

➡️Get your Wise Business Card today

If you’ve ever chased receipts or waited weeks for reimbursements, you already know the limits of a manual expense claim process; spreadsheets and email chains might work for a few claims, but they don’t scale.

That’s where expense claim software makes a difference. Designed to automate repetitive tasks, it helps Singapore businesses track, approve, and reimburse expenses faster without the paperwork headache.

When paired with the Wise Business Card, it becomes even more powerful.

Employees can pay directly for approved expenses, and every transaction flows into your expense claim system automatically — no manual data entry, no waiting for reimbursements.

| Feature | Manual process | Expense claim software |

|---|---|---|

| Receipt capture | Paper or emailed receipts submitted later | Snap photos or upload directly from mobile |

| Policy checks | Approvers check manually | Auto-flags missing info or overspend |

| Approval routing | Email threads or printed forms | Instant digital approval with audit trail |

| Expense visibility | Seen only at the month-end | Real-time dashboard and spending limits |

| Accounting sync | Requires manual data entry | Integrates with Xero or QuickBooks |

| Reimbursement speed | Weeks after submission | Days after approval |

Here’s how a modern setup looks in practice:

The result? Faster reimbursements, fewer manual claims, and better visibility across teams and currencies.

With Wise Business Card, companies can also avoid foreign transaction fees and always convert currencies at the mid-market rate with a low, transparent conversion fee starting from 0.26%¹ — ideal for Singapore SMEs handling regional transactions.

| How anyIP uses Wise Business Cards to manage team spend |

|---|

| anyIP, a proxy infrastructure company scaling across borders, issued Wise Business Cards to every employee and synced transactions to its accounting stack, gaining real-time visibility and cutting reconciliation time by nearly half, making cross-border spend easier to track and control.➡️Dive into how AnyIP streamlined expense claims with Wise Business here. |

Mastering expense claims doesn't need to be complicated.

It’s about building a simple, reliable system that keeps everyone accountable. When the process is smooth, employees get reimbursed faster, finance teams close books with less stress, and management sees where money’s going in real time.

Digital tools make that easy. An expense claim system or expense claim software Singapore businesses can rely on captures receipts instantly, enforces policy rules, and syncs directly with accounting tools.

And when those systems connect to the Wise Business Card, you remove most reimbursements entirely. Your team can spend in multiple currencies for ad-hoc business expenses with no foreign transaction fees and transparent conversion at the mid-market rate.

➡️Get started with Wise Business today

Sources:

Sources checked on 14 October 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Thinking of investing in Singapore properties without having to deal with high ABSD? Read this complete guide to buying commercial property in Singapore.

There are two ways to close a company in Singapore: strike off or wind down. This article guides you through both processes.

Discover HubSpot's 2025 pricing plans, compare features across Marketing, Sales, Content, and Service hubs, and learn how to optimise costs with Wise Business.

Discover how much Telegram Business Pricing Plans in Singapore cost and everything you should know before building your business on Telegram.

Looking for a corporate e-learning platform? Discover LinkedIn Learning corporate pricing plans, features, and how they stack up to competitors like Udemy.