Wise Business account requirements in New Zealand

Find out what you need to open a Wise Business account in New Zealand. Check required documents, steps, and how to get started online in minutes.

Looking to bootstrap a business? We’re covering the best free business bank accounts in New Zealand. Most cover more than the bare bones essentials, meaning lean Kiwi start-ups can get started on the cheap.

In this post, we’ll discuss pricing expectations, which businesses benefit most from free accounts, and the top considerations when shopping around. To cap things off, we’ll review a few of the top contenders, too.

| Table of contents |

|---|

Sorry to be the bearer of bad news, but nothing is free in this world, not least in the financial services sector. All business accounts will have you pay one way or another. The question is how much and under what terms.

Some accounts skip monthly fees in favour of a one-off registration fee, saving you stacks of cash over the long term. Others waive monthly fees for a pre-defined period until your business gets off the ground. Whichever you choose, expect charges for staff-assisted services, overdrafts, international transactions, business cards, and more.

Large enterprises tend to prefer premium business accounts for their big business-friendly features. Free business accounts are more popular among small players looking to lower operational costs. Some of the types of businesses that can benefit are:

Here’s what to weigh up when comparing free business accounts in New Zealand.

Read the fine print to determine what fees apply and when. Monthly account fees add up over the years; it doesn’t take long for the one-off payment model to work out cheaper.

While a lengthy fee-free period may look good on paper, consider the costs once the period lapses. Some banks offer enticing introductory offers, but become less competitive when the promo expires. You’ve probably seen mobile phone providers use similar tactics in New Zealand.

Kiwi businesses sending money abroad should factor in international transfer fees. Standard SWIFT transfers entail significant costs, as the sending bank, receiving bank, and intermediary bank slug you with their own separate fees.

As a bank alternative, Wise charges a single transfer fee with transparent pricing and uses the mid-market exchange rate. That could save you money on every international transaction.

If you’re not a fan of paperwork, look for an account with a simple online setup process. Non-residents may struggle to open a New Zealand bank account, as proof of residency and/or citizenship is often required.

Businesses using accounting software may prefer a bank that integrates with their preferred platform. When linked to a business account, accounting programs like Xero or QuickBooks can automate reconciliations, reduce repetitive cross-checks, and provide insightful cash flow reports. That functionality simplifies bookkeeping and reduces headaches at tax time.

You’re strapped for cash now. But how will your business look in 2 or 5 years? Scalability is crucial for any brand that plans to expand. Choose wisely, as it’s a hassle to switch accounts later, as you’ll need to provide suppliers with your new details.

Most New Zealand banks offer loans to help budding young businesses invest and grow. If borrowing is on the agenda, compare interest rates and limits. Most banks will evaluate your credit history and existing relationship before laying down the terms.

Business credit cards can provide a lifeline to escape tricky cash flow conundrums. If you might not pay it off before the interest-free period lapses, a low-interest card can minimise losses. Companies that consistently pay debts on time may find business credit cards with Everyday Rewards or Airport Dollars offer better value.

Low-cost business accounts may not offer the same level of customer support as premium, upper-tier options. Review the details to identify available channels, such as live chat, email, face-to-face meetings, or telephone support.

Availability doesn’t guarantee quality. Consider contacting your preferred bank to evaluate hold times, responsiveness, willingness to assist, and English language skills.

Some businesses, such as market stall merchants and sole-trading tradies, still need to make cash deposits and withdrawals. A bank with numerous nearby ATMs could prove invaluable. Other businesses may want in-person consultations with an industry expert, in which case a bank with a local branch in your area may appeal.

While some fees will always apply, we’ve created a list of business account solutions that might give some direction for cost-conscious customers.

You could argue BNZ Business First Transact1 is the only genuinely free business account in New Zealand. Customers can register for free using the self-service online portal, and there are no monthly account or transaction fees.

Of course, charges apply to staff-assisted services, such as account establishment and amendments, as well as bill and automated payments. You’ll also pay a foreign currency service fee of 2.25% of the withdrawal, and $5.00 per payment when sending New Zealand dollars overseas.2

Overdrafts are available to help resolve cash flow woes. BNZ offers an Overdraft Base Rate margin of 12.00% p.a. and 0.15% per bank month, with a minimum of $5.00.

BNZ has a range of business cards you can link to your Business First Transaction account. Options include the low-interest Business First Lite Visa, flexible Purchasing cards, and an Advantage Visa Business to earn BNZ points with everyday spending.3

Got surplus money lying about? Customers also get a Rapid Saver Account to earn interest on their cash reserves.

The BNZ: Business First Transact is only available to SMBs with an annual turnover of under $5 million. 1

ANZ does things a little differently by appealing to cost-conscious businesses through a fee waiver deal. As part of the ANZ Business Start-up package4, the bank offers 2 years of $0 monthly fees on the ANZ Business Current Account. After the fee-free period lapses, you’ll pay $8.50 per month.5

Business Start-up package customers also enjoy in-depth insights and a consultation with an ANZ specialist. The bank waives the first 2 annual fees on its ANZ Visa Business card. That includes additional cards, so feel free to order one for the whole team.

As it’s a start-up package, eligibility requirements apply. You must have an annual turnover of under $500,000, be less than 2 years in business, or be a new customer, and not have previously held the package.

Signing up online is quick and easy for New Zealand residents. As the country’s largest bank, ANZ has a vast network of ATMs and branches on both islands.

Running a non-profit? You can get exemptions for various fees on the ANZ Business Premium Current Account.5

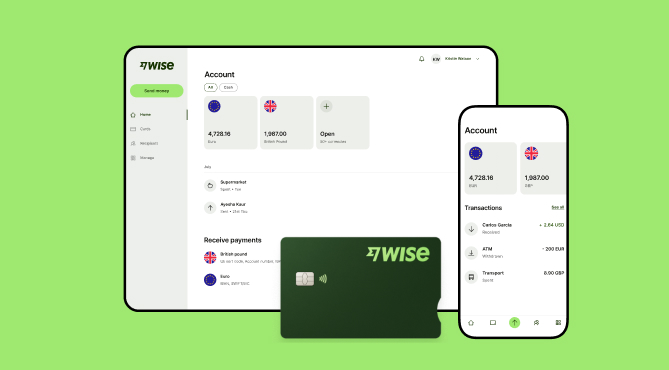

Wise Business really shines for Kiwi businesses that make frequent international transactions. Instead of costly bank transfers through a series of hidden fees, businesses get to make foreign currency transactions at the mid-market exchange rate. Wise Business facilitates cross-border business transactions at low and transparent fees so that businesses know how much their transfers costs.

With Wise Business, the first business debit card is free; however, subsequent cards will cost 10 AUD a pop. Wise Business includes accounting software integration, multi-user access, and batch payments to streamline day-to-day operational chores.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out what you need to open a Wise Business account in New Zealand. Check required documents, steps, and how to get started online in minutes.

Looking for a multi-currency business account for your startup in New Zealand? Read this guide before you apply.

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn who needs a business account, its benefits, how to open a business bank account in NZ, and compare top options for effortless tax and record-keeping.

Wise Business vs Wise Personal: Understand the differences between Wise Business and Personal accounts in New Zealand. More on price and feature comparisons.

Looking to open a business bank account with TSB? We’ve got you covered. Here’s all you need to know about the fees, account types and requirements.