Liquidation meaning in business

From definitions to processes and timeframes, we’re covering what liquidation means to a business in New Zealand.

From separating finances to simplifying taxes, business banking has many benefits. The right services can save you time, money, and admin migraines, plus provide a lifeline to resolve those cash flow woes.

But not every product suits every company. The trick is finding what works for you.

We’re covering the top products and considerations for business banking in New Zealand. We’ll also outline the leading banks for SMBs, agri-businesses, and corporations, as well as Wise Business, an alternative specialising in low-cost international transfers.

| Table of contents |

|---|

It is always best practice to separate business expenses from personal expenses to streamline record-keeping. That is why business accounts are the primary product offering as it allows users to hold, transact, and reinvest money. The importance of a local business account is to have better financial visibility that can make it easier to report and reconcile, especially when filing business taxes in New Zealand.

A speedy cashflow solution is the business credit card, which offers instant access to a line of credit. But as any fiscally responsible Kiwi knows, credit cards have high interest rates if you don’t pay them off in time.

Smart entrepreneurs opt for low-interest-rate credit cards when forecasting cash flow troubles. Businesses with high turnovers might prefer rewards cards to claim points for every dollar spent.

Corporate debit cards are alternate offerings that function as means for businesses to transact with the existing funds they hold in their account. This is especially beneficial when paying for business resources like subscriptions and recurring bills.

Business loans are a longer-term borrowing solution to help small companies grow. You can use this handy cash injection to invest in advertising, infrastructure, technology, talent, or other areas. Of course, you’ll need to pay that money back, so compare interest rates.

Before authorising a loan, you must convince your bank that your business is viable and you can repay the money on time. Documents such as profit and loss statements, cash flow forecasts, and a business plan can help build a case.

Unforeseen events can see your business grind to a halt. To mitigate the risk, you can protect your company through business banking insurance.

Most banks offer customisable plans. Depending on your circumstances, you might choose to insure your assets or protect your business against liability claims. Other insurance products protect against interruptions, income loss, disabilities, cybercrime, and vehicle damage.

Banks can help you establish various payment solutions to help your business grow.

Examples include EFTPOS and POS systems, mobile wallets, POLi bank transfers, PayWay, PayID, and virtual payment terminals. Evaluate the fees, integration requirements, and security.

Many New Zealand banks, especially the Big 4, offer consultations with experts in specific industries. Customers may get limited consultations for free or at reduced rates, depending on their business banking plan. Specialist consultations occur face-to-face at a branch or by phone.

It’s worth doing your due diligence when comparing business banking services.

The Big 4–BNZ, ANZ, Westpac, and ASB–dominate the business banking space in New Zealand. But they’re not the only options. Let’s compare the key players to help you make a more informed decision.

BNZ1 offers business banking solutions for organisations of all sizes.

Its Big Small Business Package specifically targets Kiwi SMBs with tools, services, collaboration spaces, and advice from a local Small Business Partner. Larger businesses receive a dedicated Partner providing tailored advice, as well as access to various industry specialists. Agri-business consultants can help New Zealand farmers maximise returns.

Big corporations, financial institutions, and governments can use BNZ’s institutional banking service. Over 30 specialists consult on complex topics like corporate finance, transactional banking, syndicated loans, sustainable finance, and market research.2

BNZ business banking products include: 1

| 👆Click here to read more on BNZ business account |

|---|

The ANZ HOWTWO Small Business Support Programme helps budding young companies thrive. The programme waives account fees for two years and provides perks like financial insights and an ANZ Business banking specialist check-in.

The bank offers various business credit cards with CashBack, Airpoints™, or Low-Rate options. Its business hub has a solid selection of articles, guides, videos, templates, and webinars.

Kiwi farmers could consider ANZ for its Agribusiness products. Options include a Farm Start-up package, an Agri-Current account, agri-business financing, farm management software, and a consultation with an agri-business specialist. ANZ also offers comprehensive institutional banking services.

ANZ business banking products include: 3

As the New Zealand Government’s bank of choice, Westpac4 specialises in providing All-of-Government banking services, including foreign exchange, cards, and payments. Westpac has been working alongside the Government since 1989,5 and has built a reputation for excellence through large-scale institutional banking.

Corporations and SMBs can also use their business banking services, which range from overdrafts to investments and accounts. Customers can consult with specialists in industries such as:

Socially conscious customers will appreciate that Westpac is New Zealand's first carbon-zero certified bank and has supported the Westpac Rescue Helicopter for over 35 years.4

Westpac business banking products include: 4

| 👆Click here to read more on Westpac business account |

|---|

ASB6 offers business-friendly services, including payment portals, Visa card tracking, Xero and MYOB integrations, and flexible cash flow management solutions.

Its business banking services cater to SMBs, rural, commercial and corporate businesses at three key stages:

As the three-time winner of Canstar's Bank of the Year Digital Banking Award, ASB offers user-friendly online banking services.

The bank runs a range of community-driven initiatives. Examples include the agri-business Smart Solar and Every Hectare Matters programmes, a $500 million programme dedicated to affordable and social housing, and the Te Waka Whaihua team to support Maori communities.7

ASB business banking services include: 6

| 👆Click here to read more on ASB business account |

|---|

Although they hold the highest market share, the Big 4 aren’t the only options worth considering. Kiwibank8 is a smaller, proudly locally-owned competitor with a customer base of 38,000 New Zealand businesses.

As a reliable local lender, Kiwibank has an impressive selection of business borrowing options, including overdrafts, loans, revolving credit loans, asset finance, and property finance.

Upon signing up, the business banking team will help you find the right services, tools, and solutions. A roster of blogs and podcasts keeps customers informed about the latest business trends.

Kiwibank business banking products: 8

| 👆Click here to read more on Kiwibank business account |

|---|

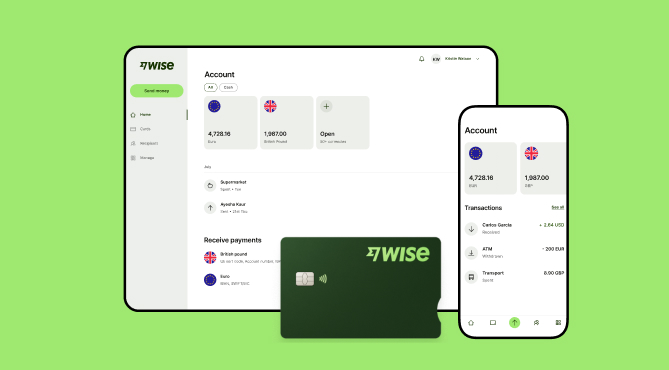

Kiwis who frequently send money across borders may want to consider Wise Business. It is built specifically for sending, receiving, and holding money in multiple currencies.

Wise Business facilitates transactions at the real mid-market exchange rate with a small, transparent fee. It even gives access to local business account details in major currencies like AUD, USD, and EUR. This means you can pay overseas suppliers or get paid by international clients as if you had a local bank account in their country, saving you significant money and hassle.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From definitions to processes and timeframes, we’re covering what liquidation means to a business in New Zealand.

Looking for the best small business insurance in NZ? We’re covering all the essential info, including relevant local providers.

Need to know how to write a business proposal? From proposal types to best practices and structure, we’re covering all the essentials in this post.

Looking for the best small business website builders in New Zealand? We’re covering 7 top options for different needs, as well as the key considerations.

Discover the best CRM software for small business NZ. We explain how CRMs work, features to look for, and 5 budget-friendly tools for Kiwi SMBs.

Keen to compare the best business account interest rates? We’re weighing up the top competitors available in New Zealand today.