Ryt Bank vs GXBank 2026: Which Digital Bank is Best for Your Ringgit?

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Many Malaysians choose to open foreign currency accounts, to save for travel, to pay for overseas bills such as school fees, or to diversify their assets. Whether you need a foreign currency account for saving or for day to day transfers, CIMB¹ has an option for you.

This guide walks through the CIMB foreign currency account plans, features and fees to help you decide if one is right for you. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

You can open either a CIMB foreign currency current account or a CIMB foreign currency fixed deposit account.

A current account allows you to transact freely including sending telegraphic transfers and transfers to a ringgit account. However, there’s no card available for spending and withdrawals and no interest paid on your balance. The fixed term account is a little different in that it offers interest or profit, based on the length of time you’re prepared to leave your balance in the account.

There’s no CIMB multi currency account - these accounts hold one currency each, so you would need to open multiple accounts if you want to have a balance in more than one currency. As a minimum deposit amount may apply, this might not be convenient as it would force you to tie up more of your funds to meet the account eligibility criteria.

You can open a CIMB Foreign Currency Current Account² in any of the following currencies:

- USD

- GBP

- JPY

- AUD

- NZD

- SGD

- CHF

- EUR

- CAD

- HKD

- CNH

- THB

- AED

Your account does not earn interest, but it does allow you to transfer in and out of it easily. This could be useful if you have regular bills to pay in a foreign currency - such as rent or a mortgage on a home overseas. The account does not offer a linked debit card which means this is not really intended for travel use.

CIMB also offers fixed deposit accounts including a conventional³ and an Islamic option⁴. These accounts require you to commit to leave your funds for an agreed term in return for interest or profit. Both account types have a minimum deposit amount of 10,000 MYR or the equivalent in your preferred currency.

The CIMB foreign currency fixed deposit account can support any one of the following currencies:

- USD

- EUR

- GBP

- AUD

- NZD

- SGD

- HKD

- CNH

- CHF

- CAD

- JPY

At the time of writing there’s no interest being paid on balances in CHF and JPY. Customers are advised to consider a different account if they’re interested in one of these currencies. For the conventional account, the term can be anything from 1 day to 12 months, with variable interest rates based on term and currency selected.

The CIMB foreign currency fixed deposit-i account can be opened in the following currencies:

- USD

- EUR

- GBP

- AUD

You can select a term from 1 week to 12 months depending on your preferences.

You can find the CIMB foreign currency rate⁵ on the CIMB website, or in the Clicks app. Make sure you choose the correct rate based on the transaction you intend to make, as the rates are listed by actions such as buying or selling currency to send a telegraphic transfer for example.

The CIMB exchange rate may include a markup. That’s a fee added onto the mid-market exchange rate to calculate the retail rate offered to customers sending a payment or converting an amount for deposit to a foreign currency account.

Markups are very commonly used, but they can make it harder to see exactly what you’re paying for your currency conversion. The only way to check what the markup is, is to compare the CIMB retail rate for your currency against the mid-market rate which you can get from Google or using a currency conversion tool. If there’s a difference, this is likely to be the markup.

There are a couple of different fees you’ll want to know about, depending on the type of CIMB foreign currency account you choose to open. Here’s a roundup.

| Service | CIMB foreign currency current account fees⁶ |

|---|---|

| Maintenance fee | 10 USD every 6 months |

| Transaction fee for debit/credit entries | 2 MYR per entry |

| Statement requests | Monthly statement provided with no additional fee Charges of up to 20 MYR/month for more frequent statements |

| Additional copy of statement from the past year | 10 MYR + 2 MYR/page |

| Additional copy of statement older than 1 year | 30 MYR + 2 MYR/page |

*Correct at time of research - 1st September 2025

| Service | CIMB foreign currency deposit account fees⁷⁸ |

|---|---|

| Maintenance fee | No fee |

| Transaction fee | No fee |

| Withdrawal fee | No fee for direct bank deposits 1 MYR stamp duty for cheque withdrawals |

| Additional copy of statement from the past year | 10 MYR + 2 MYR/page |

| Additional copy of statement older than 1 year | 30 MYR + 2 MYR/page |

*Correct at time of research - 1st September 2025

| 👀 Wondering how different foreign currency accounts compare? Check out our comparison of the best multi currency accounts in Malaysia |

|---|

You can open a CIMB foreign currency account in the CIMB Clicks app once you have an MYR account or other similar product with CIMB. You’ll need to complete the account opening process for your MYR account online or in person and can then add in a foreign currency account of your choice. You may also be able to register for CIMB Clicks if you have different products from CIMB such as a credit card or loan. Check your eligibility to register for Clicks if you’re unsure.

Here’s how to open a CIMB foreign currency current account in Clicks:

The process to open a fixed deposit account is similar. You’ll need to log in to CIMB Clicks and then tap Apply and Invest. Here you can select the option to open a foreign currency fixed deposit account including the currency, tenure and amount you want to deposit.

The only occasion on which this process is not possible is if you’re looking to deposit funds for a 1 day tenure. This account type can only be opened in person by visiting a CIMB branch.

You can open either the foreign currency fixed term account or the foreign currency current account using CIMB Clicks. To register with CIMB Clicks you need to have an existing relationship with CIMB through either holding a current or savings account with the bank, or having a different product from CIMB such as a trust, credit card or loan.

You must be aged 18 or older to open your foreign currency account with CIMB, and joint accounts are also available if you would prefer. Minimum deposit amounts apply depending on the account you select:

If you would like to hold more than one currency with CIMB you will need to open multiple foreign currency accounts - and this minimum deposit amount will apply every time.

Make seamless foreign currency payments and transactions with low fees and the mid-market rate with Wise.

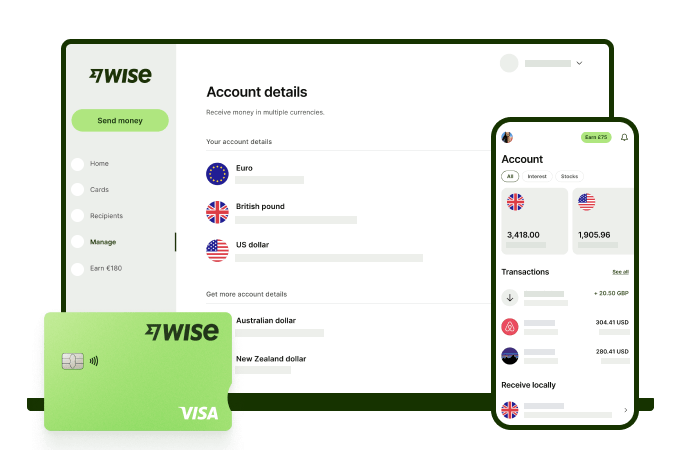

The Wise account is an easy way to hold and exchange 40+ currencies, including MYR, USD, GBP, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.77% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 1,000 MYR when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in MYR and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Get the most out of every ringgit and save more when you use Wise.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A guide on Ryt vs GXBank and which is the best digital bank for 2026. Find out who wins on interest and how Wise can help you no matter which bank you pick.

Is Ryt Bank Malaysia’s best digital bank? Read our 2026 review on Save Pockets, AI bill payments, and the zero-fee Ryt Card.

Compare Wise vs GXBank to stretch your Ringgit. Earn interest with GXBank savings, but use Wise to avoid FX fees.

Learn more about HSBC foreign currency accounts like the Everyday Global and CombiNations account - including requirements, fees, and more.

Learn more about the UOB Foreign Currency Fixed Deposit and Current Account including requirements, fees, and more.

Learn more about the Standard Chartered Foreign Currency Fixed Deposit and Savings Account including requirements, fees, and more.