Opening a business bank account in Australia: Process and documents

Thinking of expanding your business to Australia? Discover if it's possible to open a business bank account down under, right from Ireland.

Irish businesses looking to expand overseas may be drawn to South Africa as an excellent location to start to trade in African markets. If you’re thinking of starting to do business there, opening a business bank account in South Africa makes sense. You’ll be able to receive, hold and send payments in rand more easily, and may be able to cut down on currency conversion costs.

This guide looks at how to open a business bank account in South Africa as a non-resident there with some major banks. And because banks may have restrictions or fees which make them less suitable to Irish businesses, we’ll also touch on other options like Wise Business, which has an account you can use to hold, receive, send and spend ZAR.

Before you decide whether a South African business bank account is right for you, it helps to understand your most common account options. To give an example, let’s look at popular accounts for business from Standard Bank, the largest bank in the region¹:

- Business accounts for startups and small businesses

- Business current accounts for more established companies which have fees based on turnover, and also may offer discounts on additional optional services

- Specialist accounts for trusts and property businesses

- Foreign currency accounts for business, for savings or trade.

You’ll usually find that South African business bank accounts have a monthly fee. This could be a set price based on the account type and feature availability, or it may vary depending on the size of your business.

Yes. It is possible to open a business bank account in South Africa as a non-resident.

There are dedicated business banking services for foreign owned businesses from banks like Standard Bank² and Nedbank³. If you choose to register your business in South Africa, there are then also a much broader range of account options available to you.

To open a business bank account in South Africa it’s very common to need to talk through your application with a member of bank staff before you can complete the process.

This may mean you may need to visit a branch in person, although some banks might be able to support your application remotely by phone, or through an appointed representative or proxy.

You can probably open a business bank account in South Africa for your Irish business but the process may be tricker than you expect, and the account itself is likely to have ongoing fees to pay.

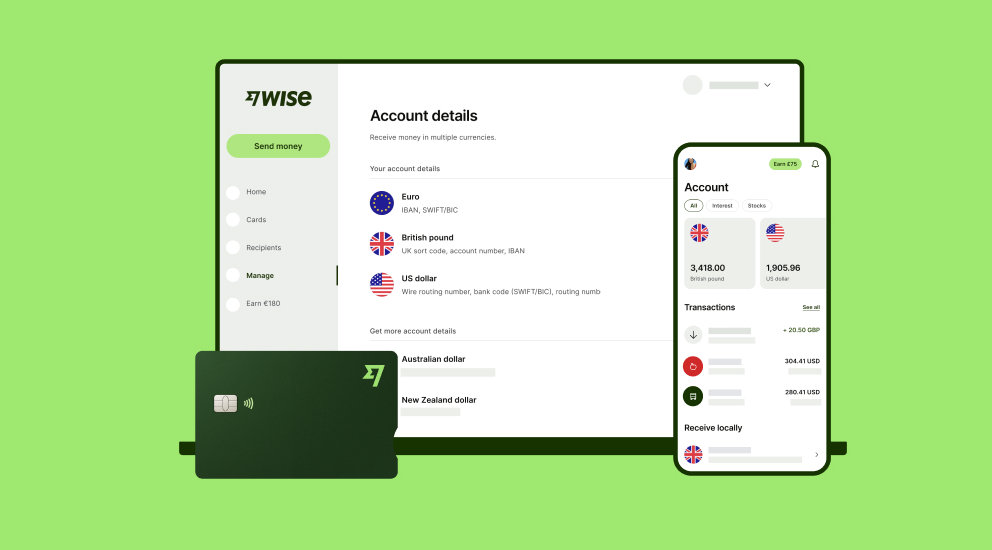

So if you're looking for another option, have a look at Wise Business account, which allows to hold ZAR alongside other currencies like EUR, GBP, USD and more in one single account.

Wise Business lets you open an account in Ireland with your local business documents. You can then receive ZAR payments through SWIFT*, hold a balance in rand, send payments to suppliers, or convert back to EUR. Overall 40+ currencies are supported, making this a great option for Irish businesses.

Access to account details, and the ability to receive payments, are only available with the Wise Business Advanced plan, which you can get for a one-time fee of €60.

Other options which also offer multi-currency business accounts with ZAR support include Revolut Business⁴, which has several different account plans offering ZAR for holding, and to receive with your SWIFT account details. You’ll need to pay a monthly fee which depends on the account you pick, but you can then hold all your different currency balances in the one account easily.

The requirements and documents to open a business bank account in South Africa as a foreign company can vary depending on the bank you choose and your business type.

You may find you need to take documents along in person to a bank branch, so if you’re at all unsure what’s needed it’s best to call ahead of time to make sure you don’t have a wasted trip.

Generally the paperwork requested will include:

- Business Account Application Form - non resident

- ID of owners and signatories

- Proof of address not older than 3 months

- Company registration documents which vary depending on entity type.

If you’re applying through a representative and need to submit documents online or by mail, you’ll usually need to have everything notarised by an accepted signatory. Fees may apply for this service. As an alternative you can sign documents in the presence of a member of the bank team, which usually means a notary isn’t needed.

South African banks might be able to offer you an account for your Irish business, but it’ll probably come with maintenance fees and might be trickier than you expect to open.

For many business owners, holding ZAR alongside EUR and other currencies is a more flexible alternative and a smart solution offered by Wise Business.

Open a Wise Business account via website or in app, to receive ZAR payments through the SWIFT network, hold a balance in rand, and then use it to pay suppliers or contractors.

Whenever you need to switch from one of Wise’s 40+ supported currencies to another, you get the mid-market exchange rate with low, transparent costs and no hidden fees. That means you get a great deal whenever you send a payment, convert in your account, or spend with your Wise debit card.

The Wise Business Essentials plan is free to open and covers core needs like sending money, ordering debit cards, and using accounting integrations.

For companies that need to receive local or foreign payments, the Advanced plan (one-time fee of €60) is a great option, as it provides local account details in 8+ currencies.

Check the Wise website for the latest pricing.

Disclaimer: The Wise Business pricing structure is changing with effect from 02/02/2026. Receiving money, direct debits and getting paid features are not available with the Essential Plan, which you can open for free. Pay a one-time set up fee of €60 to unlock Advanced features including account details to receive payments in +20 currencies. You’ll also get access to invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check Wise website for the latest pricing information.

Sources used:

Sources last checked on date: 29th August, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of expanding your business to Australia? Discover if it's possible to open a business bank account down under, right from Ireland.

Expanding to Singapore? Discover straightforward options for opening a business bank account there, right from Ireland.

Navigate the process of opening a business bank account in Dubai. We'll show you how to make it simple and stress-free.

If you're looking to open a business bank account in Switzerland, you've come to the right place. Read all you need to know.

Are you doing business in the United States from Ireland? Let's look at the requirements for opening a business bank account in the country.

Is it possible to open a business bank account in the UK as a non-resident? Read all about it in this article.