Gusto and Wise Platform: Empowering US SMEs through fast, transparent global payments

Gusto on the U.S. SME market and how payments are economically empowering customers.

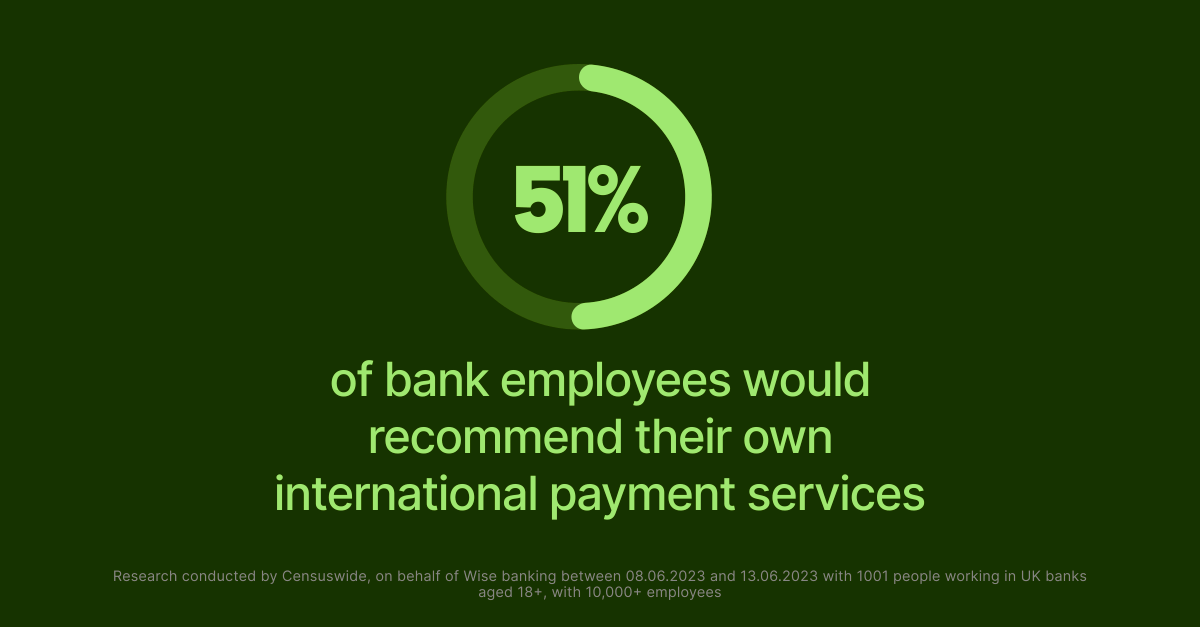

A recent Censuswide survey, commissioned by Wise, finds that barely half of bank employees would recommend their respective institutions' international payments services

A recent survey commissioned by Wise has revealed that only 51% of employees at the UK's top banks would recommend their respective institutions' international payments services. These findings serve as a wake-up call for traditional banks to prioritise improving their international payments offerings in the years to come, or risk losing out to more specialised cross-border payment firms.

The research set out to understand whether banks’ employees are bought into their own international payment products. As it turns out, many struggle to stand by what they’re selling. Barely half believe that the fees they charge to customers sending money abroad are fair, with 19% of respondents explicitly stating that they are not proud of their international payments services.¹ A further 32% admit that although they have recommended their bank’s services in the past, they would not do so again.

On top of the lack of confidence bank employees have in recommending their products to others, the survey revealed an even greater lack of confidence in using their own products themselves; 62% of respondents claimed that they would consider using a fintech’s card abroad this summer in favour of their own bank’s.²

| Steve Naudé, Head of Wise Platform, said: | |

|---|---|

|

At Wise, we have spent over a decade building the best way to move and manage money internationally. Over 16 million personal and business customers have chosen us - often over their own bank - to serve their international payment needs. But we don’t necessarily believe that the best way for customers to send money internationally is via the Wise app - it’s within their existing bank or financial institution’s platform. We want to give banks their customers back - and help them restore their own employees’ trust in the cross-border services they provide.

That’s why we built Wise Platform, Wise’s infrastructure solution for financial institutions and major enterprises. Wise Platform partners with over 70 banks and enterprises worldwide, including Bank Mandiri, IndusInd Bank, Monzo and Google Pay to bring faster, cheaper international payments to millions of bank customers directly within their existing app.

Find out more about how Wise Platform can transform your bank or business’ international payments services today.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Gusto on the U.S. SME market and how payments are economically empowering customers.

Fast, convenient remittances to the Philippines just became more accessible to financial institutions, businesses and their customers around the world. That’s...

Discover why half of American small-mid sized enterprises see cross-border payments as a hurdle to global expansion, and why partnership holds the key.

Discover why Raiffeisen Bank International partnered with Wise Platform to deliver seamless international payments across Central and Eastern Europe.

Discover how Nubank, Mox and Bank Mandiri are leveraging resilient global payments infrastructure to deliver exceptional customer experiences.

See how leading Nordic bank Lunar built a cross-border payments offering around what Nordic customers actually wanted.