The importance of cash reserves for startups and how to plan ahead

How much cash reserve does a startup really need? Learn how to save effectively and ensure your future is protected.

Managing expenses can be complex and time-consuming, especially when businesses are using traditional payment methods like company credit or debit cards. The volume of transactions and the documents required to track these expenses can make the reconciliation process cumbersome.

Corporate purchase or procurement cards, known as ‘P-cards’, can make it easier. They can help to simplify the approval process and enable your company to manage expenses in a more efficient way.

In this helpful guide for UK businesses, we’ll explain how P-cards work, the benefits of using them and how to choose cards for your business. We’ll also touch on the differences between P-cards and other expense cards, and best practices for setting up a P-card programme.

And while you’re looking for better ways to manage expenses, check out Wise Business. Open an account and you can get debit cards and employee expenses cards for low-cost spending in multiple currencies.

💡 Learn more about Wise Business

A P-card is a particular kind of business debit card. It’s designed to let employees make business purchases without needing to go through the usual purchase request and approval process - or having to use their own personal card and request reimbursement.

The business issues each person who needs one with a P-card, and sets spending limits and policies for what the card can be used for. Then the employee can simply spend directly with the card, both online and in-person.

P-cards are most commonly used for the following purchases and expenses:

Using purchase cards can make managing employee expenses quicker, easier and much more straightforward for all parties - especially compared to long-winded purchase approval processes.

Some of the main P-card benefits include:

You might think that a P-card is just the same as a corporate credit card, but there are actually quite a few differences. Let’s take a look:¹

| Features | P-card | Corporate card |

|---|---|---|

| Spending controls | Extensive - including spend limits and vendor/category restrictions | Limited |

| Approval processes | No complex or written approvals required - pre-approval is set with limits and restrictions | Can be complex, requiring written approval |

| Tracking and monitoring | Real-time monitoring, with records automatically updated | Manual tracking, low visibility of individual transactions |

| Expense reporting | Automated and detailed | Manual reports, with the requirement to match records with receipts |

There are quite a few providers of P-cards available in the UK, from banks to fintech companies. But what should you be looking for when choosing the right option for your business? Here are some key factors to consider:

The most important part of effectively implementing and managing a P-card program is the spending policy that underpins it. You need to decide on specific role-based spending limits, restricted and approved vendors and categories, and a number of other details that will determine how your P-cards are used.

You’ll then need to find a system and a P-card provider which enables you to enforce these policies and set strong controls. It’s best to automate the process wherever you can, to save valuable admin time.

Another important step is to communicate clearly with your team, ensuring that the rules and conditions of your P-card program are easy to understand.

Ongoing management, auditing and review is also crucial, to ensure your cards are not being misused and that the program is running as it should.

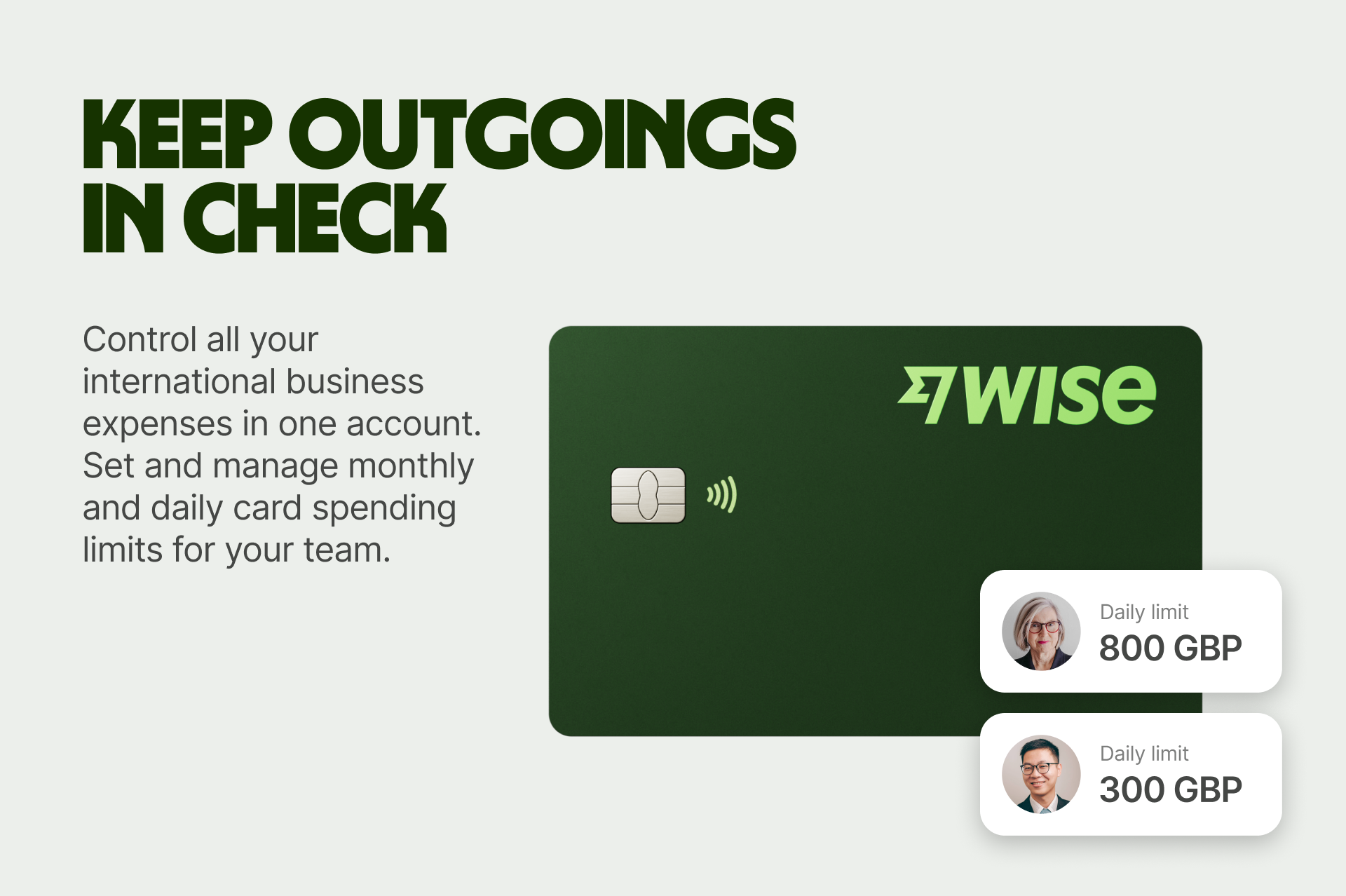

If your business operates internationally and your employees are regularly spending time abroad for work, Wise Business debit cards could be the ideal solution.

These contactless international debit cards work for spending and cash withdrawals in 150+ countries worldwide, with no foreign transaction fees or subscription fees.

Whenever someone spends or withdraws cash overseas, the currency is converted at the mid-market exchange rate, with just a small conversion fee to pay.

There’s also 0.5% cashback paid on all eligible spending.

Once you have a Wise Business account, you can order unlimited expense cards for just a one-off fee of £3 a card. You can add employees to your account, with controlled access - and you get full control over spending their limits.

What’s more, it’s easy to integrate Wise with your accounting tools, and your accountant can view team spending for smarter collaboration.

Get started with Wise Business 🚀

Controls for P-cards usually include the following:

Real-time monitoring is another crucial part of P-card program controls.

The use of P-cards can streamline the expense reporting process, by automatically capturing transaction data. It also reduces the need for manual data entry, which in turn can improve the accuracy of financial records by eliminating or reducing the risk of human error.

It depends on the card and provider, as well as the company’s spending policies. But generally speaking, corporate P-cards can be used internationally - although foreign transaction fees and currency conversion costs may apply.

Yes, P-cards are just as secure as other types of corporate debit or credit card, with providers using advanced security technology and tools. In many cases, cards can be instantly frozen or cancelled - a useful feature if lost or stolen. They also offer real-time monitoring of transactions by the company, which can help to spot unusual spending patterns early.

After reading this, you should have a better idea of what P-cards are, how they work and the benefits they offer. We’ve also looked at how to choose a P-card provider for your company, and how to implement your own P-card program.

So, you should now be all set to start using P-cards to simplify and streamline expense management within your business.

Sources used:

Sources last checked on date: 22-Jul-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

How much cash reserve does a startup really need? Learn how to save effectively and ensure your future is protected.

Over the past two decades, Estonia has developed a reputation for cultivating successful startups. So much so that the country now holds the title for the...

Find out how you can diversify revenue streams as a UK startup, from launching new products and subscriptions to monetising your expertise.

Discover proven steps to take to get clients as a freelance web developer. Our guide explains how to target clients, making a compelling sales pitch, and more.

Discover how to get clients as a freelance copywriter in the UK and start saving on unnecessary conversion fees with Wise Business.

An IPO can unlock millions in funding, but it's not simple or cheap. Here's what happens when a private company goes public on the London Stock Exchange.