The importance of cash reserves for startups and how to plan ahead

How much cash reserve does a startup really need? Learn how to save effectively and ensure your future is protected.

Planning to implement a subscription pricing model for your UK business? One of the first things you’ll need to do is choose a payment gateway.

This is the platform that will process recurring payments from your customers each week, month or year. You will also use it to manage subscriptions, as well as potentially providing customers with a self-service model to amend or cancel subscriptions.

In this helpful guide, we’ll cover everything you need to know about subscription payment processing services in the UK. This includes how they work, benefits, a list of popular providers and much more.

And while you’re looking into cost-effective ways of getting paid by your customers, make sure to check out Wise Business. It’s the ideal solution for receiving international payments from gateway providers like Stripe, without losing out to high fees and currency conversion costs.

💡 Learn more about Wise Business

A payment gateway is a platform or service which processes payments on behalf of businesses. A subscription payment gateway is just the same, but with the ability to automate recurring payments according to a pre-set schedule.

An example of this in action is a fitness company offering gym memberships. The customer signs up for a gym membership, which includes an agreement to sign up for automatic billing. The fitness company uses a payment gateway to automate the collection of monthly payments, which are automatically taken from the customer’s bank account or debit card.

The subscription model is also commonly used by utility and telecommunications companies, entertainment streaming platforms, insurance companies, Software-as-a-service (SaaS) providers and magazine subscriptions.

It can even be used for fruit/veg box or meal delivery services, beauty businesses, gaming platforms and much more.

Subscription payment gateways are typically paired with a billing service, if not already included in the platform. When used together, these services automate every step related to the capture, collection and processing of recurring payments.

This includes the following steps:

As you get started implementing your new subscription model, here are some best practice tips to bear in mind:

There are a few different types of billing models commonly used for subscription payments. This includes:

Now, let’s take a look at some of the UK’s most popular payment gateways which support subscription billing:

| Provider | Costs | Key features |

|---|---|---|

| Braintree | - No monthly fees - 1.9% + £0.20 per transaction¹ | - Customised user interface - Account Updater tool - Wide choice of payment methods |

| Chargebee | - Plans from £0 to £499 a month - Payment fees vary by payment processor² | - Billing - Managing subscriptions and invoicing at scale - Receivables tools - Wide choice of payment methods |

| Stripe | - No monthly fees - Payment fees from 1.5% + £0.20 per transaction - Billing add-on from £450/month or 0.7% PAYG³ | - Stripe Billing for full subscription management - Payment links - Wide choice of payment methods |

| GoCardless | - No monthly fees - Payment fees from 1% + £0.20 per transaction⁴ | - International payments - Support for direct bank payments via Open Banking - Wide choice of payment methods |

| Worldpay | - £19.95 a month - 1.5% per card transaction⁵ | - eCommerce and Payment Gateway solutions - Real-time insights via WorldPay Dashboard - Wide choice of payment methods |

The subscription payments model can offer many benefits to both your business and its customers. These include:

Now, how do you get started with implementing a subscription payment gateway? Here’s a step-by-step look at what to do first:

All of the payment gateways we’ve covered in this guide are suitable for subscriptions. So you’ll need to choose the right fit for your business model and needs, comparing key features, cost, user-friendliness and other factors that are important to you.

Yes, Stripe supports subscription payments through Stripe Billing. This is an add-on to the processor’s core service, which offers features specifically for subscription billing models and has monthly or pay as you go fees.

Entertainment streaming services such as Netflix, Apple TV+, Amazon Prime Video or Disney+ offer the perfect examples of subscription services in action.

The customer signs up for recurring billing directly with the streaming service, and subscription payments for a set amount are automatically taken from the bank account or card on the customer account each month.

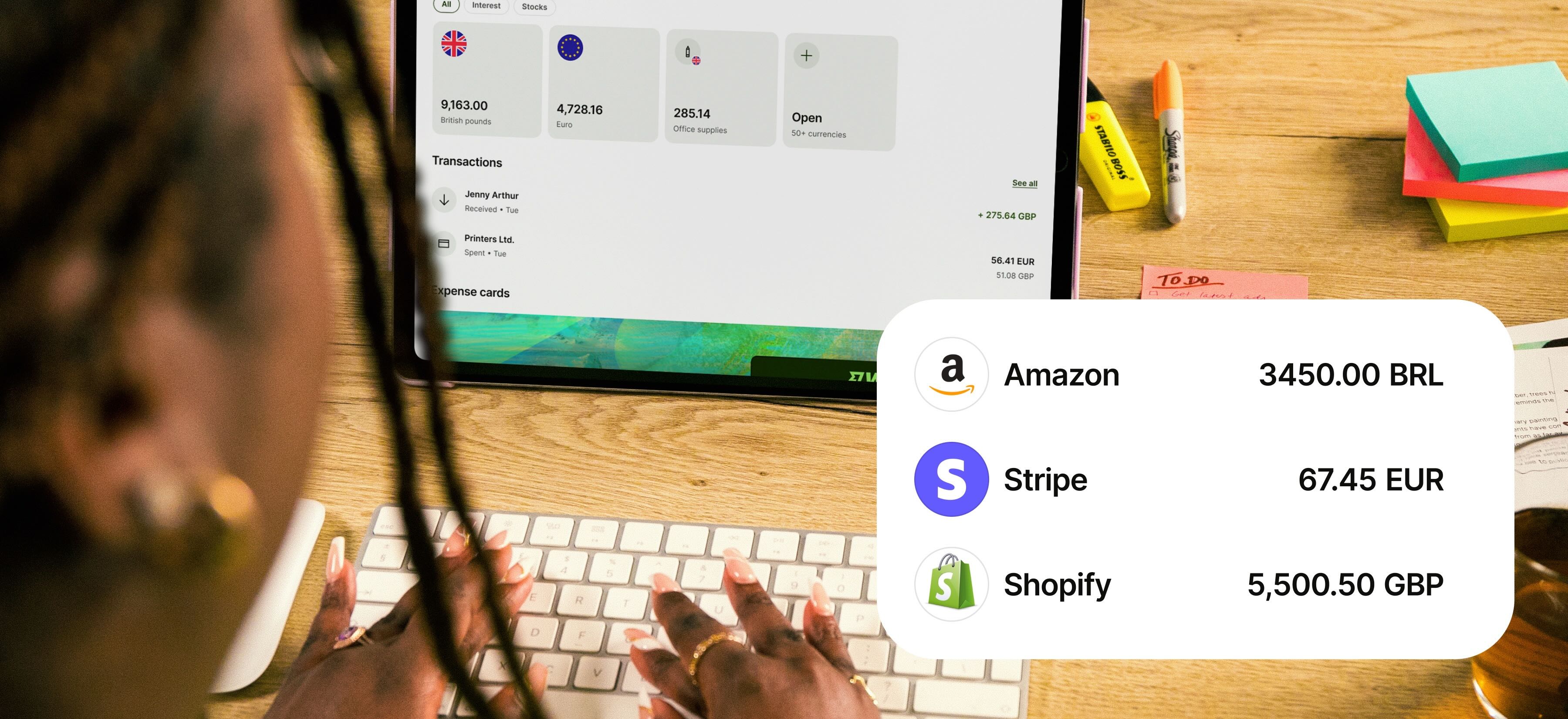

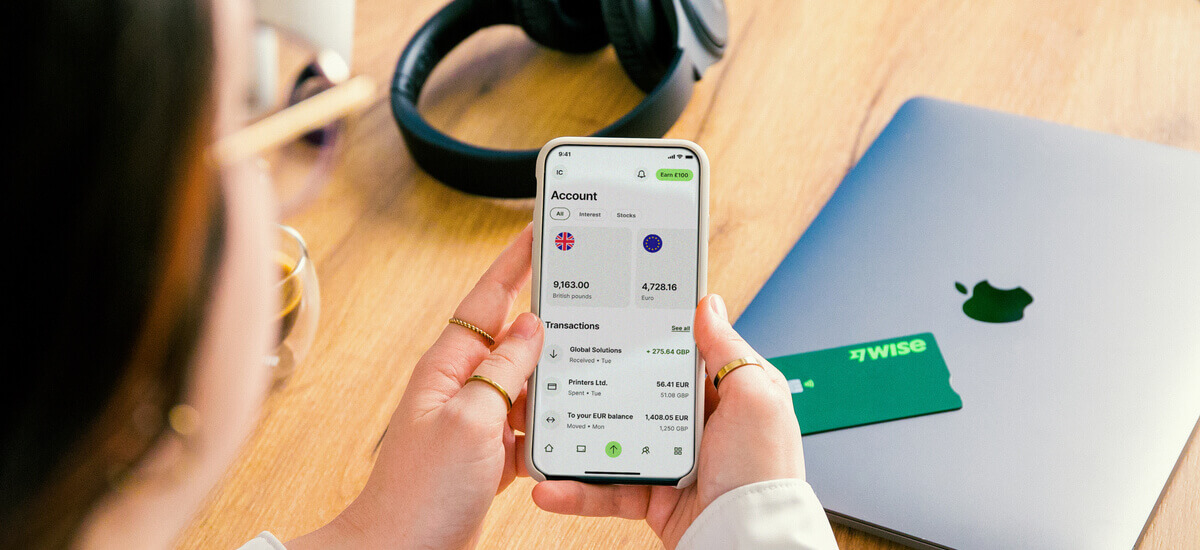

Wise can help UK businesses to receive payments in multiple currencies, with low fees and the mid-market exchange rate.

A Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds, these payments can come directly from your customers, from PSPs like Stripe and Amazon, or from platforms like Chargebee.

All you need to do is add the relevant currency account details to the platform you need to withdraw the funds. Once you receive the payment in Euros, Dollars or other supported currencies, you can hold this money into your multi-currency account, send with Wise Business debit card or convert back to Pounds with low fees and the mid-market exchange rate.

Get started with Wise Business 🚀

After reading this guide, you should be all set to choose and implement a subscription payment gateway.

We’ve given you a list of popular UK payment processing providers, all of which support subscription billing. And we’ve looked at how to get set up, the benefits of subscription payments and a few best practice tips too.

All that’s left to do is pick the right payment gateway for your business and its customers.

Sources used:

Sources last checked on date: 30-Oct-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

How much cash reserve does a startup really need? Learn how to save effectively and ensure your future is protected.

Over the past two decades, Estonia has developed a reputation for cultivating successful startups. So much so that the country now holds the title for the...

Gusto on the SME market and how payments are economically empowering businesses - and people - around the globe.

Find out how you can diversify revenue streams as a UK startup, from launching new products and subscriptions to monetising your expertise.

Discover proven steps to take to get clients as a freelance web developer. Our guide explains how to target clients, making a compelling sales pitch, and more.

Discover how to get clients as a freelance copywriter in the UK and start saving on unnecessary conversion fees with Wise Business.