The importance of cash reserves for startups and how to plan ahead

How much cash reserve does a startup really need? Learn how to save effectively and ensure your future is protected.

Considering using Payoneer for your business? When signing up for a new business account or financial service, you’ll want to know about all of the features on offer.

One popular Payoneer feature among UK businesses is Capital Advance. This is a working capital solution that gives you an advance on upcoming marketplace earnings.

But how does it work, how much does it cost and is it right for your company? Find out everything you need to know here in our essential Payoneer Capital Advance Review.

Coming soon: Ecommerce payments

Use Wise to accept payments on your website.

Register now

Payoneer Capital Advance is a working capital solution available to ecommerce sellers who have a Payoneer account and use the platform to get paid.

It gives you an advance (essentially, a loan) based on projected future marketplace sales and earnings.

The types of businesses that make use of Payoneer Capital Advance are ecommerce sellers making use of marketplaces such as Amazon and eBay. It’s also useful for some small and medium-sized businesses (SMEs) such as marketing agencies, along with freelancers and travel hosts.

There are three different kinds of Capital Advance products available with Payoneer:¹

You can’t apply for Payoneer Capital Advance - you need to start accepting payments with the platform and wait for Payoneer to send you an offer. As you accept and settle offers, you may then be offered higher levels of Capital Advance such as Grow and Plus.

Once you’ve been accepting payments through Payoneer for a while, you may be sent a Capital Advance offer.

The amount of working capital you’ll be offered is calculated using the historical sales performance of your marketplace stores, such as Amazon for example. Predicted future sales figures will also be factored in.

When you accept a Payoneer Capital Advance offer, the funds are provided to you right away.

At this stage, Payoneer buys a part of your future account receivables, equivalent to the amount provided by Capital Advance plus a fixed fee.

You’ll then repay this advance gradually, until the full settlement amount has been collected.

So, why use Payoneer Capital Advance? It offers a few advantages to certain types of business, such as:¹

However, along with the benefits, it’s also important to consider the potential downsides of using Capital Advance.

One of these is shrinking working capital later, as you start to make repayments. You’ll get access to funds which can ease cashflow issues right now, but you need to make sure your business won’t suffer from reduced marketplace revenue in the weeks and months to come.

Eligibility for Payoneer Capital Advance will depend on your stores' payment history and how long you’ve been accepting payments via Payoneer.

But there are also eligibility criteria focused on your marketplace store. Here are the requirements for businesses selling on Amazon:²

You can’t apply directly for Payoneer Capital Advance, as it doesn’t quite work that way. Instead, you’ll need to start using the platform to accept payments for ecommerce activity and wait for Payoneer to contact you with a Capital Advance offer.

Here’s what to do to give yourself the best possible chance of receiving an offer quickly:³

If you’re sent an offer by Payoneer Capital Advance and you accept, you should receive the advance in your Payoneer account instantly. However, it can take a few minutes for the funds to arrive.³

The most you’ll be offered through Payoneer Capital Advance is 140% of your marketplace store’s monthly volume.

This is capped at a maximum amount of $750,000 USD (approx. £560,260 in GBP).¹

It’s important to note that you can also choose the amount of Capital Advance you’d like - you don’t have to accept the maximum figure offered.

Now we come to the really important question - how much does it cost to use Payoneer Capital Advance?

The good news is that there’s just one fixed fee. This varies depending on the specific offer you’re sent by Payoneer, and the fee will be clearly shown on the offer details page.¹

You don’t need to pay this upfront either, as the fixed fee will be added to the total settlement amount. This means you pay it back as part of the collection percentage that Payoneer takes from each future marketplace payment.

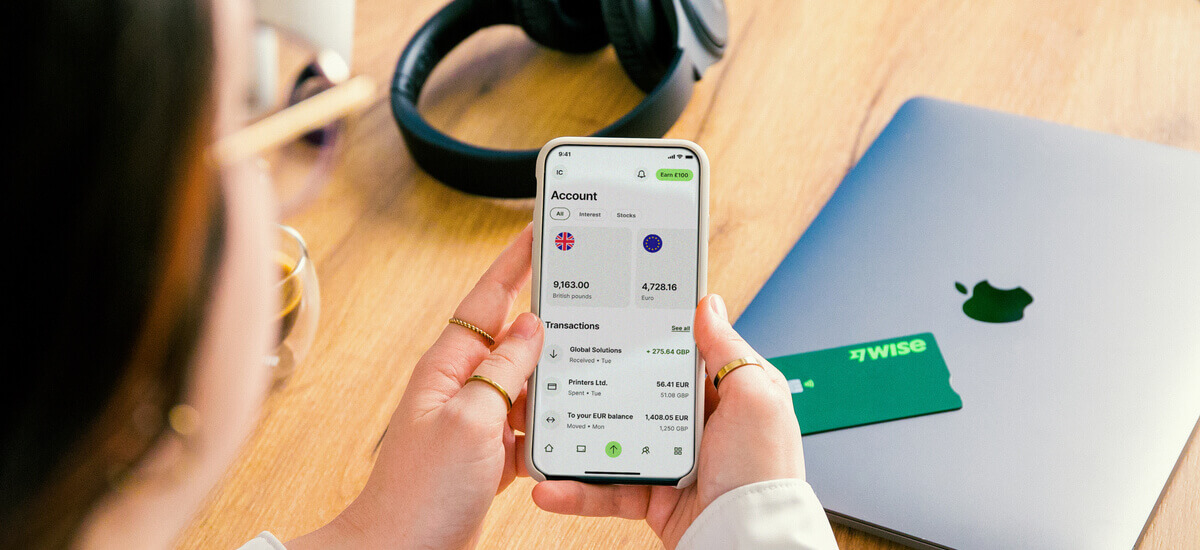

Wise Business can help UK businesses, freelancers and sole traders to manage finances across multiple currencies, with low fees and the mid-market exchange rate.

When you open a Wise Business account, you’ll benefit from all of these useful features:

Get started with Wise Business 🚀

And that’s it - our essential Payoneer Capital Advance review, covering everything you need to know. We’ve looked at how Capital Advance works, why you might want to use it and how to access it. Plus, key info on fees, payout times, maximum amounts and much more.

You should now be able to decide if it’s right for your business. If so, simply start accepting marketplace payments with Payoneer and wait for those Capital Advance offers to start coming in.

Sources used:

Sources last checked on date: 13-May-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

How much cash reserve does a startup really need? Learn how to save effectively and ensure your future is protected.

Over the past two decades, Estonia has developed a reputation for cultivating successful startups. So much so that the country now holds the title for the...

Gusto on the SME market and how payments are economically empowering businesses - and people - around the globe.

Find out how you can diversify revenue streams as a UK startup, from launching new products and subscriptions to monetising your expertise.

Discover proven steps to take to get clients as a freelance web developer. Our guide explains how to target clients, making a compelling sales pitch, and more.

Discover how to get clients as a freelance copywriter in the UK and start saving on unnecessary conversion fees with Wise Business.