Best joint business bank accounts in the UK

Looking for the best joint business accounts in the UK? We compare features, fees and best usage to help you find the ideal shared account.

If you’re just starting out on your entrepreneurial journey, you’ll need smart ways to manage your money. This probably means you’re looking for the best bank account for small businesses, with features and tools that meet your needs. individual needs.

We’re here to help, with a rundown of the best small business bank accounts available in the UK right now.

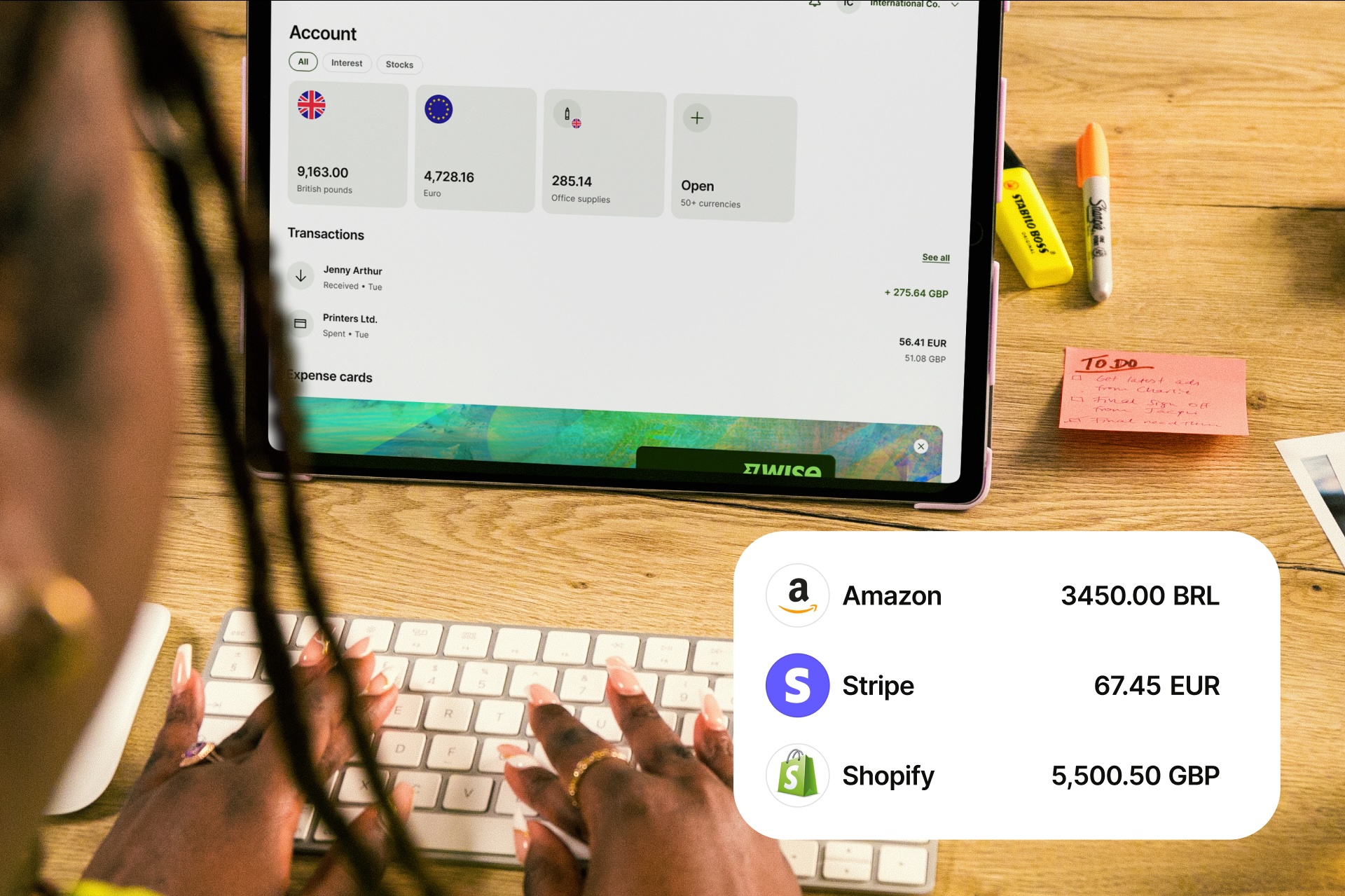

We’ll also touch on some non-banking alternatives like Wise Business, which offers multi-currency accounts with no monthly fees and ways to get paid in foreign currencies conveniently.

Get started with Wise Business 🚀

Whether or not you’re obliged to get an account dedicated for business use will depend on the type of business entity you have. Generally, if you have a UK business registered at Companies House, you’ll need a specific business account to keep your finances in order.

Even if you’re not legally required to have a business account, it’s still a good idea to separate personal and business finances. It helps you manage your business funds, pay your taxes and keep an eye on your cash flow and profit.

There’s no single best business account for small business. The right one for you will depend on the features you need and what type and volume of transactions your business typically carries out.

Many accounts offer ways to receive customer payments, add linked payment cards or access interest earning features. And some, like Wise Business, also offer impressive international payment facilities.

Comparing a few different options is the best way to find the right one for your company. Here are the banks and non-bank alternative providers we'll review below:

- Tide

- Cashplus - Now Zempler Bank

- Revolut Business

- Wise Business

- ANNA Money

- Starling Bank

- CountingUp

We’ll start with an overview of some important features - the rating providers get on Trustpilot, which is a handy measure of customer satisfaction, and the ongoing costs.

| Bank/Provider | Trustpilot score | Monthly fee |

|---|---|---|

| Tide | 3.9 - 'Great' (24,960+ reviews)1 | £0 - £69.99 /month depending on plan |

| Cashplus/Zempler Bank | 'Great' (12,870+ reviews)2 | £0 - £19 /month depending on plan |

| Revolut Business | 4.5 - ‘Excellent’ (220,510+ reviews)3 | £10 - £90 /month depending on plan10 |

| Wise Business | 4.3 - ‘Excellent’ (261,890+ reviews)4 | None |

| ANNA Money | 4.2 - ‘Great’ (3,830+ reviews)5 | £0 - £49.90 /month depending on plan11 |

| Starling | 4.2 - ‘Great’ (44,370+ reviews)6 | None12 |

| CountingUp | 4 - ‘Great’ (2,960+ reviews)7 | £3 - £18 /month depending on plan13 |

We’ve picked these providers based on the following:

- Eligibility

- Features and services

- Fees

Each is different, so use this guide to narrow down your choices and then do some of your own research to pick the perfect one for you.

Tide business banking has accounts for businesses and sole traders. To apply for a small business account with Tide you’ll need to have a business registered in the UK with Companies House, and comply with Tide’s acceptable use policies. You must also be aged 18 or above, and have a valid UK phone number to apply8.

Tide business accounts offer 4 different tiers to suit different customer needs, from the Free account for new businesses looking for a pay as you go experience, along with three increasingly more comprehensive accounts for established businesses with complex needs.

Once you have a Tide account, you can use it for business invoicing, and get accounting integrations, linked debit and expense cards. There's also the option to open a business savings account.

Here’s a summary of the key Tide business fees to know about8:

| Free | Smart | Pro | Max | |

|---|---|---|---|---|

| Monthly fee | None | £12.49+VAT | £24.99+VAT | £69.99+VAT |

| Expense cards | £5 /month | 1 free card included, then £5 /month | 2 free cards included, then £5 /month | 3 free cards included, then £5 /month |

| Transfer in and out | £0.20 | 25/month free, then £0.20 | Free | Free |

| ATM withdrawals | £1 | £1 | £1 | £1 |

Cashplus, which now goes under its new name of Zempler Bank, offers 3 different account types to eligible UK customers. To apply you must be a senior director of a UK based business which is registered with Companies House, and which is in one of the Zempler Bank supported industries9.

Zempler Bank business account types are: the Business Go account which has no monthly fee, and the Business Extra account which has a monthly fee but offers some extras, including some free transactions and some cashback on card spending. Card usage also has different fees depending on which account you pick, with some fees waived for the Extra customer.

Zempler Bank business account types are:⁹

- Business Go - a basic account with no monthly fee

- Business Extra - this has a monthly fee of £9 but offers some extras, including some free transactions and some cashback on card spending.

- Business Pro - designed for larger businesses with more complex needs, this account has a monthly fee of £19 but has more features, more free transactions and higher limits than other plans.

Here’s a quick look at some key Zempler/Cashplus fees to know about14:

| Business Go | Business Extra | Business Pro | |

|---|---|---|---|

| Monthly fee | £0 | £9 | £19 |

| Card fee | £9.95 /each | No fee | No fee |

| ATM use | £2 locally, £3 internationally | No fee | No fee |

| Foreign transaction fee | 2.99% | No fee | No fee |

| International payments10 | Fees vary for outgoing international payments Incoming payments: Up to £22 | Fees vary for outgoing international payments Incoming payments: Up to £22 | Fees vary for outgoing international payments Incoming payments: Up to £22 |

Revolut Business accounts are available to customers who have legal residence in the UK, Switzerland or EEA, with a registered and active company in a country supported by Revolut - including the UK10.

You can choose from 4 different plan options, including a basic account with no monthly fee, and several accounts with ongoing costs. All options have linked debit cards and can hold and exchange 25+ currencies, with limited fee-free weekday currency conversion which uses the Revolut rate with no extra fees. Plans with monthly fees unlock more features like no fee transfers, interest on your balance, and preferential customer service options, and higher no fee transaction limits.

Here’s a quick list of some of the key fees for the Revolut account.10 Other costs may apply depending on how you use your account.

| Basic | Grow | Scale | Enterprise | |

|---|---|---|---|---|

| Monthly fee | £10 | From £30 | From £90 | Custom |

| Card option | Plastic and virtual cards | 1 Metal card, plus plastic and virtual cards | 2 Metal cards, plus plastic and virtual cards | Custom options |

| No fee weekday currency conversion | £1,000 /month | £16,000 /month | £60,000 /month | Custom |

| ATM use | 2% withdrawal fee | 2% withdrawal fee | 2% withdrawal fee | 2% withdrawal fee |

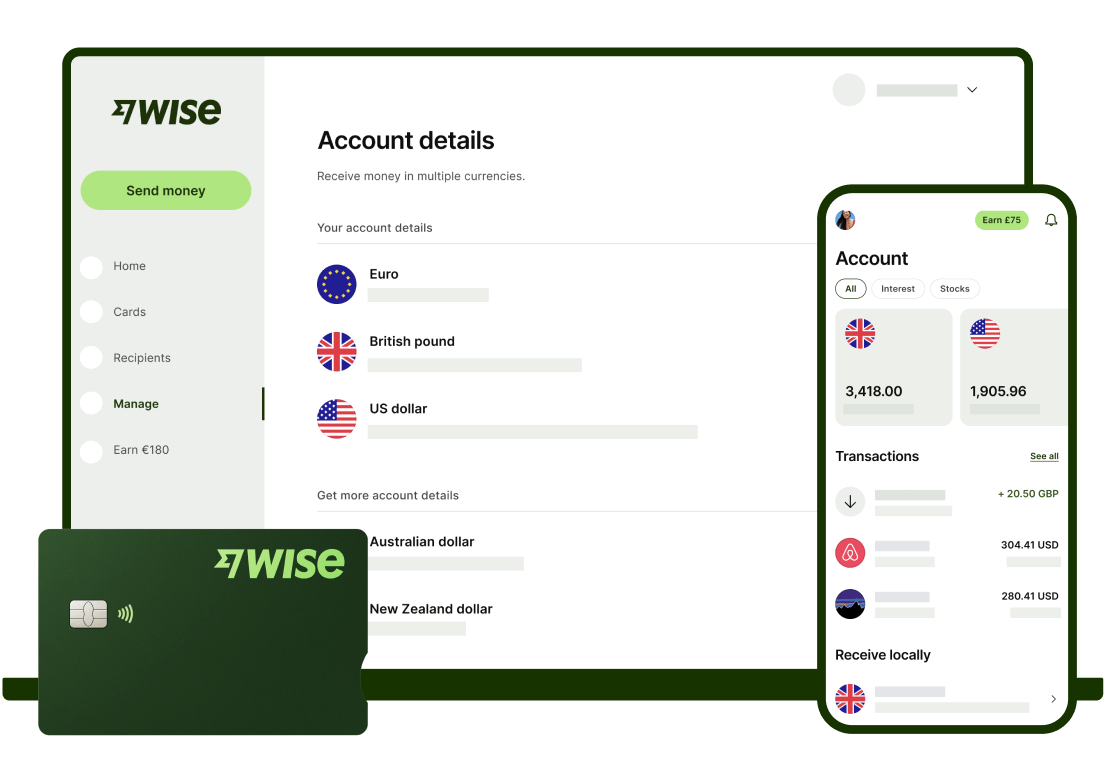

Wise isn’t a bank, but it’s authorised by the FCA in the UK as an e-money institution, and offers multi-currency accounts and cards for UK businesses through Wise Business.

Open a Wise Business account to hold and exchange 40+ currencies, with optional debit and expense cards 140+ countries. When you need to get paid by others you can do so with local and SWIFT account details (only with Wise Business Advanced) in multiple currencies - plus you could earn Wise Business Interest on balances in pounds, US dollars and euros.

Investments can fluctuate, and your capital is at risk. Interest is offered by Wise Assets UK Ltd, a subsidiary of Wise Payments Ltd. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you're uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

Wise Business also offers time saving extras like batch payments, multi-user access, cloud accounting integrations and the Wise API to streamline workflow.

If you have a UK incorporated business you’ll need the following to open your Wise Business account:

- Personal and contact details of the account representative

- Business name, entity type, registration number and sector

- Business registered address and trading address if different

- Information about the company’s directors

You’ll also need to upload some documents:

- Photo ID and proof of address for the account representative

- Business documents - which vary based on entity type

Let’s look at some of the core fees for Wise Business:

| Wise Business fee | |

|---|---|

| Open an account | £50 (Advanced plan) or for free (Essentials plan) |

| Hold 40+ currencies | Free |

| Order a card | Free |

| Spend with your card | No fee to spend a currency you hold - conversion from 0.33% when needed |

| ATM withdrawals | 2 withdrawals to £200 /month free, then £0.50 + 1.75% |

| Receive payments | Receive with local and SWIFT account details (only with Wise Business Advanced) in many currencies for free £2.16 GBP fee for incoming GBP SWIFT payment €2.39 EUR fee for incoming EUR SWIFT payment $6.11 USD for incoming USD wire |

| Send money overseas | From 0.33% |

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Get started with Wise Business 🚀

ANNA Money has 3 different account types for UK customers, suited to small and growing businesses. ANNA small business accounts are intended for customers who are the director of a limited company or a partner in a Limited Liability Partnership (LLP). You’ll be asked for ID and address documents when you apply, and depending on your entity type may also need to upload relevant business registration information.

Different ANNA Money accounts have their own features and fee structures, including expense cards, local and international payments, payment links for accepting customer transfers, and cashback on some eligible card spending. You can pay cash into your account, and all plans get a discounted trial of the ANNA tax add-on, which you can then choose to pay full price for if you decide it’s valuable to you after the trial period ends.

Here are some of the fees you’ll need to know about when you’re choosing between ANNA plans - check the full pricing details before you pick.11

| PAYG | Business | Big Business | |

|---|---|---|---|

| Monthly fee | None | £14.90 /month | £49.90 /month |

| Transfers in and out (local) | 0.95% on all incoming payments | 50 free, then £0.20 | Free |

| ATM withdrawals | Free | 3 free per month, then £1 commission (£1 min.) | Free |

| International transfers | 1% conversion fee | 2 free per month, then £5 + 1% conversion fee | 4 free per month, then £5 + 0.5% conversion fee |

| Expense cards | Free | 5 free, then £3 /card/month | Free |

Starling business accounts are available to UK resident sole traders and owners of a Limited Company or LLP registered at Companies House.

Starling business accounts in GBP have no monthly fees, with some great features including local and international payments, mobile cheque deposit options, analytics tools to track business performance, and savings accounts. As Starling is a licensed bank in the UK, you may also be able to apply for a loan or overdraft.

You can also pay extra to add on accounts in euros and US dollars, and for accounting and bookkeeping services.

Let’s look at some of the fees involved with Starling business accounts:

| Starling business fees12 | |

|---|---|

| Monthly fee | No fee for GBP account |

| Add on optional services | Business toolkit - £7 /month EUR business account - £2 /month USD business account - £5 /month |

| Local payments | No fee for Faster Payments, Direct Debits and Standing Orders |

| International transfers | Local payment network transfers from £0.30, SWIFT payments £5.50 0.4% currency conversion costs15 |

| ATM withdrawals | Free |

CountingUp Business accounts are for sole traders or owners of limited companies with up to 2 directors, registered in the UK. All directors must be UK residents aged over 1813.

There are a couple of different pricing options which are set according to the amount of money you deposit to your account each month. Then, once you have your account set up, you’ll pay some transaction fees based on how you need to use it.

Counting Up has 3 different monthly price options13:

| Monthly fee | £3 /month | £9 /month | £18/month |

|---|---|---|---|

| Amount you deposit per month | £0 - £750 | £750 - £7,500 | +£7,500 |

Then, there are some transaction fees to apply, which are the same regardless of the monthly fee you pay. These include:

- Account transfers - £0.30

- Foreign transaction fee - 3%

- ATM withdrawal - £1

- Add cash - 0.5% - 3% depending on where you are

Banks and providers may have offers which include some fee waivers, particularly on monthly costs. However, transaction fees may still apply, so you’ll need to look carefully at the options available.

CountingUp waives monthly fees for 3 months at the time of writing,¹³ while Starling Bank doesn’t charge monthly fees at all. Non-bank providers like Wise and Revolut also offer accounts with no monthly fees which are also a good choice to consider.

There’s no hard and fast rule, but you’ll probably need a local bank or provider account to hold GBP and an international option like Wise Business for foreign currency payments. It can also be useful to have a savings account, to make the most of excess business cash.

If you have a UK registered business, are over 18, live in the UK and don’t work in a high risk industry, you should have no problems opening a business account with a bank or a non-bank alternative. Use this guide to compare a few options and make your pick.

Check out Wise Business if you’re looking to grow your business across borders, or if you have suppliers or contracts overseas.

With Wise you can hold and exchange 40+ currencies, send payments to 140+ countries, and get local and SWIFT account details (only with Wise Business Advanced) to receive payments in multiple currencies by customers, PSPs and marketplace sites. Whenever you need to convert from one currency to another you get the mid-market exchange rate with low fees from 0.33%. This can cut down the costs of transacting internationally considerably.

Plus, save time with batch payments, cloud accounting integrations and the Wise API to streamline workflow. See how Wise can help you do more with your money - and cut down on business admin time.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

| About the author: | |

|---|---|

|

|

Use this guide to the best small business bank accounts in the UK to get a feel for your options, and remember to compare bank accounts with non-bank alternatives like Wise Business to find your perfect partner.

Sources used:

Sources last checked on date: 23-Jun-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best joint business accounts in the UK? We compare features, fees and best usage to help you find the ideal shared account.

Read our complete comparison of the features and fees of Worldfirst vs Wise Business, written for UK businesses.

Read our comprehensive Sokin multi-currency account review for UK business customers, including pros, cons and features.

Looking for the best business accounts in Northern Ireland? Compare fees, features and benefits to find the account that supports your business best.

Read our comprehensive guide to the best UK business bank accounts for non-residents, including Wise Business, Revolut, Airwallex and Tide.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.