The importance of cash reserves for startups and how to plan ahead

How much cash reserve does a startup really need? Learn how to save effectively and ensure your future is protected.

Looking for the easiest way to submit VAT returns and comply with HMRC’s Making Tax Digital requirements in the UK? You’ll need to find the right software.

In this comprehensive guide, we’ll run through some of the best digital VAT software options for UK small businesses. Get the right fit, and it could help your finance team improve efficiency, save time and tick all the right compliance boxes.

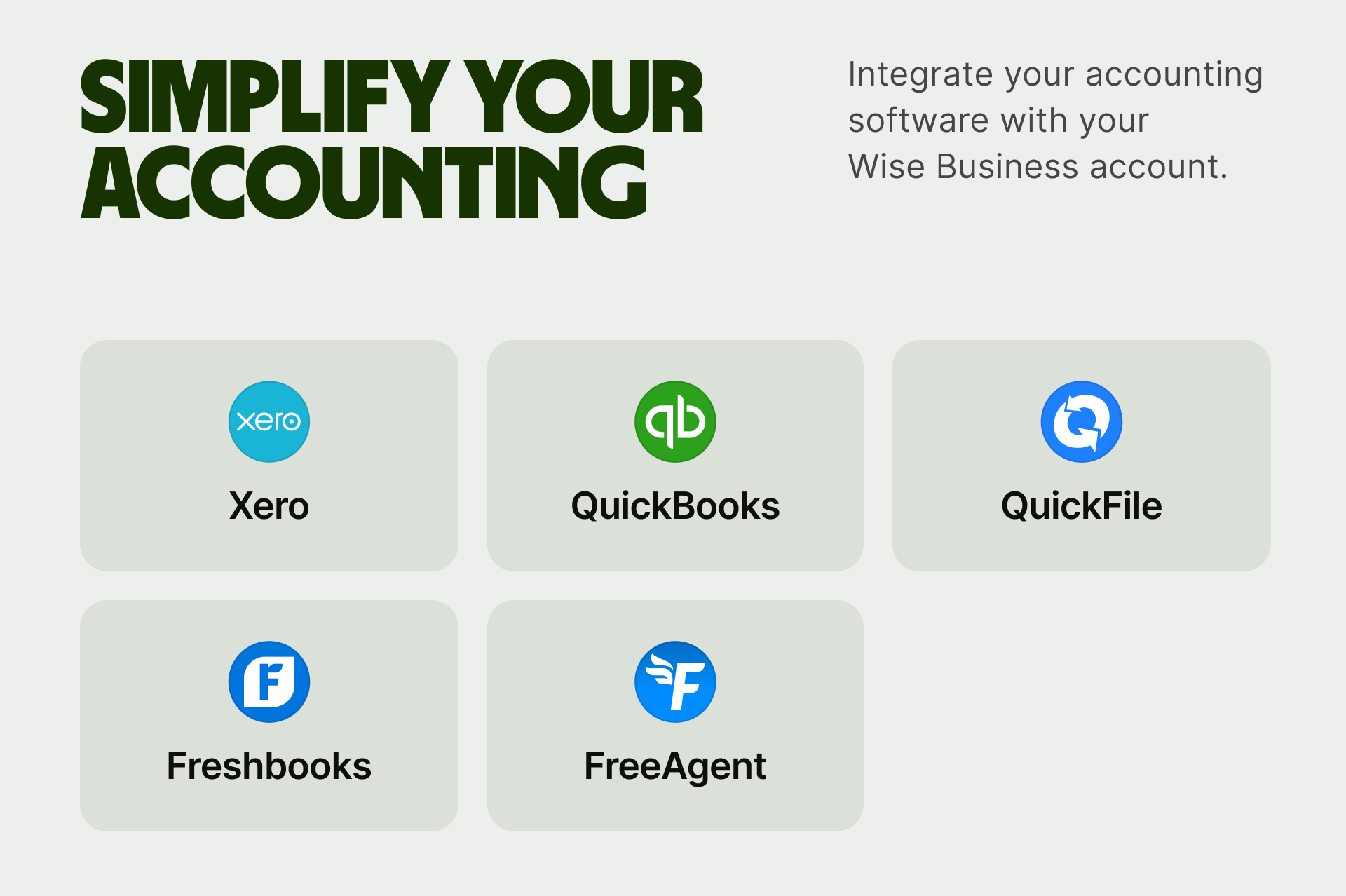

And while you’re thinking about ways to make managing your business easier, make sure to check out clever solutions like Wise Business. This powerful multi-currency account integrates seamlessly with popular cloud accounting solutions, making it easier to manage business finances both in the UK and internationally.

💡 Learn more about Wise Business

Let’s start with a quick at-a-glance comparison of all the providers we’ll be looking at here in this guide:

| Provider | Pricing | Trustpilot score |

|---|---|---|

| QuickBooks | £16 to £115/month, discounts for first 6 months¹ | 4.4 from 15,500+ reviews² |

| FreshBooks | £15 to £35/month,discounts for first 3 months³ | 3.3 from 800+ reviews⁴ |

| Xero | £16 to £59/month, discounts for first 6 months⁵ | 3.7 from 7,700+ reviews⁶ |

| FreeAgent | £27 to £33/month depending on business type, discounts for first 6 months⁷ | 4.7 from 2,500+ reviews⁸ |

| KashFlow | £11.50 to £31.50/month, discounts for first 6 months⁹ | 1.2 from 140 reviews¹⁰ |

| Sage | £15 to £39/month, free for 3 months¹¹ | 4.3 from 18,700+ reviews¹² |

| Zoho Books | £0 to £30/month¹³ | 4.2 from 5,000+ reviews¹⁴ |

Making Tax Digital (MTD) is a UK Government initiative initially announced in 2015.

It requires businesses and individuals to keep digital records and submit both income tax and VAT returns digitally. There’s also a requirement to submit quarterly updates, so that the tax system can be brought closer to real-time.

In relation to VAT, all UK businesses must now be signed up to MTD. HMRC will register any remaining businesses automatically, unless they are exempt.

To meet Making Tax Digital requirements, businesses need to use software that is compliant with MTD. This means it’s compatible with HMRC’s systems, so that VAT returns can be submitted digitally directly to HMRC.

All of the software we’ll look at below is MTD compliant, and each clearly says this on their features lists.

Here are just some of the advantages for businesses and finance teams of using MTD compliant software:

Now, let’s dive into our list of the best digital VAT software for small businesses here in the UK.

We’ll look at features (especially in relation to MTD and VAT) and what kind of business each software is best for. And crucially, pricing information.

Intuit QuickBooks is cloud-based accounting software, which offers MTD-compliant features such as:¹⁵

It has options for limited companies of all sizes, with price plans ranging from £16 to £115/month (plus discounts available for the first 6 months).¹ Check our complete review on Quickbooks pricing.

All plans apart from the Sole Trader plan offer VAT MTD features. Check our complete Quickbooks reviews here.

And good to know - QuickBooks can be seamlessly integrated with your Wise Business account.

💡 Learn more about Wise Business

FreshBooks is simple cloud-based accounting and invoicing software aimed at small businesses, sole traders and freelancers. It’s HMRC recognised, and offers the following VAT MTD features:¹⁶

It’s the ideal fit for smaller and new businesses, who don’t need a lot of advanced features. Plans range from £15 to £35 a month, with discounts available for the first 3 months.³ There’s also a free trial available. All plans offer the ability to submit MTD-compliant VAT returns directly to HMRC.

And like with QuickBooks, your Wise Business account can be seamlessly connected with FreshBooks for streamlined financial management.

Check our comparison between FreshBooks and Quickbooks here.

Xero is a popular cloud-based accounting software designed for smaller businesses. It’s MTD compliant, offering the following features for managing VAT returns digitally:¹⁷

Xero has plans available from £16 to £59 a month, with discounts for the first 6 months.⁵ All plans let you submit VAT returns directly to HMRC.

Check our comparison between Xero and FreeAgent here.

And to streamline finances even when managing a global business, you can also link your Xero account seamlessly with Wise Business.

The UK-based cloud accounting software FreeAgent offers solutions for limited companies, partnerships and sole traders. It is MTD-compatible, and offers features such as:¹⁸

Pricing ranges from £27 to £33 a month depending on business type (whether Limited Company or Partnership), with discounts for the first 6 months.⁷

Check our comparison between FreeAgent and Quickbooks here.

Your Wise Business account can also be integrated seamlessly with FreeAgent for easy financial management and reconciliation.

KashFlow, from the IRIS Software Group Limited, is cloud software for accounting, bookkeeping and payroll. It’s a fully compliant, HMRC-recognised MTD software, offering useful VAT features such as:¹⁹

KashFlow is targeted towards UK small businesses and sole traders, and its plans are priced from £11.50 to £31.50 a month (with discounts available for the first 6 months).⁹ All plans offer MTD-compliant VAT features.

Formerly known as Sage One, Sage Business Cloud Accounting is a cloud-based solution aimed squarely at small businesses - including startups.

As you’d expect from such an established and trusted name in the accounting software world, Sage is fully MTD compliant and HMRC recognised. It’s features include:²⁰

Pricing ranges from £15 to £39 a month (free for 3 months)¹¹ and all plans offer the ability to directly submit VAT returns to HMRC.

Another cloud-based accounting product designed for small businesses with simple accounting needs, Zoho Books also meets HMRC guidelines and MTD compliance standards.

Features for VAT management include:²¹

Pricing for Zoho Books ranges from £0 to £30 a month.¹³ Unlike with other providers, it gives you access to MTD VAT features even on the free plan, although you may face limits when it comes to other accounting features.

And like many of the other providers on our list, Zoho Books can be seamlessly integrated with Wise Business.

💡 Learn more about Wise Business

The first and most important feature to look for is MTD compliance and HMRC recognition. Without this, you won’t be compliant with MTD rules, or be able to submit VAT returns directly to HMRC.

Price will always be a crucial consideration, but make sure to look at customer reviews on sites such as Trustpilot.

And if there’s a free trial on offer, this will give you the ideal opportunity to test out features and get a feel for the user-friendliness of the dashboard.

It is possible to submit your VAT return from Microsoft Excel in compliance with MTD rules by using software called VitalTax. Once set up, it ensures your VAT return is sent to HMRC via the Making Tax Digital Application Programming Interface (API).²²

Unless your company is exempt, all UK businesses must submit VAT returns online in compliance with Making Tax Digital rules.

If you’ve signed up for MTD yourself, you’ll receive a confirmation email from HMRC. If you’ve been automatically signed up, you may receive a confirmation email or letter. If you can’t find confirmation and need to check your status, you can contact HMRC for further information.

Compulsory registration for Making Tax Digital was implemented for all UK businesses (unless exempt) on 1 November 2022. This means that all businesses must now be signed up for MTD, or have been automatically signed up by HMRC.²³

Check all the MTD Deadlines in our complete guide.

Yes, there is free MTD-compliant software available in the UK, including VitalTax for use with Microsoft Excel and the Zoho Books free plan.

Wise Business can help UK businesses, freelancers and sole traders to manage finances across multiple currencies, with low fees and the mid-market exchange rate.

Wise Business account connects with Xero, QuickBooks, FreeAgent, FreshBooks and more solutions to help you seamlessly manage your finances across borders.

When you open a Wise Business account, you’ll benefit from all of these useful features:

Get started with Wise Business 🚀

After reading this, you should be able to compare all the best digital VAT software available in the UK for small businesses - and choose the right one for your needs.

Whichever you opt for, just make sure it’s MTD-compliant and HMRC recognised.

Sources used:

Sources last checked on date: 18-Feb-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

How much cash reserve does a startup really need? Learn how to save effectively and ensure your future is protected.

Over the past two decades, Estonia has developed a reputation for cultivating successful startups. So much so that the country now holds the title for the...

Gusto on the SME market and how payments are economically empowering businesses - and people - around the globe.

Find out how you can diversify revenue streams as a UK startup, from launching new products and subscriptions to monetising your expertise.

Discover proven steps to take to get clients as a freelance web developer. Our guide explains how to target clients, making a compelling sales pitch, and more.

Discover how to get clients as a freelance copywriter in the UK and start saving on unnecessary conversion fees with Wise Business.