Ghana Corporate Tax - Guide for International Expansion

Learn about the corporate tax system in Ghana, its current rates, how to pay your dues and stay compliant, and best practices.

If your business offers a subscription service to customers, you’re going to need to know about recurring payments.

They can be used as part of billing practices to automatically collect payments from customer cards or bank accounts on a pre-agreed schedule (i.e. the same date every month).

Recurring payments are commonly used by utility and telecommunications companies, TV streaming platforms, insurance companies, gyms and Software-as-a-service (SaaS) providers.

In this guide, we’ll show you how to set up recurring payments for your business. This includes a list of payment processing providers, some info on fees and a step-by-step guide to getting started.

And while you’re looking into cost-effective ways of getting paid, make sure to check out Wise Business. It’s the ideal solution for receiving international payments, without losing out to high fees and currency conversion costs.

💡 Learn more about Wise Business

An effective recurring payments system can offer many benefits to both businesses and their customers. Get your setup right, and you’ll have a low-effort, cost-effective way to bring in consistent and regular revenue for your company.

Advantages for your business include:

There’s also the fact that digital billing is more environmentally friendly, as there’s no need for paper bills or invoices.

For customers, recurring payments offer a fully hassle-free way to pay for the subscriptions and services they use. After the initial setup, payments will be automatically collected - so the customer doesn’t need to enter card or bank details each month.

There are a few different ways you can implement a recurring billing system within your company.

For example, you can set up flat-rate or tiered pricing, per-user pricing, or opt for a usage-based system. There’s also ‘freemium’, which is where the core service is free but there’s an expectation that customers will upgrade to a premium plan to access more services and features.

The right option for you depends on your business model, as well as your product or service and how it is used by your customers.

You’ll also want to consider what payment methods your billing system will support - this may depend on which payment processing provider you choose.

The most popular methods are Direct Debit and debit card payments, but there’s also PayPal and mobile wallets like Apple Pay, Google Pay and Samsung Pay.

Now, let’s take a look at how to implement a recurring billing system for your customers, starting at the very beginning:

In order to set up recurring billing, you’re going to need a payment gateway.

To help you compare options, here are some of the most popular UK payment platforms which offer recurring payments:

| Provider | Trustpilot score | Costs |

|---|---|---|

| Braintree | 1.1 from 270 reviews, unclaimed profile² | - No monthly fees - 1.9% + £0.20 per transaction¹ |

| Chargebee | 3.9 from 62 reviews⁴ | - Plans from £0 to £499 a month³ - Payment fees vary by payment processor |

| Stripe | 2.2 from 14,800+ reviews⁶ | - No monthly fees - Payment fees from 1.5% + £0.20 per transaction⁵ |

| GoCardless | 2.9 from 2,000+ reviews⁸ | - No monthly fees - Payment fees from 1% + £0.20 per transaction⁷ |

| Worldpay | 4.4 from 7,700+ reviews¹⁰ | - £19.95 a month - 1.5% per card transaction⁹ |

| Paddle | 4.2 from 8,300 reviews¹² | - No monthly fees - 5% + $0.50 USD per transaction¹¹ |

To find the right payment provider for your business, here are some key factors to bear in mind:

Here’s a quick look at the kinds of fees associated with recurring billing systems:

Entertainment streaming services such as Netflix, Apple TV+, Amazon Prime Video or Disney+ offer the perfect examples of a recurring payment in action.

The customer signs up for recurring billing directly with the streaming service, and subscription payments for a set amount are automatically taken from the bank account or card on the customer account each month.

As a business, you can set up a Direct Debit with a customer by sending them a Direct Debit mandate to complete. Also known as a Direct Debit instruction (DDI), this can be sent online, on paper or even over the phone, and once signed it provides explicit permission for the recurring payment to be set up.

A Direct Debit is a recurring payment taken only from a bank account, and can take a few days to clear.

A recurring payment can be taken from a card, bank account or other payment method, and is usually cleared instantly.

Yes, Stripe supports recurring payments through Stripe Billing. This is an add-on to the processor’s core service, which offers features specifically for subscription billing models and has monthly or pay as you go fees.

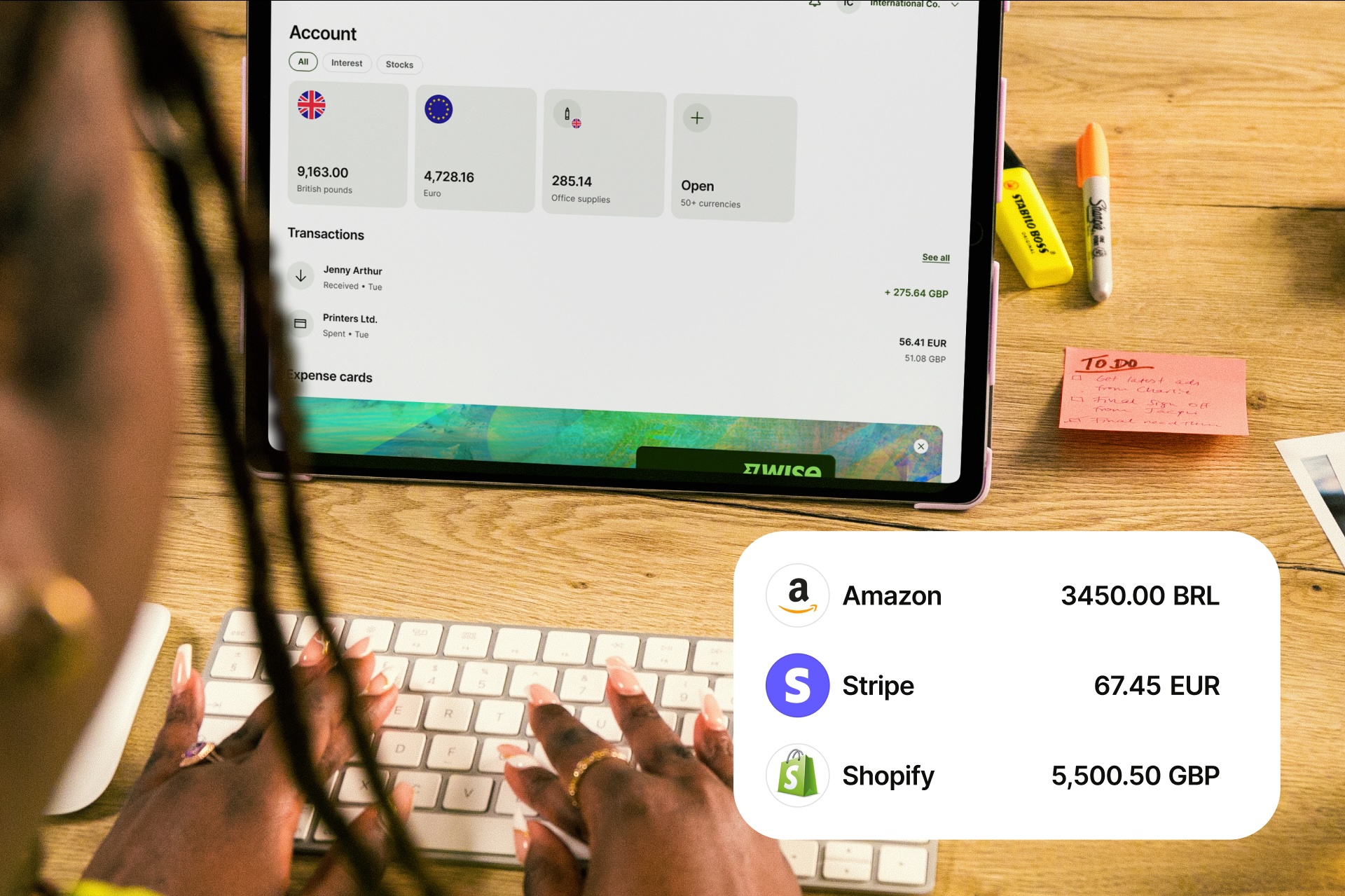

Wise can help UK businesses to receive payments in multiple currencies, with low fees and the mid-market exchange rate.

A Wise Business account comes with local account details (only with Wise Business Advanced) to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds, these payments can come directly from your customers, from PSPs like Stripe and Amazon, or from platforms like Chargebee.

All you need to do is add the relevant currency account details (only with Wise Business Advanced) to the platform you need to withdraw the funds. Once you receive the payment in Euros, Dollars or other supported currencies, you can hold this money into your multi-currency account, send with Wise Business debit card or convert back to Pounds with low fees and the mid-market exchange rate.

Get started with Wise Business 🚀

And that’s about it - our essential guide to accepting subscription payments for UK businesses.

We’ve covered payment processing providers, benefits of recurring billing and steps to get set up, so you should have all the info you need. Choose the right payment gateway and you should find that implementing recurring billing is actually pretty straightforward. Good luck!

Sources used:

Sources last checked on date: 30-Oct-2024

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Ghana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn all about accounts payable turnover including how to calculate the ratio, interpret high vs low ratios, and optimise your payables in our guide.

Learn about the corporate tax system in Uruguay, its current rates, how to pay your dues and stay compliant, and best practices.

Discover what payment reconciliation is, why it matters and how to do it correctly. Our guide covers essential steps, best practices, and common challenges.

Everything you need to know about Advanced Subscription Agreements (ASAs) including how to create one and how they compare to alternative funding.

Learn about the corporate tax system in Tanzania, its current rates, how to pay your dues and stay compliant, and best practices.