Compare Revolut Alternatives in Australia: Features and Fees

Compare Revolut and its alternatives in Australia on features and fees to find the best multi-currency account for your needs.

Platforms like Tiger Brokers¹ are very popular among Australians who invest, as they give simple ways to diversify globally and manage your portfolio right from your phone.

This Tiger Brokers review for Australia looks at how Tiger Brokers and the Tiger Trade app work, and also the Tiger Brokers fees you’ll need to consider when trading locally and internationally. We'll also introduce to you Wise that can help you save on international transfers with it's low, transparent fees and mid-market exchange rates.

| Table of contents |

|---|

Tiger Brokers is a digital trading platform which offers ways to buy, sell and manage investments in AUD, USD, HKD and CNH. You’ll manage your money through the Tiger Trade app², which is accessible, intuitive and gives you all you need to buy, sell and learn about investments.

Keep reading this Tiger Trade review to learn more about the features, fees and services available through Tiger Brokers and Tiger Trade.

This guide is for information only, and does not constitute advice. The value of investments can go down as well as up - get professional advice before you put your money at risk.

Tiger brokers Australia holds an Australian Financial Services Licence (AFSL), and is considered safe to use as long as you understand and pay attention to the general risks inherent in all investing. Tiger Brokers is also licensed in other jurisdictions including the US, New Zealand and Singapore.

Tiger Brokers is an all in one app based tool for trading and managing your investment portfolio across several major global markets. You can trade in AUD, USD, HKD and CNH, and get learning and education tools, as well as ways to track your investment portfolio’s performance across all your held assets. We’ve broken up the Tiger Brokers features into core markets to give a picture - there’s lots more information about the products available and who they may suit over on the Tiger Broker’s website.

The ASX is Australia’s largest securities market and the natural place for many investors to start their journey. With Tiger Brokers you can invest in ASX equities³ across core sectors like resources, banking and technology, with flat brokerage fees of 3 AUD in many cases. Other features include:

- Get 24/7 access to investment news and analysis

- All ASX trades are CHESS-sponsored (Clearing House Electronic Subregister System), which means your assets are automatically registered in your name

- No minimum trade amount for assets held in your account

- Derivatives trading not supported

As the largest economy in the world, getting access to US listed assets⁴ from Australia allows you to diversify your portfolio and buy into new companies and up and coming startups, as well as giant multi-nationals, tech firms and household names. Tiger Trades lets you buy and sell a range of US assets, including ETFs and fractional shares⁵ which are a great way to buy and earn from small fractions of more expensive stocks, making US investing more accessible.

More experienced investors may also like the Tiger Trade options trading feature, which offers a demo account and then ways to make riskier investment decisions for US assets.

Here are some core features:

- Access to 9,500 US stocks and over 500 fractionals

- Fixed brokerage fees of 2 USD to buy or sell up to 200 shares

- Buy fractional shares from just 1 USD

- Advanced technical indicators and charting tools to track and analyse the market

Tiger Brokers also offers other market access with ways to buy shares and ETFs in Hong Kong and China. Accounts offer real time data to guide your decisions, as well as low fees and access to different markets which include large tech firms and other high value assets.

The costs of trading with Tiger Brokers depends on the type of assets you want to buy, how often you trade and other factors.

The pricing mechanism of any trading platform can be pretty complex, so reading up on the specific costs for the types of trades you’ll make is essential⁶. Here we’ve broken out the headline costs for core types of common trades - read the full detail on the Tiger Brokers website before you start trading.

The costs of trading stocks and ETFs with Tiger Trade depends on the currency/country involved and then the value or volume of trades you place. Here’s a summary:

| Trade type | Tiger Brokers fees |

|---|---|

| ASX stocks and ETFs | 3 AUD flat fee, up to 10,000 AUD value per order and 0.03% of trade value after that |

| US stocks and ETFs | 2 USD flat fee to buy or sell up to 200 shares per order, with 0.01 USD added for every share after that |

| Hong Kong stocks and ETFs | 15 HKD flat fee up to 25,000 HKD value per order and 0.06% of trade value after that |

| China A-shares and ETFs | 15 CNH flat fee up to 25,000 CNH value per order and 0.06% of trade value after that |

*Details correct at time of writing - 25th November 2025

For US options trading, there are different choices on fees, depending on the volume of trades you’re likely to make. With the fixed plan you pay a flat fee based on the number of trades, or you can choose the tiered plan which has tiered pricing that drops off dramatically the more you trade. Here’s what you need to know:

| Trade type | Tiger Brokers fees |

|---|---|

| Options trades - fixed brokerage plan | 3 USD flat fee to buy or sell up to 4 contracts per order and USD 0.75 for every contract after that |

| Options trades - tiered brokerage plan | 0.15 USD - 0.90 USD per contract depending on volumes, minimum order fee of 3 USD applies |

*Details correct at time of writing - 25th November 2025

When you convert currencies with Tiger Brokers there’s a fee added to the conversion. This is expressed as pips - points in percentage. A pip is the smallest standard unit of measurement for that given currency pair - usually 0.0001 of the quote currency. This spread is added to the rate used for conversion - much like a bank might add a margin or markup to the exchange rate used to convert currencies when you send a payment to someone overseas.

Here are the Tiger Brokers currency conversion spreads - we’ve also got more on how you might use alternative ways to convert currencies to get lower overall costs, later.

| Currency pair | Tiger Brokers fees |

|---|---|

| AUD - USD | 55 pips added spread per transaction |

| AUD - HKD | 300 pips added spread per transaction |

| USD - HKD | 132 pips added spread per transaction |

*Details correct at time of writing - 25th November 2025

To start trading with Tiger Brokers you’ll need to set up and fund a Tiger Trade account, and then manage trades through your phone. The costs, options and process may be slightly different depending on the market and asset type.

Here’s how to buy ASX stocks on Tiger Trade as a starting point⁷:

You can also use your account to buy through market orders, which triggers a purchase when the shares you’re interested in hit a pre-agreed price.

If you’re buying assets in a foreign currency you may find it’s best to add funds to your account in the currency you want to buy in - USD for example. This might mean you get a better exchange rate, and it leaves you fully in control of when and how your AUD is converted to USD. You can add funds using a bank transfer from a multi-currency account from a provider like Wise.

Wise offers ways to hold 40+ currencies, and exchange with the mid-market rate and low fees. Add AUD to your Wise account, and convert to the currency you need to deposit when you see a good rate. You can then use your funds to load to Tiger Trade for your next purchase. You can also use Wise to withdraw dividends or asset sale proceeds in AUD, USD, HKD or other currencies.

Using a platform like Tiger Brokers is a very convenient and accessible way to grow and manage your investment portfolio in Australia. There are fees involved in buying and selling, which you’ll need to learn about - and of course the value of your assets can go up and down.

Use this guide to start your research and decide if Tiger Brokers might be the right investment platform for you - and don't forget to check out Wise as a smart way to convert, send and receive AUD and other currencies with low fees.

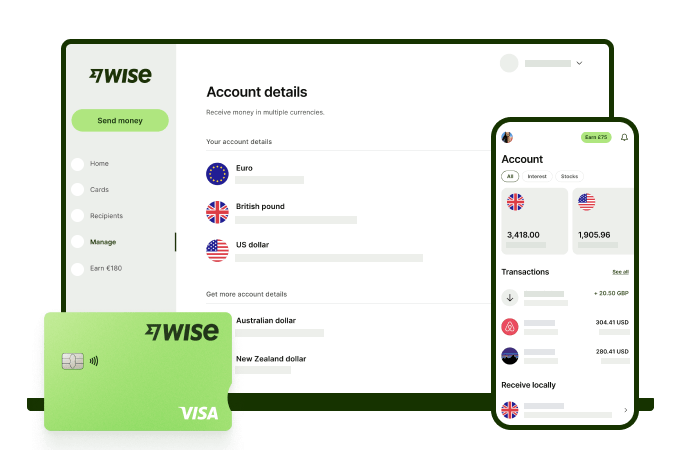

The Wise account is an easy way to save up to 5x when you send, spend, and withdraw money internationally. Hold and manage 40+ currencies, including AUD, USD, EUR, and more. All you need to do is sign up for a free account to get started, there's no monthly fees either.

You can exchange currencies at the mid-market rate on every conversion — basically the rate you see on Google. And with zero foreign transaction fees, and low, transparent pricing, Wise usually gives you the best value for your money. You can activate Wise Interest to earn returns* on your eligible balances while keeping your money available to spend.

You'll get 8+ local account details in AUD and a selection of other global currencies to get paid conveniently to your Wise account. And when it's time to send money abroad , enjoy fast, low-cost transfers to 140+ countries. Plus, you can get a linked Wise debit card for spending internationally at the same great mid-market rate.

When it comes to managing money globally, the Wise account is a handy tool that makes it easier and simpler.

*'Interest' is a custody and nominee service offered through Wise Australia Investments Pty Ltd. Growth is not guaranteed. Capital at risk.

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you. Savings claim based on our rates vs. selected Australian banks and other similar providers in Jan 2025. To learn more please visit https://payout-surge.live/au/compare%3C/a%3E%3C/p%3E

Please see Terms of Use and product availability for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare Revolut and its alternatives in Australia on features and fees to find the best multi-currency account for your needs.

Compare the best CommBank credit cards. Discover which CommBank credit card is best for you, from Qantas points to zero-interest options and travel perks.

Does your Bankwest credit card have travel insurance? Discover which cards still offer complimentary cover, the activation rules, and what it covers.

Planning an international transfer? Our Money Travels review covers everything from fees, exchange rates, and safety to help you decide if it's right for you.

Thinking about Hay Australia? In this Hay review, we break down the account features, card benefits, fees, and how it compares to alternatives.

Planning a large money transfer with ING Bank in Australia? Discover fees, daily limits, processing times, and alternatives.